Learning is about leaning into failure… on the way to getting better.

- If you’re not able to handle the tension that is caused by getting better – you’ll never do the work required to get there.

- Accomplishment brings with it a level of satisfaction.

- It also brings that ah-hah moment when you go from: ‘Not being good enough’ to ’Gettin-er-Done’.

Do the ‘Friggin’ Math… This week 81% of Congress agreed to ban the TikTok app. In the meantime, we’re fighting wars in the Middle East and Eastern Europe. We have: rampant gun violence, a broken healthcare system, an outdated tax code, inflation, runaway debt, immigration issues, housing prices, and challenges to our democracy. So, banning TikTok was the only thing our elected officials could agree upon. Ok, but if you’re going to worry about privacy overreach – then: Do the ‘Friggin’ Math:

- TikTok is 1% of: Google + Amazon + Apple + Meta. Those 4 combined represent +$7T of privacy overreach and nefarious activity.

- I’m more worried about: Big Brother reviewing my Internet searches, monitoring my online activity, and listening to my cell phone calls – than China knowing where I am while I’m watching a TikTok on ‘How to flip Pancakes’.

“We are the World…” 40 years ago, the royalty of rock spent the night in a studio recording one of the fastest-selling singles of all time. Per Seth G: the documentary shows us just how deeply imposter syndrome is imbedded even in the best of the best - as only a few of the stars were even remotely comfortable around their talented peers. We grew up thinking that if we only had the fan support and financial success that superstars have – then we’d finally be able to do our best. It seems that often the opposite is true, and perhaps the best plan is to JUST Show-Up and NOT Walk-Out.

The Market:

- Decision-Making:

o Purchases require a Decision, and Decisions involve a Purchase.

o Spending time, Taking a risk, or Making a commitment – causes our brain to act similarly to making a purchase.

o Introducing a new behavior or Asking someone to follow you – requires you to SELL that invitation.

o Learning: How to SELL the invitation in order to INFLUENCE the purchase – is a skill set worth mastering.

- The U.S. Bond Market is going through… the largest bond market crash of our lifetimes – and the Bond Market sets interest rates. By size: the Bond Market = +$130T, Stocks = $50T, Gold = $14T, and Crypto is $2.5T.

- 20% of Americans own crypto assets… and that’s 3 TIMES the number of union members, and 20 TIMES the number of EV owners. You’d think that Crypto Hodlerswould be a powerful voting bloc in the up-coming election.

- Inflation is actually 500% higher… Per Steve F: Economist Larry Summers realized that our inflation (CPI) collected data has changed since the ‘80s and no longer includes the interest paid on what we borrow (mortgages / credit cards). If we included those borrowing costs, inflation would be 5 TIMES higher.

InfoBits:

- Apple is in talks with… Google and OpenAI about integrating their generative AI software into Apple’s hardware offerings.

- Japan ended its negative interest rate policy… which will have global implications, as the Japanese carry trade has kept many markets alive for years.

- Deloitte, the world’s largest accounting firm… is undergoing a massive organizational restructuring & cost-cutting. Look out below – heads will roll.

- Saudi Arabia will launch a $40B AI fund… possibly in partnership with Andreessen Horowitz.

- Mustafa Suleyman is the new CEO of Microsoft AI… a division that will manage their consumer-facing AI products, including: Copilot, Bing, and Edge.

- Finland remains #1 in World Happiness… while the U.S. drops to #23.

- The DOJ filed a court case against Apple claiming:

o Apple has a 65%+ market share… in the U.S., but only 20% globally.

o Apple suppresses competition via its… super apps, cloud streaming apps, messaging apps (blue vs. green checks), digital wallets, and smartphone cross-platform compatibility. I didn’t know being ‘smarter than your competition’ was an actionable offense.

o Apple has a history of winning these antitrust cases… and as of 2024 it has won the most claims in lawsuits brought against them.

Crypto-Bytes:

- Bitcoin prices tumbled +13% this week to $63k… and the Grayscale Bitcoin Trust (GBTC) had $643m in outflows on Monday – the most in a day since it converted into an ETF.

- GPT-5:

o Is materially better than its predecessors,

o Is scheduled to be released in mid-2024,

o Is gaining the capability to call other AI agents, and

o Agent integration will be the big differentiator that will swing the power scales back in OpenAI’s favor.

- BTC: Above $69k = Buy – Buy - Buy… but it will take time to digest all of the overhead supply. Set an alert for IBIT @ $41 and relax.

- ETH: Above $3,500 = Buy.

TW3 (That Was - The Week - That Was):

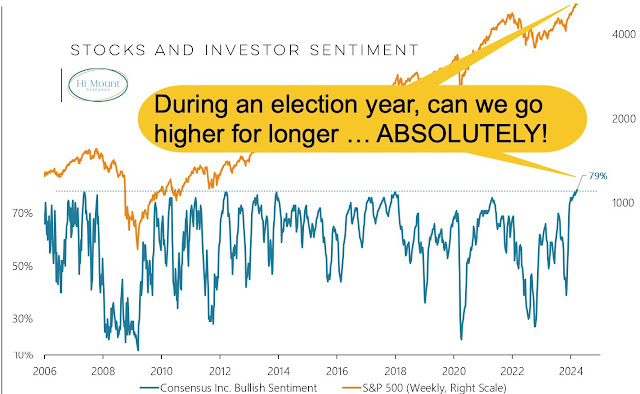

Wednesday: There remains zero fear going into the FOMC policy decision later this afternoon, with over 82% of the S&P 500 trading above their respective 150-day moving averages – the most since July 2021. The continued market strength comes despite lowered rate cut expectations from the FED following recently higher CPI and PPI inflation prints. With inflation re-accelerating there’s several ways Powell could take this: (a) He could say that the new data points were outliers, and the overall trend remains lower. That it would be a lie, but it comes with the territory. (b) He could suggest that he's going to have to remain higher for longer – which won’t win him many friends. Or (c) He can FED-speak his way around both alternatives – leaving everyone confused about what's next. I’m voting for: What’s behind Door #3.

When the Fed's statement hit at 2 pm, it left the 3 rate cuts in place, but said that they didn’t feel confident about when those rate cuts should happen. The market loved the idea that their percentage levels for the end of the year, suggest three cuts are still on the docket. So, we've got a giddy market that’s producing new all-time highs, and yes it will end badly – but not today.

Thursday: Another Fed Day has come and gone… and we’ve still failed to curb inflation. That means our FED caved in order to keep their jobs and to help Democrats stay in office. The FOMC is now saying that it can be okay with "slightly higher" inflation and yet still cut rates. Notice gold and silver – they’re not buying the "inflation is falling" baloney. Considering that the Swiss cut their rates and central banks tend to move in tandem, it seems certain that our FED will start cutting in June. My only question is whether they will go again in September, if the inflation data is ugly? At that point the decision could be more about politics and the need to pull more debt into the system.

Morgan’s Moments…

- Tip #1 = (BTC) = Bitcoin under $69k is a classic failed break-out. Given this is the first time Bitcoin has tested its former all-time highs, a deeper consolidation could be on the cards. The longer-term trends are still higher, and any dips to ~$50k are buying opportunities.

- Tip #2 = (ETH) = Ethereum under $35k is capital preservation territory.

- Tip #3 = (LINK) = I like Chainlink above $12 – with a target of $70.

- Quotes:

o Tom Lee: “Our $150k year-end target for Bitcoin may be too low, because our forecast was based on a more conservative estimate of ETF flows.”

o Hunter Horsley: “This is essentially Bitcoin’s IPO. The spot ETFs give many crypto followers an easy way to participate in the asset class.”

o Tom Lee: “People overestimate crypto’s risk because of the FTX-type of shenanigans. In 50 years, half of the 44,000 stocks have fallen 90% - and half of those have gone to $0.”

o Hunter Horsley: “AI will create a vacuum that will require blockchain’s ‘record-keeping notary’”

- Niche Play w/ Bitcoin Miners: Per J.C. Parets:

o Bitcoin miners have been underperforming in Feb and early March as investor's have been pricing in the BTC halving.

o Bitcoin miners have shown an incredible amount of strength over the last few weeks. When you plot the Bitcoin Miners ETF (WGMI) against Bitcoin (BTC) – the ratio has put in a failed breakdown.

o This suggests an upcoming aggressive move to the upside, which causes me to expect Bitcoin mining stocks (MARA & RIOT) to outperform Bitcoin in the coming months.

o Tip #4: Buy MARA and RIOT and SELL Out-of-the-Money Covered Calls on them as a hedge.

Next Week: “A Change is Gonna Come”

Background: The correlation between the Mag-7 and the S&P 100 is getting stronger, and that means: “A Change is Gonna Come”. Higher SKEWs (traders buying hedges), Lower VIX (volatility), Low CALL option volume, and a Non-existent gamma squeeze – all point toward a storm brewing on the horizon.

Trading Volumes are down considerably… and I would think nothing of it except that this was a FED week. At one-point markets were up +115 S&P points, and that type of behavior normally evokes the pros getting involved with some sizeable trades – which never materialized. Being down 15% on volume on a FED Day = now that’s abnormal.

The Gamma Squeeze is all but forgotten… and the sizzle index is confirming a Level 1 (lack-luster) performance across all Mega-Cap Tech. There’s just no Call Buying. We should (at minimum) be seeing Call Buying on a Triple-Witching Friday due to the rolling of contracts, but there was none.

Correlation has increased… and at one point on Friday we had 87 stocks (out of the S&P 100) all moving to the downside.

The SKEW is elevated… telling us that the out-of-the-money PUT options are trading at a premium to their corresponding CALLs = traders are buying hedges. Normally, when a market rips off a +115 S&P point rally to the upside: you would see higher volumes and CALL buying – versus tumbleweeds and PUT buying. ‘Something Wicked this way Comes’

WATCH: NVDA & the Luxury Trade:

- Watch NVDA next week as it will set the direction of the Mag-7 and potentially continue being the glue that holds tech to the S&Ps.

- Watch the luxury providers: NKE, LULU, LVMUY – as they are all getting annihilated as of late. This sector (over the last 5 years) has been impervious to a downtrend, but as of late – SELLERS have entered the market.

- This is often a leading retail indicator of the slowing consumer, and falling goods prices within the upcoming weeks & months.

- Tip #5: If High-End Retail continues to fall – then buying out-of-the-money PUTs in consumer staples (XLP) and Walmart (WMT) will be the trade.

SPX Expected Move (EM):

- Last Week’s Move: $81 … but we moved +$115 = we breached to the upside.

- Next Week’s Move: $54 (4-day week) … but we have End-of-Quarter window dressing coming.

- ‘Market TELLS’: NVDA, Volume, Retail, and Call Buying Volume.

TIPS:

HODL’s: (Hold On for Dear Life)

- 13-Week Treasuries @ 5.3%

- PHYSICAL COMMODITIES = Gold @ $2166/oz. & Silver @ $24.8/oz.

- **Bitcoin (BTC = $64,500 / in at $4,310)

- **Ethereum (ETH = 3,350 / in at $310)

- **ChainLink (LINK = $18.4 / in at $7.78)

- **COIN – Coinbase = ($255 / in at $125)

- **MARA – Marathon Digital = ($20.8 / in at $12)

o Sold June $40 Covered Calls

- **IBIT – Blackrock’s BTC ETF ($36.4 / in at $24)

- INDA – India ETF ($50.5 / in at $50)

o BOT Nov, +$53 / -$55 CALL Spread

- **RIOT – Riot Bitcoin Mining ($11.4 / in at $12.5)

o Sold June $25 Covered Calls

- **MATIC – Polygon ($0.98 / in at $0.94)

- Tip #5: Various Bull Call Spreads:

o RS – Reliance Steel: Sept = BOT $350 / SOLD $370 @ $6.20

o NUE – Nucor Steel: Jan. = BOT $220 / SOLD $240 @ $5.35

o MARA – Marathon Digital: Jan. = BOT $25 / SOLD $50 @ $3.50

o XLE – Energy: April = BOT $92 / SOLD $94 @ $0.90

** Crypto-Currency aware

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

http://rfcfinancialnews.blogspot.com

No comments:

Post a Comment