This Week in Barrons: May 30th, 2021

The Little Engine No. 1 That Could: To me, it’s always embarrassing when small groups of investors believe that they can run a company better than the existing management team. Well, that’s exactly what happened this week when the: Engine No. 1 hedge fund embarrassed Exxon.

Previously, Exxon’s activist investor Engine No. 1 group, slammed Exxon for its lack of an energy transition plan away from fossil fuels. The small hedge fund sounded the "Blockbuster Alert" saying that Exxon faces extinction from continually tying its future solely to fossil fuels. Unlike Shell and BP, Exxon has not vowed to move away from oil and gas – arguing that they’ll remain key as far out as the eye can see. Now, Exxon may not have a choice.

- Last week, Engine No. 1 WON 2+ seats on Exxon's BOD. It was a historic defeat for Exxon that will likely force it to change its oil-focused strategy.

- Engine No. 1’s bid to win shareholder votes, and Exxon's quest to prevent that – became one of the most expensive proxy fights in history.

Engine No. 1 owned only 0.02% of Exxon’s stock. Although Exxon aggressively spent and tried via personal phone calls to persuade investors to vote against Engine No. 1, Engine No. 1 still managed to snag seats away from Exxon. Engine No. 1 capitalized on retail investors’ worries about Exxon's shrinking profits, and its future in a lower-carbon economy. Engine No. 1 was able to get Exxon to acknowledge that:

- 110+ countries have pledged carbon neutrality by 2050,

- California, Japan, and the UK will ban sales of all new gasoline cars in 2030’ish,

- A Dutch court ordered Shell Oil to cut its carbon emissions,

- And Chevron investors voted (against management) to cut global emissions.

Very few times do you get to see a very small tail (a 0.02% owner) wag a very big dog (Exxon). Congrats to Engine No. 1 for teaching an old dog some very new tricks.

The Market:

There is a ‘tiny bubble’ that has shown up in stage seed investing. Per HL, the world is seeing way too many startups without a full team or finished product raise $4m rounds at $20m valuations. There’s a lot of money out there chasing deals – thank you FED. There’s a lot of venture capitalists flush with capital, and a lot of early stage investors ready to spend their ‘early exit’ / ‘stock-market’ gains. As a group, seed stage investors tend to hold on to ‘dated’ core competencies longer than they should. Seed stage investors should remind themselves that creativity is often the generous act of solving an interesting problem on behalf of someone else. In terms of timeframes, the average seed stage investment takes 5’ish years to mature. The average book is written a year before it comes out. The average ‘tweet’ takes 24 seconds from thought to launch. Longer lead times allow us to focus on the destination, not the bumps or the detours. Deadlines for long lead time announcements – force us to hurry-up and stick-with-it.

Factually, this week we saw:

1. The Russell 2000 be the strongest of the major indices. The RUT ripped higher by 2.4% - closing at its highest weekly mark since early-May.

2. Real estate broke out into blue-sky territory. The XLRE rallied 2.17%, and up over 18% YTD.

3. Semiconductors had a strong week. The semiconductor ETF (SMH) surged 4.6% and closed within 5% of all-time highs. And NVDA joined those in blue-sky territory.

4. Facebook flew to an all-time weekly high along with NVDA in the tech sector.

5. Bitcoin struggled to bounce back after last week’s beating, and is still 20% off its May 19th low.

6. Ethereum bounced back a little better than Bitcoin (trading around $2,400), and is up more than 40% from its previous week’s low.

7. Meme Stocks such as AMC Entertainment (AMC) ascended 116% on the week – making it a weekly double. AMC’s year-to-date return is over 1,000% - which puts it just 150% behind GME. To quote JC: “If you’re short AMC or GME – you’re an IDIOT.”

8. Another positive development is the emerging market for several growth stocks such as: RBLX, UPST, and PATH.

InfoBits:

- You've been warned: This year, China ordered 34 of the country's largest tech companies to comply with anti-monopoly laws or face “severe punishment." The scrutiny is hitting companies in their share prices and balance sheets.

- Tim Cook-ing in the kitchen... because if Fortnite-maker Epic wins their lawsuit, Apple may be forced to give up app / distribution control. Customers could be allowed to freely install software on iPhones. It could be a real make-or-break moment for Apple.

- Lordstown Motors miserably missed earnings… and reported no revenue. They are raising cash, and slashing 2021 production forecasts.

- Phil Mickelson made history… as he became the oldest golfer ever to win a major championship. Congrats for putting AGE back in that bottle!

- Florida governor Ron DeSantis… signed into law a restriction on social media companies’ ability to ban candidates on their platform.

- ZipRecruiter (the job search and recruiting company)… just went public via direct listing on the U.S. exchange.

- Germany passed driverless vehicle legislation… allowing them on public roads next year. It lays out a path for companies to deploy robotaxis and delivery services in the country at scale.

- Peloton will start building its 1st U.S. factory… creating 2k jobs.

- Noom (the weight-loss app)… raised $540m as sales nearly doubled in 2020 thanks to pandemic snacking.

- Amazon closed a $8.45B merger with MGM. This will contribute to Amazon’s services, offering greater access to MGM’s film catalog and storytelling talents.

- Ford plans to spend more than $25B on electrification by 2025. Ford also expects 40% of its entire global vehicle volume to be all-electric by 2030.

- GameStop closed at its highest price… since March 12th.

- Facebook will begin punishing… accounts that share false or misleading information by reducing their distribution network. It will make it harder for people to view their content.

- Google will gain access from HCA to patient info… to further develop healthcare algorithms. They don’t know enough about us already?

- Gap Home is entering the housing market… with everything from scented candles to King comforter sets for $65. They are partnering with Walmart because 90% of Americans live within 10 miles of a Walmart.

- HP and Dell posted strong profits… thanks to strong laptop demand.

- Dollar Tree and Dollar General beat earnings… courtesy of stimulus checks.

- SoFi (a lending company)… moved closer to an IPO via its merger with a SPAC. The SoFi SPAC could begin trading as soon as next Tuesday.

- Warby Parker (a prescription eyewear company)… is considering an IPO as soon as this year with a $3B valuation.

- Twitter Blue, a $3 monthly subscription service… is coming soon.

- 2,500 NYC drivers are organizing… to create a better ride-hailing group.

Crypto-Bytes:

- Huobi has scaled back some of its services… in certain countries, and has stopped its miner hosting services in mainland China – in response to the recent crackdown on crypto in that country.

- Almost exactly 11 years ago… a hungry programmer traded 10K bitcoins for two Papa John's pizzas. They would be worth about $350m today. Here’s hoping for extra cheese.

- Ray Dalio (Bridgewater Assoc. founder) is on the Bitcoin bandwagon. “Bitcoin's greatest risk is its success. If Bitcoin is successful, the government will try to kill it, and they have a lot of power to succeed.”

- Compute North has partnered with Marathon Digital Holdings… to sustainably mine Bitcoin. Marathon will house 73,000 Bitcoin mining rigs in Compute North’s 300-megawatt Texas data center which is 70% carbon neutral.

- Elon Musk took to Twitter… to signal support for an apparent effort by Bitcoin miners to make their operations more environmentally friendly.

- Fed Reserve Governor Lael Brainard is pushing for a digital dollar… citing possible benefits of a cryptocurrency backed by the central bank.

- Bitcoin traders taking excessive risk and selling when prices fell… were the culprits for last week’s 30% drop in bitcoin prices.

- Blockchain development platform QuickNode… just raised $5.3m in order to provide more for its upcoming web version.

- Carl Icahn (Wall Street legend and former crypto skeptic)… wants to be involved “in a big way.” Mr. Icahn’s paradigm has completely shifted when he said: “The only value of the dollar is using it to pay taxes. I’m looking at the whole crypto business, and how I might get involved in it in $1B to $1.5B way.”

- Uniswap (the leading automated market maker on Ethereum)… will soon unleash advanced liquidity mining. Paradigm Capital has been working on a staking system for the newest version of the software.

- Sweden expects its central bank digital currency (CBDC) to begin soon… and are testing real-world payment situations. If everything runs smoothly, Sweden will be the 2nd country (after China) to advance its CBDC plans.

- Sheetz (a convenience store chain)… is beginning to accept crypto (including stablecoin) as payment. Merchant fees are reduced from the normal 3% CC fee to 0.5% with Sheetz Pay / Flexa – without any additional wait times. https://twitter.com/DocumentingBTC/status/1398262944920702977

Last Week:

Monday: I think whatever was bothering the markets last week, is now in the rearview mirror. The NASDAQ is again over its 50-day moving average, and is off and running. DKNG is looking good, the technicals are firmed up, and if it gets over $46.53 it’s worth a shot. AMT is looking like it wants to try once again to reach up and bang its head at the $255 level, and if it tops $252.05 it could be worth a shot. And AAPL over $128 is probably good for a shot.

Wednesday: Today is feeling listless and directionless. I'm watching: PLTR, CVLT, and LC. Ford (F) has broken out, and is a trade over $13.80. PLTR has been rejected at its 50-day for 3 months, but if it can get over $22.30 then I’m in for a trade – but I will bail if it loses $22.27. LC over $14.90 looks good, and PLUG over $29.75 may work.

Thursday: Imagine our President wanting to spend a lot more money. Pres. Biden is proposing a $6T budget – which increases federal spending to World War II levels. Hey let’s spend lots ‘o fake money, on a fake economy, while propping up meme stocks like AMC and GME. What’s wrong with this picture? What can we can look at in here? I like NNOX with their new technologies. I could see taking a shot at it over $25.60, and PLTR if it gets over $22.20.

Friday: Real commodities are becoming scarce. Silver (on paper) is being traded for $28 / ounce. However, the 2021 physical deliverable is selling for $42.07 an ounce – a 50% premium to the paper metal price. So, if you wonder why Stanley Druckenmiller, David Tepper, Ray Dalio and others are buying crypto and commodities (while the dollar declines) – look no further than the U.S. Mint’s latest post where they openly say: “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights. This level of demand is felt most acutely by the Mint. In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows for the remaining 2021. As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase. We will announce a revised launch date as soon as possible.” The paper metals market is beginning to creak and groan. See Chad and Bill if you need physical metal at: cornerstonebullion.com.

Crypto Market Action:

This week in crypto we saw:

- a clear supply rotation from short-term to long-term holders, with the selling coming from coins aged 1 day to 1 week.

- exchange flows moving from slightly bearish to clear net outflows, which reflects younger traders moving in and out of the market – not confident in taking a directional position.

- net accumulation by the major players, but there was selling in coins aged from 1 to 6 months – reflecting simple profit-taking without panic.

- new retail entities are coming into the network attracted by lower prices,

- and miners are not accumulating as heavily as they were previously.

Next Week: Premium Sellers… Start Your Engines.

Market Update: This is one of the best opportunities to sell premium in years.

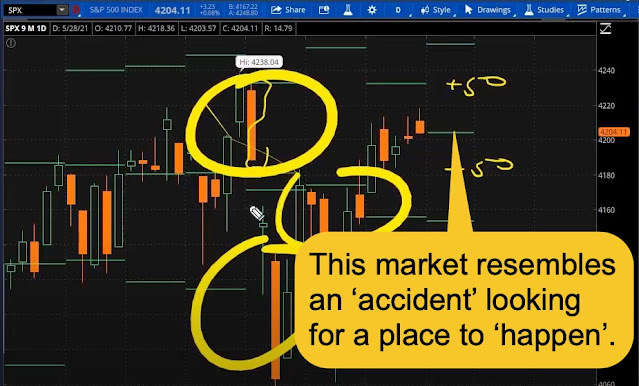

- Sector Expected Moves: We are working on a 7-consecutive week run, with us being locked inside a 100 SPX point trading range. As market places stagnate, risk will continue to perpetuate and amplify – especially right now during times of high option volume.

- Trade Stagnates while Risk Amplifies: The SPX ($4,200 / contract) trades about 1m contracts per day. The SPY ($420) trades 4m per day, and the VIX trades another ½ a million per day. All of these products are based upon the same S&P index. Given options are ‘time-based contracts’, the longer you stay within a tight range - you accumulate open interest, and you amplify the final move / resolution. The concentration of liquidity is growing the gamma risk in virtually every major index product: SPX, QQQ, IWM – and the correlations are incredibly high. The bottom line is that when we actually crack the range, there will be a serious move one way or another.

- Bond Implied Volatility vs Historical Vol: Reviewing expected moves: the QQQ and the IWM closed right on the upper edge of their expected move. Right now, the only 2 sectors that matter are: Tech and Financials, and they are both moving in lock-step (higher risk). The Bonds have been trapped in the same range since early March. The historical volatility within bonds is incredibly low while the implied volatility is average – offering us a premium selling opportunity. Tip #1: Wait for the range in the TLT to crack, then sell premium – aka let the market come to you.

It’s good to be a Premium Seller = Positive Theta:

- Premium continues to burn within a stagnating market.

- Volatility is getting crushed over the past 3+ weeks dropping from a VIX of 30 down to 16 which further enhances a ‘premium selling’ position.

- We have a stagnation issue in allocation: The longer you stagnate in a particular range, you need to be more careful about your risk mitigation. Therefore, sell premium lightly until we break this 4,100 to 4,200 trading range on the SPX.

SKEW (the Ratio of OTM PUTs to OTM CALLs) is at All-Time-High Levels:

- SKEW is a VIX for OTM (out-of-the-money) options. The SKEW at the unheard of 155 level, tells us that the premiums for out of the money put options are trading at unheard of levels above the OTM calls.

- Index Puts are trading for MASSIVE premiums: For example: let’s go out to August on the SPY. The SPY is trading at $420 right now – with an August expected move of 31 points. So, if we go $100 out of the money – the $320 August PUTS are priced at $1.17 with a 33% vol., versus the $520 August CALLS are priced at $0.02 and a 16% vol.

- Therefore: Tip #2: get ready to sell OTM PUTs on the SPY’s …hedged by buying inexpensive CALLs on the VIX. The Options market is pricing in a CRASH, it’s up to you to understand how to play it.

- Tip #3: Another way to play the CRASH: is to BUY AMC / GME stock – either could go to $100,000 per share – a topic for another day.

SPX Expected Moves (next week):

- Last Week’s EM = $76, but Next Week’s = $51

Tips:

Happy Memorial Day weekend. In the midst of grilling burgers and outdoor fun, I always remind myself to take some time to honor those who didn’t come back from our many wars, conflicts, and police actions. I never forget to say thank you. I was lucky – my father and uncles made it back. I have friends that weren’t so lucky. I think of them, and hope that someday we can put a stop to humans killing humans.

The S&P and the DOW are just a ‘wink’ away from their all-time highs. One 200-point day puts the NASDAQ in that very same position. So, do we come right up to them and get repelled? There’s a double top forming in the S&P and DOW, and a triple top on the NAS. That’s a lot of resistance to get through.

- Q: Can our FED pull it off?

- A: The answer is YES, if the FED wants to continue blowing this bubble. But if our FED starts ‘taper talking’ – that might be the death knell.

HODL’s: (Hold On for Dear Life)

- Bitcoin (BTC = $35,800 / in at $4,310) & buying

- Bitcoin Cash (BCH = $670 / in at $170) & buying

- CTI BioPharma (CTIC = $2.54)

o Sold June $3 CCs for income

- Electramericcanica Vehs (SOLO = $3.26)

o Sold Sept $4 CCs for income

- Express Inc (EXPR = $3.23)

o Sold June $4 CCs for income.

- Ethereum (ETH = $2,400 / in at $310) & buying

- Grayscale Ethereum (ETHE = $25.21 / in @ $13.44) & buying

- Grayscale Bitcoin Trust (GBTC = $30.22 / in @ $9.41) & buying

- Grayscale Trust (GDLC = $26.70 / in @ $39.75) & buying

- Hyliion (HYLN = $10.51 / in @ $0.32)

o Sold June $10 CCs for income

- Infinity Pharma (INFI = $3.33)

o Sold June $4 CCs for income

- Iridex Corp (IRIX = $7.86)

o Sold June $8 CCs for income.

- Hecla Mining (HL = $9.00 in @ $7.50)

o Sold Sept $9 CCs for income.

- Litecoin (LTC = $170 / in @ $191)

- Transocean Limited (RIG = $3.78 in @ $3.80)

o Sold Aug $5 CCs for income.

- Sandstorm Gold (SAND = $8.71 in @ $6.90)

o Sold June $8 CCs for income.

- SOS Limited (SOS = $3.51 in @ $2.91)

o Sold June $3.50 CCs for income.

Thoughts:

Tip #4: Gold (GLD) is up 13% for the past seven weeks. Inflation fears and falling Treasury yields are pushing GLD higher and the US Dollar lower. If you don’t want to fight the FED – consider a bullish trade in GLD. GLD’s OTM options are trading at a premium to its equidistant OTM puts, suggesting risk to the upside. GLD’s options are rich enough to make short premium strategies interesting. If you think that GLD might continue to rally over the next few weeks, the short Put vertical that’s long the $173 Put and short the $175 Put in the July expiration is a bullish strategy that has a 75% probability of making 50% of its max profit before expiring.

Tip #5: Currently, the VIX is near its April lows, which were the lowest levels since the COVID spike in 2020. If you’re looking for a minor correction or a major sell-off, then Call options in the VIX are your ticket to success. The VIX is near its lowest level of the past year, making VIX options cheap, and making debit spreads the strategy of choice. If you think that the market might sell off and the VIX spike up in the next few weeks, the long Call vertical that’s long the $19 Call and short the $21 Call in July is a bullish strategy that has a 65% probability of profiting by expiration.

Tip #6: Are people flocking back to movie theaters, or is it just another sequel to “Punishment of the Shorts”? AMC, a GME-like, meme-stock popular with the anti-short Reddit crowd, has doubled in the past week. This is a case of ‘market making gone wild’. The stock’s OTM calls are trading over equidistant OTM puts, indicating that the market sees more risk to the upside. AMC’s current 204% overall IV cries out for short premium strategies. If you are bullish on AMC and think it might rally or stay off its lows in the next few weeks, the short $13 Put in the July expiration is a bullish strategy that has an 81% probability of making 50% of its max profit before expiring.

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson