What time is it?

1. What’s the hardest part of your day?

o What are you doing to make it easier?

2. Do you spend your time reacting or proacting?

o How much is focused on solving question #1?

3. What information would make you more effective?

o What are you doing to obtain that information?

4. What outcome(s) scare you?

o What are you doing to de-risk those situations?

Jeff Bezos always asked the question: “Are you the type of company that works really hard to RAISE prices, or the type that works hard to LOWER them?” Good question, and after price comes timing and speed to market – as a set of typical project success metrics. SG coined the term: Avocado Time. It seems that individual avocados are delicious for less than 2 days. Before that 2-day period, they are under-ripe and too hard to eat. After those 2 days, they’re soft, mushy, and not as tasty. The ability to calculate an Avocado Time moment – when two businesses have a chance to connect, be in sync, and bring out the best in each other – mixes art with science. It’s the timing piece that most young entrepreneurs miss, and the reason the average successful entrepreneur is 41 years old. Avocado Time can NOT be optimized or leveraged. And Avocado Time is the ONLY chance you have of making a real connection and a difference. So, as you review your weekly / daily issues list, along with solving some of them – figure out an Avocado Time communication strategy that will allow your solution to resonate and be implemented.

The Market:

The #1 reason customers remain with a supplier = reliability. In fact, increased business tracks directly with increased reliability. “You are busy – because you’re reliable?” Reliability will be just one of the reasons that you’re busy, but Reliability could easily become the only reason you’re NOT busy. To help with Reliability:

1. Learn how to say ‘NO’ more often, and with rationale and solution. The deals you made during COVID might not be the deals you should be handling now. Your reputation for reliability has earned you more trust, and that trust gets you invited to work with better clients. That means you’ll need to turn down more opportunities as you maintain your reliability.

2. Learn how to Tell the Truth. It’s hard at first. But being truthful doesn’t mean being perfect – it just means being clear.

Lately, our markets have been all about FED ‘reliability’. After J. Powell’s remarks, markets feared that the FED would begin tapering its bond and mortgage buying sooner. Currently, our FED is spending $120B / month buying bonds, and another $40B / month buying mortgage backed securities. The FED knows that if they raise rates or remove just a few ounces from their ‘reliable’ liquidity punchbowl – markets will come tumbling down. Unfortunately, to maintain its ‘reliability’ our FED cannot say ‘NO’ or ‘Tell the Truth’. So, the fate of our FED has been cast, it will quickly become a re-actor to the markets and not the pro-actor we need it to be.

InfoBits:

- Inflation Watch (YoY): (a) Gasoline +56%, (b) Used Car Prices +30%, (c) Insurance +17%, (d) Airfare +24%, and (e) Laundry +26%.

- Props to Hindenburg Research: According to a new regulatory filing, Lordstown Motors does NOT have binding orders from customers for its EVs. It seems like David Hamamoto (who heads the SPAC that took Lordstown Motors public) has some e'splainin to do.

- The iconic “Dogecoin” dog Shiba … was sold as an NFT for $4M – making it the most expensive meme NFT of all time.

- There are more REALTORS selling homes… than homes available for sale.

- 2021 IPOs have already raised $171B… eclipsing the $168B raised in 2020.

- Waymo, the Google-birthed self-driving vehicle startup… just raised a massive $2.5B to advance its self-driving tech.

- Waymo has something that nobody else has… a maps app with +1B users. Integrating Waymo into Maps offers a speedy way toward robotaxis. Google will also weave Waymo into Google Pay and Google Home for seamless booking.

- Amazon ordered 1,000 autonomous driving systems… from five-year-old, self-driving truck technology startup Plus and has acquired the option to buy as much as 20% of the company as well.

- Costco has its own secret weapon called Kirkland. Their own private-label offers everything from vodka to eggs, and batteries to toilet paper. Kirkland coffee = Starbucks, Kirkland diapers = Huggies, and Kirkland cran-juice = Ocean Spray. Kirkland did $52B in sales last year – nearly $20B more than Coca-Cola.

- McDonald's will launch its 1st loyalty program on July 8: McDonald’s was founded in 1955, I just assumed that they HAD one?

- Microsoft… became the 2nd U.S. company to reach a $2T market cap.

- R.I.P. John Mcafee (creator of the anti-virus software). John was ‘Epsteined’ in his Spanish prison cell. He went on record many times that if he ever turns up dead, it will NOT be suicide – but rather because he was whacked. He even had "Whacked"tattooed on his right arm.

- Krispy Kreme is coming back to the public markets…. with a $4B valuation.

- Warby Parker filed for to IPO… looking for a +$3B valuation.

- Sweetgreen (the salad chain) also filed to IPO… valued @ $1.8B.

- BuzzFeed’s going public via the 890 5th Ave. SPAC. BuzzFeed aims to compete with: Google, Facebook, and Amazon for ad dollars. BuzzFeed leans towards unprofitability and stagnation – not a winning combo with investors.

- Panasonic Corp (Tesla’s leading battery supplier)… has sold its entire stake in Tesla for about $3.6B.

- Embark Trucks is going public via SPAC… valuing the company at $5.2B.

- Total U.S. e-commerce sales during Amazon Prime Day… crossed +$11B.

- Amazon and others are buying solar and wind plants… to meet their emissions goals.

- Wendy's is testing a new plant-based spicy black bean burger: As the chicken sandwich wars die-off – the plant-based burger wars are taking shape!

- Per MA: “What we have learned from the COVID lockdowns has permanently shattered our work/life balance.” It turns out, many of the best jobs really can be performed from anywhere, through screens and the internet. Companies are remotely managing work-teams – irrespective of the sophistication and/or the complexity of the team’s problem.

Crypto-Bytes:

- The National Republican Committee (NRCC)… will accept donations in cryptocurrency.

- Tesla CEO Elon Musk said… the company will resume bitcoin transactions once it confirms there is reasonable clean energy usage by miners.

- Tanzania’s President… urged the Bank of Tanzania to prepare for wider adoption of crypto.

- The Netherlands Minister of Finance thinks… that monitoring crypto would be more effective than outright banning it.

- Colombia’s President said: “We see [crypto] as an opportunity and we are welcoming the investment that can come from this industry.”

- Paul Tudor Jones said to… "Go all in on the inflation trades" like bitcoin – if our FED continues to dismiss consumer inflation.

- Bank of America’s global survey claims… that more than 80% of fund managers think Bitcoin’s in a bubble.

- Chinese BIT Mining delivered 320 machines to Kazakhstan… after being forced by the state energy regulator to shut down its data center in Sichuan. The company is expected to send another batch of 2,600 machines before July 1.

- Chinese logistics firm is airlifting… +3 tons of mining machines to Maryland.

- PayPal and Visa… have joined Blockchain Capital’s new $300m venture fund.

- Treasury Sec. nominee says that they will prioritize implementing crypto rules. How about: “We will accept no competition to our bogus U.S. dollar.”

- 1st Repo Trade: Goldman Sachs did its first repo trade using JPMorgan’s private blockchain network. The initial trade came in the form of a U.S. Treasury bond exchanged for JPCoin.

- Andreessen Horowitz (a16z) raised $2.2B for its Crypto Fund III… the industry's largest crypto-related fund to date. They’re also hiring the former SEC official Bill Hinman as an advisory partner.

- Derivatives giant FTX is following Binance’s lead… in offering tokenized stocks (TSLA, AAPL, and COIN).

- ARK CEO Cathie Wood is keeping her faith in Bitcoin… she bought the Bitcoin dip. Just call her: BTC’s BFF.

- "Most people always criticized bitcoin because it wasn't mainstream. Now that it's mainstream, people are criticizing the fact that it's mainstream." – Miami Mayor Francis Suarez

- El Salvador’s Bitcoin Law (which makes the cryptocurrency legal tender),will come into effect on Sept. 7. They will use the Chivo e-wallet, which will have $30 of bitcoin preloaded for everyone who downloads the app. That’s a serious incentive in a country where per-capita income is about $80 / week.

- Robinhood’s planned initial public offering (IPO)… is facing delays due to its growing cryptocurrency business.

Last Week:

Monday: I'm sure many think that it's the perfect time to buy the dip, but I’m not so sure. The DOW was down 5 sessions in a row, with the last one being a loss of 533 points in a day. An oversold "dead cat bounce" is certainly in the cards. Despite the FEDs not actually doing anything with rates or tapering, the atmosphere has changed. You can only dismiss 5 and 6% increases in PPI and CPI for just so long before everyone starts to feel the pinch. The inflation cat is out of the bag, and NO it's not transitory. Even without the COVID inspired supply shortages, we still have +10% annual inflation. I bought more ENG this morning @ $2.78. With RGLS, I’m looking to buy the stock when it’s over $1 and selling calls against it. A recent Goldman headline has our FED plowing another $500B into U.S. Stocks. At least they don't try and hide it anymore.

Tuesday: More and more people are starting to catch up on what the globalists are doing to the middle class – buying up all of the housing at absurd prices, locking first time home buyers out of the market, and then putting all those properties out as rentals. SFR's (single family rentals) are being bought above listing prices, and Blackstone just agreed to buy all of Home Partners if America’s portfolio for $6B. In terms of what looks good: WMT looks interesting and I could see taking some over $137.55. HL looks interesting again. It has a brick wall at $7.90. if it gets through that, it could go well. I would try it over $7.93

Wednesday: Yesterday we witnessed the power of the jawbone. A weak market start, began to reverse once FED-head Williams said that rate hikes are "well off in the distance." No matter how badly this market needs to correct, FED’s like Williams and Powell simply will not let it happen. This just in: The Supreme Court ruled that the structure of the agency that oversees mortgage giants Fannie Mae and Freddie Mac violates separation of powers principles in the Constitution. The justices sent the case involving Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac, back to a lower court for additional proceedings. So, the stocks of FMCC and FNMA got whacked big time. Anyway, the market is flat across the board. I could get interested in: SLB > $34.10, PLTR > $26.35, and RIG > $4.60

Thursday: Today, SPWR over $28.20 looks interesting. PLTR which stopped right on $26.35 yesterday, it is now $26.63 – over $26.68 I’ll take it. IR looks really good to me. The technicals are curving nicely. IR over $47.35 works for me.

Friday: Today brings some economic reports and the last of the 16 talks from our FED. The DOW is reaching for the stars. The NASDAQ is sort of whimpy, and the S&P is doing fine. Today we found out that: (a) May personal spending FELL -0.4% vs an estimate for -0.1%. The Personal Expenditures Index rose +3.4% to a new all-time-high since 1991. Oh, and just yesterday the S&P 500 made a new all-time high with more than half (52%) of components below their 50-day moving averages. Ah yes, fun in an ever-narrowing market. If you're not "in the club" of favorites, you might not be anywhere.

Entrepreneurship … Where has it gone?

Per MJP: an acticle was released this week: The Slow Death of Stanford’s Start-Up Culture: https://stanfordreview.org/the-slow-death-of-stanfords-startup-culture/. To be clear, current Stanford students remain interested in entrepreneurship and startups, as evidenced by the number of students with “Entrepreneur” as their LinkedIn header. However, when combing thru the data we find an over-whelming number of dubious undergraduate ventures with little to no market potential. There are Instagram knockoffs pointed at a particular niche. Many of the companies listed are just blogs, newsletters, or agglomerations of Google results. And this doesn’t include the significant number of startups that are actually a single student doing a completely normal hobby – like volunteering or drawing, and then calling themselves: “Founder/CEO of a Non-Profit”.

- Stanford (at its peak) would produce 6 real, start-up companies / semester,

- Stanford is currently only producing 1 viable, start-up candidate / semester.

Over the last 25 years, Higher Ed. has dramatically expanded entrepreneurship education – and that very expansion has produced less entrepreneurs.

Next Week: Markets are Displaying Inefficient Behavior!

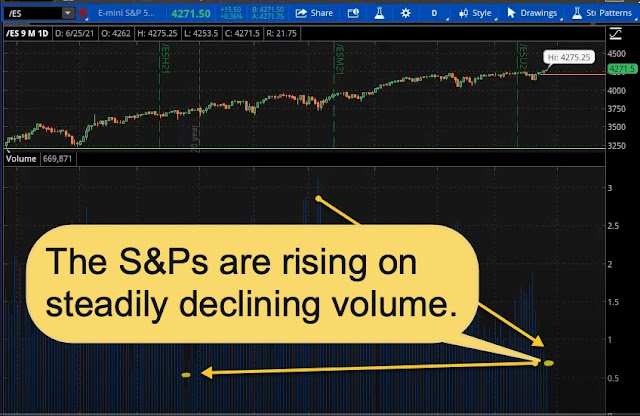

Last week, the following indices breached their Expected Move(s): SPX, IWM, QQQ, XLF, XLE, and TLT. Part of that was the volume of trading was incredibly light on Friday. You have to go back to Christmas Eve to see volumes this low, and low volumes will contribute to market inefficiencies. Factually, markets are increasingly breeching their expected moves – which should tell us: Tip #1: to NOT sell short-term premium, but rather to buy short-term options and pay for the trade by selling long-term premium on OTM options. But when was the last time we saw all of the major indices (including Bonds) break-thru their expected moves?

Will rising rates become an issue again? We saw rates rally last week, and if they continue to the upside – down comes tech once again. Tip #2: Watch our interest rates (TNX). If the TNX gets back to the 1.7% level, we will have issues with big tech.

Dollar Reservations: The huge bid under the dollar is due mainly to risk returning to the marketplace and causing a flight to quality. But, if the dollar continues to move higher, it will prevent the S&Ps and NASDAQ from making new ATH’s.

Crypto cracks are not proliferating outward - into the broader marketplace. When you’re watching BTC, watch the 30,000 level because that is what is being defended with a fair amount of trading. Tip #3: If Bitcoin (BTC) breaks below 30,000, then tech (NVDA) will also be pulled down with it.

Volatility fell but the ‘tail risk’ is still waging the dog: The VIX is at its lowest point since the onset of COVID. However, the VVIX is around 106 – which is alarming. But it’s the SKEW (ratio of OTM Puts to OTM Calls) that continues to make ATHs. So, I’m still looking at this market as being incredibly risky. Fair warning: “If you’re selling near-term premium, you are out-of-your mind.” You’re not getting paid anything for taking a ginormous risk. Tip #4: In this type of market, you are buying near-term premium, and selling long-term premium to pay for the trade.

SPX Expected Move: Last week’s move was $91, and the coming week is down to $53. Last week we ‘actually’ moved $120, and the options experts are saying that we’re going to move less than 50% of last week’s move. Really? I think next week will give us a larger than $53 move.

Tips:

HODL’s: (Hold On for Dear Life)

- AMC – Bought more on principle,

- Bitcoin (BTC = $33,200 / in at $4,310) & buying

- Bitcoin Cash (BCH = $450 / in at $170) & buying

- Peabody Energy (BTU = $7.77)

o Sold July $8 & 10 CCs for income

- CTI BioPharma (CTIC = $2.34)

- Electramericcanica Vehs (SOLO = $4.36)

o Sold Sept $4 CCs for income

- Education New Oriental (EDU = $8.12)

o Sold July $10 CCs for income,

- ENG (ENG = $3.46 in at $2.86)

- Express Inc (EXPR = $7.10)

o Sold July $5 CCs for income,

- Ethereum (ETH = $1,872 / in at $310) & buying

- Franks International (FI = $3.30)

o Sold Oct $5 CCs for income,

- GME

- Grayscale Ethereum (ETHE = $18.17 / in @ $13.44) & buying

- Grayscale Bitcoin Trust (GBTC = $27.68 / in @ $9.41) & buying

- Grayscale Trust (GDLC = $20.65 / in @ $22.75) & buying

- Hecla Mining (HL = $7.59)

o Sold Sept $9 CCs for income.

- Hyliion (HYLN = $12.49 / in @ $0.32)

o Sold July $13 CCs for income

- Litecoin (LTC = $150 / in @ $191)

- Transocean Limited (RIG = $4.44)

o Sold Aug $5 CCs for income.

- Sandstorm Gold (SAND = $8.08 in @ $6.90)

- SOS Limited (SOS = $3.34 in @ $2.91)

o Sold July $3.50 / $4 / $4.50 for income,

o Sold Aug $4 for income.

- Tellurian (TELL = $4.27)

o Sold July $5 CCs for income.

Thoughts:

Tip #5: Due to tremendous Call-Buying, keep an eye on WISH next week because a large number of option traders are forcing the stock higher. For example: If XYZ stock is at $9.75 and the Reddit crowd has been buying a boat load of $12 Calls – it’s kind of like allowing the market makers to be your bookie. They don’t want to pay off, but they have to narrow the spreads. So, all those purchased calls act like a magnet for moving the stock higher. Sometimes a huge option position will also pull a stock higher. There’s a boatload of $15 and $15.50 calls on WISH being purchased, so there’s fair chance it will get there.

Overall, I have to think they’re going to get that DOW up to its closing high. That would place all three major indexes at all-time high levels, and they seem to like that. I’m leaning long into this, gritting my teeth, and hoping that I’m not the last one in or out when the house-of-cards begins to fall.

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

No comments:

Post a Comment