Innovation:

- Will never be embraced by everyone, and IF you require unanimous consent – you will never move forward.

- Will never be convenient, and IF it were – someone would have done it before you.

- May not work, and hopefully everyone is ok with failure.

Therefore, if your project needs any of the above to move forward, you probably need to choose a different project.

When Defending the Status Quo:

- Try denying the problem, minimizing it, making up data, distracting from the conversation, making people feel like hypocrites, and emphasizing the convenient elements of what is already in place.

- Try acknowledging the problem, but also pointing out that it’s far too late to do anything about it.

Per Seth G: Both defenses work and happen constantly. But neither defense is true, helpful, or generous.

The Market:

What a week Tim Cook (CEO of Apple) had… On Thursday, Apple reported anemic Q3 results, completing a fiscal year where revenues fell 2.8%. That’s actually not a bad result given the smartphone market shrank 10.5% in the same time period. Still, it’s yet another reminder that Apple is no longer a growth company. Tim’s other big event this past week was his sixty-third birthday – which puts him at least a decade older (and wiser) than his respective tech counterparts. Happy Birthday Tim Cook!

InfoBits:

- Big Oil went on a buying spree… betting that a green future is a distant future.

- Charlie Munger has never liked VCs… “If you want to make money by screwing your investors, then being a VC is for you.”

- The average yearly VC returns… over the past 20 years is 11.8%, versus 12% for the Nasdaq.

- Twitter’s valuation is down ~57%... since Elon purchased it.

- WeWork will declare bankruptcy next week. In 2019 it was valued by SoftBank at $47B – before it lost its mojo.

- Anheuser-Busch’s (Budweiser’s) U.S. revenue… fell 13.5% YoY.

- A Rodin sculpture worth $3.6m went missing… from a Glasgow museum. It was last seen 74 years ago, and is one of ~1,800 other missing pieces from the city’s museums.

- McDonald’s and Chipotle will raise worker wages in CA to $20/hr… and pass the entire wage-increase directly on to their customers.

- UAW work stoppages cost Big-Auto… GM = $800m, Ford = $1.3B, and Jeep maker Stellantis = $3.2B.

- Six Flags and Cedar Fair will merge in an $8B deal. The merger will put 27 amusement parks, 15 water parks, and 9 resorts across Canada, the US, and Mexico under one stock ticker.

- It’s Pharmageddon for CVS, Walgreens, and Rite Aid… as they plan to close 1.5K stores. Many continue to turn to mail-order services like Express Scripts, Amazon Pharmacy, and Cost-Plus Drugs – fueling even more brick-n-mortar closures.

- Labor market cools… as October’s nonfarm payrolls increased by 150,000 jobs. The unemployment rate rose to 3.9% - the highest level since Jan. 2022.

Crypto-Bytes:

- At his own trial, SBF’s response to the facts was… “I don’t know” or “I don’t recall” over 150 times.

- SBF was found guilty on seven counts of fraud... as the jury only needed 4 hours to deliberate – which means they knew within a few minutes and then ordered lunch.

- SBF’s sentencing is scheduled for March 28th… and he is expected to get 20 to 30 years in prison – although it could go up to 105 years.

- Bitcoin saw a “golden cross” last week… which some traders interpret as bullish. Bitcoin’s price has more than doubled this year, and analysts point to the ETF excitement being the latest catalyst – along with the impending debt crisis.

- Coinbase reported its seventh straight quarterly loss… however, its stablecoin partnership (USDC) with Circle saw profitability as interest rates rose.

- Per Jurrien Trimmer (Director of Global Macro at Fidelity)… “Bitcoin’s current price rise is in-line with past bull markets. Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement. I think of it as exponential gold.” Exponential Gold == the downside protection of gold + the upside advantage of tech stocks.

- Per Balaji Srinivasan… “By 2040 everyone under the age of 30 will have grown up in a world where bitcoin has always existed. There will be no difference between bitcoin and gold as both have been around forever in their eyes.”

TW3 (That Was - The Week - That Was):

Monday: Our FED’s preferred measure of underlying inflation accelerated in September to a four-month high – all the while consumer spending increased, and October’s near-term inflation expectations rose to a five-month high. The data comes ahead of the FOMC interest rate policy decision mid-week though no changes are expected. Currently, over two-thirds of the S&P stocks are trading below their 200-day moving averages, and the 10-Year has climbed back to 4.93%. Watch Raytheon (RTX) as a move over $80 would pull me in.

Tuesday: Wow. After sliding sideways and down for 3 months, I can only assume that ‘the collective’ decided that on Monday we should take back 500 DOW points. Was there any news driving that, maybe peace in the Middle East? Nope. I’m confused.

Wednesday: I continue to like uranium (UEC) and would buy more over $6.04, but currently we’re waiting on Powell. The only real question is: ‘How hawkish/dovish is he going to be?’ A few excerpts that I gathered from Powell’s press conference:

- "Strongly committed" to achieving 2% inflation.

- The full effects of tightening have yet to be felt.

- Nominal wage growth is showing “some signs” of easing.

- The labor market remains stronger than expected.

- The FED will “proceed carefully” on upcoming policy.

- Reducing inflation will likely require a weaker labor market.

- And, “We are not talking cuts or even thinking about them at this point.”

Friday: Heading into Friday, major averages are on track for their best weekly performance in nearly a year. The S&Ps are up 4.87% week-to-date, Nasdaq +5.15% WTD, the Dow +4.38%, and the Russell +4.72%. Per @jasongoepfert: “This is the 24th time the Russell closed at a 52-week low, then surged to its best 4-day rally in at least 3 months. A year later, the small-cap index was higher 100% of the time with a median return of +25.6%.” Gaining 1,512 DOW points in four sessions is not normal. Our FED jumped into the debt market, bought bonds, and got the 10-Year to drop like a rock. Instantly the market thought that corporations can now roll over their debts at a lesser rate, and borrow their way to glory. That instantly pushed the 10-Year yield down to 4.57 and the futures spiked higher.

AMA (Ask Me Anything…)

Should I be investing more in bitcoin? As US Treasuries continue to fall in value – bitcoin continues to rise. Investors appear to be treating bitcoin as a safe haven – as they dump bonds to buy bitcoin. Since the start of Russia v. Ukraine – bitcoin has gained ~50%. Since the beginning of Hamas v. Israel – bitcoin is up ~24%. The entire crypto market is up ~67% YTD, and ~33% YoY. As bonds move lower, bitcoin has been appreciating because professional investors are viewing bitcoin as the ultimate safe haven asset. After all, bitcoin provides clarity and predictability regardless of what is happening in the world. Peace or war, loose or tight monetary policy – bitcoin will continue to produce 900 bitcoin per day until the next halving. This level of predictability is foreign to financial markets because their legacy systems have become a reactive cesspool of guessing and human error. Currently large financial institutions, pensions, endowments, and foundations – all hold trillions of dollars in bonds. If that capital was to flow in a different direction, it would be catastrophic for the U.S. and an asset like bitcoin would have to re-price at substantially higher levels. Financial assets have traditionally benefited or suffered due to confidence. Currently, capital flows suggest investors are decreasing their trust in Treasuries and increasing their trust in bitcoin. If this phenomenon continues, it will mark one of the most significant changes to financial markets in decades. Yes, you should increase your allocation to BTC.

Next Week: Do they think we’re stupid?

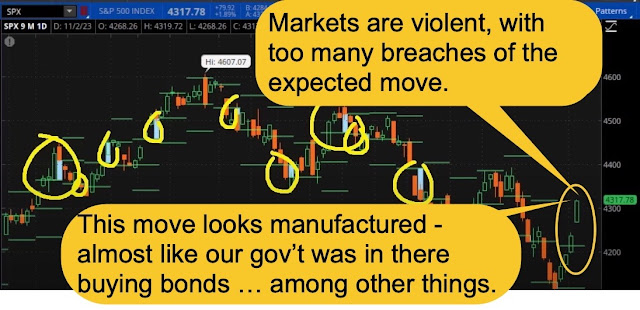

When you look at the above chart you notice 2 things:

1. The best forecasters in the world – have gotten it ‘dead wrong’ for 8 out of the last 13 weeks. That’s a horrible average and begs the question: ‘Manipulation’?

2. We moved +1,750 DOW points last week – on what news? Is there peace in the Ukraine, or did we cure cancer? No, to both. Again: ‘Manipulation’?

#1 = The Jobs Report…. Per Bob R: Financial news commentators told us that in October we created 150k new jobs. Unfortunately, the BLS’s Birth/Death model had injected 412,000 fake jobs into that number. So, in reality we lost 262,000 jobs in October (removing 412k from the +150k) – but that’s not all. The BLS data also showed that we lost all of the 348,000 phantom jobs that they created in September. So, we’re in a recession, it's getting deeper, and we’re not allowed to know it.

#2 = Last Week’s Action… The yield on the 10-Year Treasury is the ‘benchmark’ off which many things are based. In mid-October, the 10-Year had gotten to 5%, and you could hear things breaking in the debt market. Contracts were being cancelled, defaults were soaring, and repos were off-the-charts. So, last Monday we had a treasury with no money, an upcoming government shut-down, and a bond market on the edge of a full-blown credit meltdown. So, Ms. Yellen did what any ‘drunken sailor’ would do: she conjured up an enormous bond offering, printed money, and bought it all herself – driving the 10-Year yield back down to 4.5%. And guess what – it worked: it drove the stock market bat-crap crazy. CNBC’s Steve Liesmann remarked: "The bond market is moving like a penny stock". Unfortunately Janet, that’s not a sustainable model.

#3 = The Santa Rally… Each year we tend to get a seasonal year-end rally that some call the Santa rally. Simply looking at this past week, we gained over 1750 DOW points. And while the DOW is the most widely watched index in the world, it's only 30 stocks – the real focus is the S&P.

- In July, the S&P topped at 4607, and slid to 4325 in August.

- It bounced higher to 4515, and then plunged to 4430.

- Then it rallied to 4511, before falling to 4220.

- Finally, it moved back to 4380, before bottoming at 4103.

What you saw was a series of lower lows and lower highs, and currently the market is in wicked-bounce mode. The S&Ps are currently around 4380:

- If the S&Ps roll back over, we're probably going to see 4230 again, and if that doesn't hold – we’ll be back to testing 4100.

- If the S&Ps take a shallow pause at the 4380 level and then push through that – we could be looking at a run to 4500.

TIPS:

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $2000/oz. & Silver @ $23.3/oz.

- 13-Week Treasuries @ 5.45%

- **Bitcoin (BTC = $34,750 / in at $4,310)

- **Ethereum (ETH = $1,830 / in at $310)

- Apple (AAPL = $177 / in at $177)

- BITO (Bitcoin Strategy ETF = $17.40 / in at $17.22)

- CCJ – Uranium = ($42 / in at $33.8)

- DO – Diamond Offshore ($13.4 / in at $15)

- NFGC – Newfound Gold ($3.8 / in at $3.8)

o SOLD Jan. $5.00 CALLS

- UEC – Uranium Energy Corp ($5.8 / in at $4.8)

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>

No comments:

Post a Comment