Do NOT Trust this market... [Click Here]

“I want the ball”… Traders get all the crap and zero credit for inventing, practicing, and perfecting various decision-making and conflict resolution strategies on a generational scale. Traders own their final decisions. As much as everyone loves collaboration and debate, owning the final decision is frightening, empowering, and always in the hands of the person you trust the most. Entrepreneurs relish this. They want the ball – because the ‘buck stops with them’. The next time someone in a meeting asks: ‘Who wants to make this decision?’ Go ahead and raise your hand – because that’s what Winners do – they want the ball.

“So, what’s the catch?” … is an important question. Per Seth G: Lots of opportunities come with ‘a catch’, and that presents 2 different challenges. (1) Sometimes, a really good opportunity doesn’t actually have a catch; therefore, spending time looking for one keeps us from the work we ought to be doing. And (2) sometimes, a really exciting opportunity is so exciting that we forget to look – and we should. Learning to ‘accurately value our time’ and ‘actively listen’ are 2 skill sets that are worth perfecting.

The Market:

- "If you can't explain it simply, you don't understand it well enough…" Albert Einstein.

- Welcome STAGFLATION – a land where prices continue to rise and economies slow down. Factually:

o Our Q1 gross domestic product (GDP) rose 1.6% YoY. That was below analyst estimates of 2.4%, and down from 3.4% and 4.9% during the last two quarters of 2023.

o Consumer spending is lower than anticipated, only rising 2.50% YoY – much lower than Q4’s 3.30% gain and estimates for 3%.

o The Personal Income Spending index rose at a 3.4% YoY pace, marking its biggest gain in a year. The Core (excluding food and energy) rose 3.70% - almost double our FED’s 2% target.

o Slower economic growth and sticky inflation is our FED’s worst nightmare, and signals that the opposite of a ‘soft-landing’ is up ahead.

- STAGFLATION was caused by continued over-spending / money printing. Per Anthony P: Our government is broke and refuses to say ‘NO’ to any request for money – for fear that any negative response will include being voted out of office. So, their solution is to: print more money, increase prices & inflation, and:

o Grow the national debt,

o Debase the U.S. Dollar,

o Allow hard assets, commodities, and Bitcoin to skyrocket, and

o Force people to invest (not save) their way to financial freedom.

- "The stock market is a device for transferring money from the impatient to the patient…” Warren Buffett.

InfoBits:

- Tesla's revenue fell -13%, and net income fell -55%... as Elon keeps changing the conversation onto cheaper EVs & robotaxis.

- Grand Theft Auto publisher (Take-Two) will lay-off ~600 staff… and scrap several projects. In the last year, ~20,000 workers have been let go from gaming giants: Microsoft, Sony, EA, and Epic.

- Goldman is selling its automated Marcus Invest business to Betterment.

- The Richmond Fed Manufacturing index… marked its sixth consecutive negative reading in April, and put U.S. manufacturing back into contraction territory.

- The FTC is enacting a nationwide ban against non-compete agreements… meanwhile the Commerce Dept said: “See you in court” as they fight to uphold the ban.

- Millions more salaried workers will soon qualify for overtime pay… under a final rule released by the U.S. Dept. of Labor.

- Taylor Swift's latest album: "Tortured Poets Department"… sold 700,000 vinyl records – breaking a weekly sales record in the first 3 days.

- WNBA No. 1 draft pick Caitlin Clark… signed an 8-year / $28m shoe deal with Nike. It’s the highest sponsorship deal for a women's basketball player.

- Meta is giving multimodal and AI capabilities… to all of its Ray-Ban smart glasses. [‘Hey Meta, can you tell me who that is in front of me?’]

- The clock is TikTok’ing… as ByteDance (the owner of TikTok) has 9 months to sell its ownership to a U.S.-based organization.

- It’s not so Gucci when sales decline 21% YoY… Their customer is back to being ‘the wealthy’, and the average purchase has risen 64% post-pandemic.

- Apple quietly released OpenELM… a family of small, open-source language models designed to run efficiently on devices like iPhones and Macs.

- Home Depot has started to sell Halloween merchandise.

Crypto-Bytes:

- $217m in outflows from Grayscale's Bitcoin Trust…. is part of a broader slump affecting various other bitcoin spot ETFs.

- The 'Buy Bitcoin' sign held up behind Janet Yellen… during a 2017 Congressional testimony, has been sold for 16 BTC (over $1m).

- Holding your own Bitcoin (self-custody) has never been more popular... and as the saying goes: “If they aren't your keys – it’s not your Bitcoin.”

- Bitcoin moves in the opposite direction of the US Dollar (DXY)... therefore, I want to see the dollar establish a downtrend.

- The SEC postponed its decision on an Ethereum ETF approval… extending the timeline to mid-June 2024. Approval could significantly influence the landscape of cryptocurrency investment products.

- For the past year, 2.5% of the NFT holders… are responsible for over 50% of all NFT transactions in secondary markets.

- Stripe (the payment processor) will enable crypto payments… on Solana, Ethereum, and Polygon.

- “If you're going to invest in bitcoin… a short-term time horizon is 4 years. No one has ever lost money holding bitcoin for 4 years...” Michael Saylor (owner of $14B in BTC).

- Tip #1: Bitcoin long above $61,000 with resistance at $73,000.

- Tip #2: Ethereum long above $3,000 with a target of $4,000… to take advantage of a potential mean reversion trade higher.

TW3 (That Was - The Week - That Was):

Tuesday: Hopes-n-Dreams rallies need: (a) an oversold condition, (b) a little "FOMO", and (c) our FED buying some 10-Year Notes. One thing we should pay attention to, is that utilities are very strong, which is odd because utilities are normally sold when markets are rallying. The utilities ETF (VPU) has gone from $136 to $144 in 5 sessions. That doesn't fit with the rip-your-face-off rally that we’re seeing. This bounce could be a suckers move that’s designed to pull people in, and then yank the rug when everyone's looking for new all-time-highs.

Wednesday: It's been a long time since I've seen this buying pattern in the markets, but lately I can set-my-watch by the daily, 12:45pm market rally. Watch for this pattern going forward. After the bell we get earnings from META, and that will set the tone for tomorrow. On Friday we get our FED’s favorite inflation indicator (PCE) @ 8:30am.

Friday: Yesterday after the bell, MSFT and GOOGL both released earnings and beat their estimates quite handily. Google even announced a $70B buy back, and their first dividend of 20 cents/share. This morning our FED’s PCE inflation indicator is out, and both spending and consumption were higher than projected, but the Core PCE came in at estimates. Markets are soaring higher, but I think they might be whistling past the graveyard. With the surge in spending and consumption, and inflation remaining elevated – our FED has no reason to cut rates.

Morgan’s Moments…

- Tip #3: Look for COIN (5/2) and HOOD (5/8) to spike higher for earnings.

- Tip #4: Watch MARA and HIVE for an upcoming announcement. Bitfarm’s CEO stepped down last week. Marathon’s (MARA) latest press release says that they will exceed hashrate expectations this year by the exact figure Bitfarms (HIVE) has in their own plan.

o Per Western Mc: “Bitfarms is more efficient at mining than Marathon. If acquired, Marathon would have more assets, more machines and efficiency that could help with scale and cost reduction.”

o Per Sweet W.: “HIVE’s pre-halving costs were $19k/bitcoin – and post are ~$40k. MARA’s costs pre-halving were $42k and $84k post. So, HIVE will represent various production efficiencies to MARA.”

- A BTC Trading Yardstick that professional crypto traders use… is the 200-day simple moving average. Last week Bitcoin’s 200-day was approaching $48,000 – just short of the all-time high set in February 2022 of $49,452. Past data shows that the most intense phase of the bull cycle unfolds after this average surpasses its previous peak.

Next Week: Do NOT Trust this Rally…

Background… There are risk assets in play, that are not right for the type of rip-your-face-off bounce we had last week. We are in a catalyst / binary driven marketplace, and currently some significant asset classes are behaving incorrectly. We moved 1.5 X the Expected Move higher in the S&Ps – all due to the 2 Std. Deviation move higher in technology. Remember, the hallmark of volatility is the ferocity that it injects into its rallies.

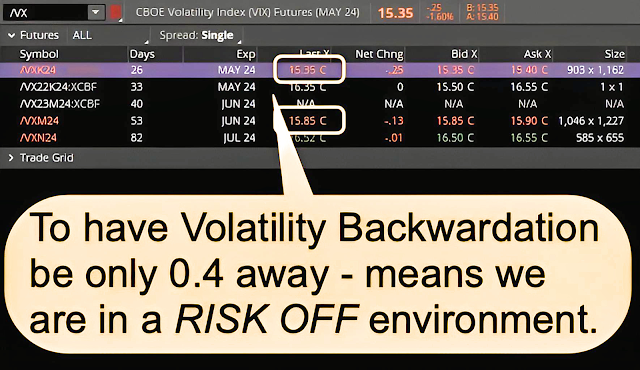

Lack of Volatility Crush… Normally after a huge up-week we would see the VIX move from the 19’ish level – downward into the 10 to 12 area. The VIX remains around 15 – which tells me that it’s still nervous about what’s around the next corner. The difference between the May and June volatility futures (/VX) is only $0.45. That tells me that traders are seeing approximately the same level of heightened risk when they look out 26 days into May as when they look out 53 days into June. Tip #5: The fact that we’re still close to Volatility Backwardation after the up-week that we just had – is disconcerting.

Bonds are still on edge… and by looking at the corresponding interest rates (TNX) we see that it will only take a slight push higher – until we’re back into big-time volatility again. FYI: most traders believe that we will see 5% on the 10-Year Note before we’ll see 4.25% again. So, even with the big up-week – interest rates are still elevated.

PCE, Inflation & our FED… This week gave us PCE data – which is our FED’s inflation indicator of choice. The PCE index came in hot = higher inflation than what was expected. But markets still rallied because they temporarily believe that Google and Microsoft’s earnings are more important than inflation. Our FED knows that to stop inflation at this point, it would need to crush our markets. At this juncture, our FED and our Treasury Dept. (Janet Yellen) are unwilling to take those market-related steps.

Oil, Gold, Bitcoin & the Dollar… Oil and Gold are still near their all-time-highs. Tip #6: For this rally to continue, Gold needs to remain below $2,400/ounce, Oil below $90/barrel, and the Dollar below $106. The Dollar (~$106) appears to be setting up for a move higher – allowing us to export even more inflation to the rest of the world = not a good sign for markets.

Yen in Crisis? The Japanese Yen is truly an accident waiting to happen. On a 5-Year chart, the Japanese Yen is crashing and last week did nothing to stop it. Tip #7: The Bank of Japan will need to step in and support their own currency – which could be good for digital investors (Bitcoin) – but will hurt other asset prices as a whole. The Yen-in-Crisis could be the catalyst that sparks a Global-Debt-Crisis.

Catalysts for the Upcoming Week… (a) Monday afternoon has Janet Yellen showing us how she will roll-over a gargantuan amount of U.S. debt. (b) Wednesday has our FED giving us the latest interest rate announcement. And (c) Friday has our monthly Jobs Report. With events this precise and impactful, this market is made for ‘defined risk’ positions.

SPX Expected Move…

- Last Week’s EM = $97… and we moved $134 to the upside – 1.5 X the Expected Move.

- This Week’s EM = $84… Huh? We just moved $134 last week, and this coming week – with a FED mtg. and a JOBS Report – are going to have REDUCED risk? Enough said == Please be safe.

TIPS:

There’s no doubt the economy is slipping.

- GDP has dropped into the 1 to 2% range.

- Our unemployment rate and Jobs Report are now more for political purposes than accuracy.

- Our trade deficit is upside-down.

- Our savings rates have fallen from 5.2% to 3.2% YoY.

- Our credit card debt continues to push above a record $1.1T.

- Consumer spending rose 0.8% MoM – outpacing our 0.5% income growth. Spending rose strictly because everything costs more.

- I believe that Wednesday’s FOMC message will be fairly hawkish. I don't see how J. Powell could be announcing upcoming rate cuts when the very thing he’s fighting (inflation) is moving higher. And I have to imagine that markets will be none-too-happy and react accordingly.

HODL’s: (Hold On for Dear Life)

- 13-Week Treasuries @ 5.4%

- PHYSICAL COMMODITIES = Gold @ $2,349/oz. & Silver @ $27.5/oz.

- **Bitcoin (BTC = $63,500 / in at $4,310)

- **Ethereum (ETH = 3,160 / in at $310)

- **ChainLink (LINK = $14.8 / in at $7.78)

- **MARA – Marathon Digital = ($19.4 / in at $12)

o Sold June $40 Covered Calls

- **IBIT – Blackrock’s BTC ETF ($36.3 / in at $24)

- INDA – India ETF ($52.3 / in at $50)

o BOT Nov, +$53 / -$55 CALL Spread

- LUNR – Intuitive Machines: ($5.4 / in @ $6.40)

o SOLD: May $7 and June $7.50 Covered Calls

- **RIOT – Riot Bitcoin Mining ($11.9 / in at $12.5)

o Sold June $25 Covered Calls

- Various Bull Call Spreads:

o GLDJ – Gold Junior Miners: June = BOT $41 Calls

§ Now @ $3.25 – in @ $3.60

o MARA – Marathon Digital: Jan. = BOT $25 / SOLD $50

§ Now @ $3.13 – in @ $3.50

o NUE – Nucor Steel: Jan. = BOT $220 / SOLD $240

§ Now @ $2.33 – in @ $5.35

** Crypto-Currency aware

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

http://rfcfinancialnews.blogspot.com