Facebook’s new smart glasses… are the latest attempt in a long line of smart glass failures. But FB's smart glasses have one advantage – they don’t look very smart. FB partnered with Luxottica to launch Ray-Ban branded, video-capturing – Wayfare glasses. They’re everything you hoped for and feared – in smart glasses. They cost $299 and can:

- Capture photos and videos,

- Post content to social apps, and

- Listen to music or take phone calls using their built-in, open-ear speakers.

Productivity Tools that Organizations Use… per SG + others:

- Calendly = to book one-on-one discussions.

- Doodle = to coordinate group meetings and/or calls.

- Streamyard = to record small-group discussions for distribution and playback == avoiding time-costly ZOOM meetings.

- Google Docs = to share workspaces.

- Zapier = to move information securely from one silo to another.

- Figma = for graphic collaboration.

- and Discourse = to improve development & ideation.

Teaching reimagined: Even though life has changed a lot in the past 130 years, our academic core curriculums have remained relatively stagnant. Why aren’t we teaching elements people can use like: statistics, gaming, communication, history & propaganda, citizenship, the scientific method, programming, art, decision-making, and cognition. If these are the elements we need and value, maybe we’re not teaching them because we don’t have the right teachers?

The Market:

The Greater Fool… maybe? There are now hundreds of digital NFTs each worth more than a $1m each. They all: (a) come with a story, (b) quickly change in value, and (c) are fun to talk about with your friends and peers. One day, every one of them will be owned by someone who is unable to sell it for a profit. Greater fool trading is a great hobby, but don’t confuse it with investing.

Can you say Free Tuition? Amazon just announced a new employee benefit: free college tuition for over 750,000 U.S. employees. Yep – Amazon will now enroll you in a fully paid bachelor’s degree program after 90 days of Amazon employment. Even if you work just 20 hours a week at Amazon, you could be eligible for up to a 50% college tuition reduction. Amazon understands that $15 / hr. is no longer sufficient to build a workforce. Amazon will probably have to pay-out over $1.2B over the next 4 years for education. These are the elements that Amazon feels are necessary to attract new talent.

InfoBits:

- "Give a man a gun… and he will rob a bank. Give a man a bank and he will rob the world." Per HT, only one of these crimes will land you in prison.

- PayPal will acquire Paidy… for $2.7B - as it pushes into the buy-now-pay-later arena. Japan is home to the world’s third-largest market for online shopping, and is also one of the few developed markets where paper currency is still king.

- 1/3 of our electricity companies… are state-regulated "natural monopolies" that have no incentive to pay for any upgrades. Policy makers are debating whether to fine utilities for not upgrading their infrastructure.

- Theranos’ Elizabeth Holmes… is throwing shade on the Silicon Valley mantra: “Move fast and break things”. Remember: WeWork’s Adam Neumann and Nikola’s Trevor Milton. Well, it’s rare for a CEO to face trial AND 20 years in jail.

- The US added 749K new job openings in July… for a record 10.9m openings. Meanwhile, 8.4m Americans remain unemployed.

- Cloud software startup Databricks… raised another $1.6B at a $38B valuation. That’s the 4th largest valuation for a venture-backed, private company in history.

- Harvard just announced… that it “does not intend to make any future investments in fossil fuels because climate change is the most consequential threat facing humanity.”

- The FDA delayed their Juul Labs ruling… because they’re deciding whether these devices as creating more harm than good.

- The judge forced Apple… to allow alternative payment options for in-app purchases – costing Apple and Google billions in app store commissions.

Crypto-Bytes:

- You can’t hide from the weakness in crypto this week. Bitcoin pulled back to $45,000 and Ethereum to $3,300. Markets continue to de-leverage and digest the impact of El Salvador's legalization move.

- El Salvador is the 1st country to adopt bitcoin as legal tender… allowing residents to pay all public and private debts in the cryptocurrency. It’s a policy that begins a new period of national self-determination for the country.

- Mastercard purchased CipherTrace… a firm that scans blockchains for illicit transactions, at a time when a number of governments and banks are looking to ramp up monitoring and compliance.

- Former CFTC top official Brian Quintenz… has joined VC firm Andreessen Horowitz as a part-time adviser. Quintenz left the CFTC after advocating for stablecoins and self-regulating organizations.

- The U.K. Post Office… will now offer users the ability to purchase crypto through its identity-verification service == EasyID.

- "I don't necessarily think applying 80-year-old laws to these kinds of dynamics are really the best way that government can promote innovation, wealth creation, and access to financial inclusion,” … former CFTC official Brian Quintenz on the regulatory cryptocurrency gridlock in the U.S.

Last Week:

Monday: This week, over 7m people will no longer be getting the ‘extra’ unemployment payments they've enjoyed for many months. Also, Goldman says that over 740,000 evictions are going to take place over the next few months. For this and other reasons, I think we’ll see ‘chop to lower’ over the next several days. But since nothing has changed and our Fed is still printing, I have to think we will see gains eventually. September is historically the soggiest month, but not when you've got a rabid Fed printing money as fast as it can.

Wednesday: Be cautious with Coinbase (COIN). When the SEC gets involved and the CEO takes to twitter to defend himself – things can go sideways in a hurry. A high-ranking insider at SLQT bought over $2m worth of their own stock. After looking at the chart, SLQT could be worth a shot over $12.80. Also watch the uranium miners. CCJ for instance has run from $17 to $22 in 6 sessions. With all this push for the new green deal, nuclear is definitely in the air.

Friday: Companies are beginning to lower guidance due to supply chains still being broken. The fallacy that stocks are priced due to earnings is being tested. In this market, stocks are priced because of the Fed. This morning it appears that our market may need a bounce. Will it hold or reverse? I don’t think that this chop is over. Volatility is alive, and that means more drops than pops as I see it.

TW3 (That Was - The Week - That Was):

Fractionalized NTFs: Remember when the Doge Coin dog was turned into an NFT and sold for $4m? Now, it’s one of the most valuable NFTs on the Ethereum blockchain, valued at over $447m. That single NFT has been broken up into billions of investible ERC-20 tokens. It’s the best example of a new trend called: fractionalized NFTs. Fractionalized NFTs allow millions to buy “stock” in an NFT. The DOG tokens, which were sold for $0.013 each, represent shares of ownership in the NFT. The token’s auction alone raised 11,942 ETH == $45m.

Inspired by El Salvador… there is a queue of countries now forging ahead with crypto legalization. #1 = Ukraine, which recently adopted a bill legalizing and regulating all virtual financial assets, including crypto. Cryptocurrencies in the Ukraine have long been a gray area that was neither legal nor forbidden. The law passed on Wednesday allows the country to regulate digital currencies. It also spells out certain protections against fraud for those who own Bitcoin and other cryptocurrencies. #2 = Panama could be the next country to regulate crypto as it recently introduced a bill proposing to use Bitcoin and Ethereum as currency. The bill also explained why crypto adoption would be beneficial for the country. #3 and #4 = Cuba and Paraguay are both working on bills to legalize digital assets. This means that crypto is clearly not just an economic issue, but a political one. As more global governments start acknowledging the power of crypto, we know one thing = it’s not going away any time soon.

Next Week: Mild Selling feels like Massive Risk

Market Update:

- The SPX breached its downside expected move last week. This is only the 4thdownside breach in all of 2021.

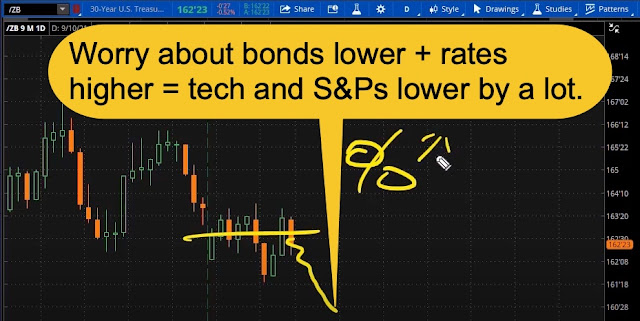

- Bonds will lead Equities for the foreseeable future. Lately, we’re seeing some sell side activity inside of the bonds. As bonds move lower – interest rates move higher. When interest rates move higher, financials should be moving with them – but currently correlation means more than fundamentals.

- Bonds are at an inflection point. If they sell off any further, it is going to result in a ‘tech’ disaster due to higher interest rates – which will put the brakes on virtually every stock buyback program out there.

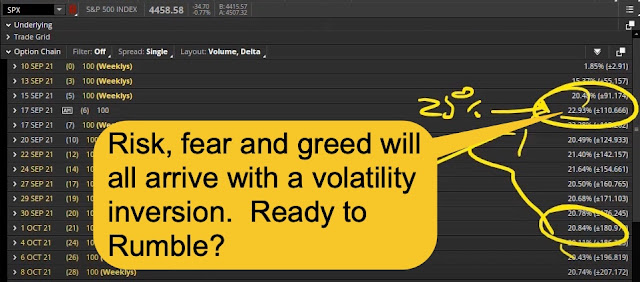

- We need to watch the volatility futures going forward. Things get ‘serious’ when the volatility futures either go ‘flat’ or become ‘inverted’. Right now, the crowded trade is to ‘sell’ short-term and ‘buy’ long-term volatility. But the minute short-term volatility begins to falter – there could be a short squeeze and traders will begin to sell the SPX like crazy – virtually guaranteeing a liquidation event. Be careful of the ‘buy the dip’ (BTFD) crowd – as it could turn into ‘sell the rally’ (STFR) in a heartbeat.

Big Tech is Raising Concerns:

- The market cap for the Monsters of Tech: (Apple + Microsoft + Amazon + Facebook + Google) is approaching $5.5T and the stocks are up a combined 33% YTD. The QQQ’s are only up 21% YTD. Therefore, it’s easy to conclude that any additional upside in the QQQ’s is potentially dependent upon the Monsters of Tech moving higher.

- Within the Monsters of Tech, AMZN is only up 8% this year. AAPL is only up 15% YTD. And MSFT is up 35% YTD.

- FB, GOOGLE and NVDA are up 40%, 63% and 71% respectively YTD. The fate of the entire Nasdaq potentially resides on the backs of these 3 stocks.

- Tip #1: If you see continued selling in Bonds, then watch: NVDA, FB and GOOGL. If they start SELLING OFF, it would be enough to drive the QQQ’s and S&P’s lower. The volatility (VIX) will immediately invert, and that’s just how quickly markets could move to the downside.

SPX Expected Move:

- Next week is Triple Witching. That is when futures roll over, equity options expire, and index options also expire. Last week’s expected move was $50 and we moved lower by $80. Next week, the SPX is expected to move $115 – “Get ready to rumble”.

- IF bonds sell off, there’s a high probability that the selling spills over to tech and directly into NVDA, GOOGL, and FB. Watch those 3 stocks because they alone could initiate: “Mr. Toad’s Wild Ride”.

Tips:

HODL’s: (Hold On for Dear Life)

- AMC – Holding

- Bitcoin (BTC = $45,700 / in at $4,310)

- B2Gold (BTG = $3.66 / in at $4.16)

o Waiting to sell CCs for income,

- Englobal (ENG = $1.94)

o Sold Dec. $2.50 Calls for income,

- Ethereum (ETH = $3,300 / in at $310)

- Express (EXPR = $5.28)

o Sold more Sept. $5.5, and Sold Oct $5’s

- GME – Holding

- Grayscale Ethereum (ETHE = $31.61 / in @ $13.44)

- Grayscale Bitcoin Trust (GBTC = $36.80 / in @ $9.41)

- Grayscale Trust (GDLC = $33.65 / in @ $22.75) & buying

- Hyliion (HYLN = $8.52 / in @ $0.32)

o Sold Oct. $10 CCs for income,

- Infinity Pharma (INFI = $3.56)

o Sold more Sept $3 Calls / Oct $3 and $4 Calls for income,

- Transocean (RIG = $3.71)

o Sold Nov. $4 Calls for income,

- Exela Tech (XELA = $2.25)

o Sold Sept. $2.50 Calls / Oct $2 and $3 Calls for income,

- Yamana Gold (AUY = $4.14)

o Waiting to sell CCs for income.

Thoughts: Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Tip #2: TRADES == 2 Downside & 1 Upside:

- AMZN Buy a Put Spread == Buy +1 OCT 21 $3510 PUT / Sell -1 OCT 21 $3505 PUT @ $2.35 DEBIT

- JNJ Buy a Butterfly == Buy +1 OCT 21 $170 CALL / Sell -2 OCT 21 $175 CALL / Buy +1 OCT 21 $180 CALL

- XLF Buy a Put == Buy +1 19 NOV 21 $41 PUT

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>

No comments:

Post a Comment