This Week in Barrons: 11-1-2020:

Entrepreneurial Problem Solving…

“When you ‘democratize’ entrepreneurship, you unknowingly trivialize all that it takes to be successful.”

Per SG: the entrepreneurial method of problem solving is man’s most powerful invention. It has changed what we wear, eat, the health of our families, the way we earn a living – basically the world as we know it. The rules are simple to say, but schools and organizations do a poor job of implementing most of the elements that they try. Personally, I don’t know many entrepreneurship programs in the U.S. that even dive into it. It goes as follows:

- Step 1: Do your homework on what was done before you.

- Step 2: Understand the thinking behind what they did and the rules they created, in order to later change and expand upon those rules.

- Step 3: Test what people never did, and especially the ‘edge’ cases.

- Step 4: Put your work ‘out there’ so that others can examine, correct, and improve upon it.

- Step 5: Explain what you did so that others can follow in your footsteps, and replace it with something even more useful.

There are very few issues in our world today that entrepreneurs couldn’t resolve if we were all willing to act in good faith and work our way completely through the steps.

The Market:

Let’s be clear, unless you’re Amazon – it’s ugly out there. All three of the big indexes are below their 50-day moving averages, and knocking on the 200-day door. The selling has been strong. It’s no mystery as to why it happened. The stimulus package never came. People can no longer pay rent, get to work, or afford medical care. COVID is raging and shutdowns are coming. I’m going short if the S&P breaks and stays through its 200-day moving average = 3,211 on the SPX.

InfoBits:

- Delivery success doesn't always deliver... Chipotle would've been better off if people only did drive-thru and/or pick-up. Delivery lost them money. I thought that’s why they opened 26 new digital-order drive-thru lanes last quarter.

- Venture capital powerhouse General Catalyst… filed to raise a $500m SPAC.

- Airbnb is targeting…. a $20B valuation when it goes public.

- Bond king Bill Gross and his neighbor are feuding…. over a $1m outdoor sculpture that has them blaring the ‘Gilligan’s Island’ theme song on a loop late all night long.

- Dunkin may spend $8.8B to go private. Why? Because it wants to be shielded from the obligations and scrutiny that come with being public during its brand transformation process.

- Families are bored, so Monopoly sales are soaring…. maybe they should call them:Bored Games?

- Tennis star Rafael Nadal finished 6th in a professional golf event… that much athleticism inside one body just isn’t fair.

- French President Emmanuel Macron announced a 2nd national lockdown… until at least the end of November amid surging COVID.

- German officials have agreed to a 4-week shutdown… of restaurants, bars, cinemas, theaters and other leisure facilities in a bid to curb a rise in COVID.

- An iPhone 12 production surge… is causing lower air quality in some Chinese cities. But enjoy your new phone.

- Consumer confidence declined in October… and remains 30% below pre-coronavirus readings.

- In case you forgot… the market declined 33% in February following COVID.

- Shopify is partnering with TikTok… to help its 1M+ merchants sell products through shoppable video ads.

- Microchip giant AMD is buying rival Xilinx for $35B…. accelerating semiconductor consolidation.

- Stanley Druckenmiller warns… an electoral ‘blue wave’ will hurt stocks but benefit gold and precious metals. Goldman is bullish for commodities in 2021.

- Boeing announced plans to cut 7,000 more jobs… in response to the downturn in air travel.

- Google’s YouTube ad growth was up…. 32% YoY.

- Facebook saw decent revenue growth…. but users decreased in CA and U.S.

- Apple iPhone sales fell 20% YoY.

- Amazon saw 37% revenue growth YoY…. and tripled its profit.

- Exxon will cut 15% of its global workforce.

- AOL founder Steve Case…. says that it’s time to change Section 230 – which basically exempts social media sites from lawsuits.

- LVMH is getting a deal on Tiffany…. as Tiffany has agreed to accept a lower purchase price, ending a spat that had threatened to derail its $16B takeover.

- Amazon's cloud computing unit AWS…. made up 57% of its profit last quarter and 12% of its sales. Why does the largest e-commerce service also own the largest cloud computing service?

- Chewy is marking its turf... by bundling pet-related services. Chewy should add pet insurance to its ‘Barking Bundle.’

- Anheuser-Busch InBev reported a 36% fall… in Q3 profits on lower revenues.

- Under Armour will sell MyFitnessPal…. for $345m – 5 years after buying it for $475m.

- WeWork says that it’s on track to be profitable next year…. and will re-think its IPO at that time.

Crypto-Bytes:

- JPM Coin will see its first transaction this week. Designed for wholesale payments and faster transactions, the system is predicted to save the banking industry hundreds of millions of dollars a year. Pretty good for something that their CEO Jamie Dimon called a fake / fraud / hoax a couple years ago!

- DBS (Southeast Asia's largest bank)…. Is building a digital assets trading platform.

- Bitcoin is up 25% for the month / 87% for the year.

- Forbes thinks COVID made BTC more interesting… to investors this year. Paul Tudor Jones said he would buy Bitcoin to hedge against inflation: Buying Bitcoin is like investing with Steve Jobs and Apple, or investing in Google - early.

- BlockFi has taken a 5% share… of Grayscale’s $4.8B Bitcoin Trust (GBTC).

- JPM is inviting 400-plus financial institutions… to start building on top of its revamped blockchain network – Liink.

Last Week:

Monday: The markets opened weak due to the resurgence of COVID. OK – I’ll bite. But then wouldn't WFH names like Zoom be up big? They're not, which tells me something else is going on. I think it's a combo platter, and they're just tired of fighting. I mentioned a couple of weeks ago that we would enter a period of great volatility as we got closer to the election. We're getting it. I can't see myself doing anything in here; however, the 50-day moving average on the S&P is at 3,408. Punching thru it could cause an end-of-day bounce. If they bounce us, I'll grab some SPY and or DIA and be content with a quick buck if I get it.

Tuesday: To be brutally honest, I don't know what to do next either. In the longer term, I have to think that the FEDs will engineer enough monetary baloney to keep us moving higher. But in the short term (over the next 15 days), who knows what could happen. FOSL has earnings on Nov 4. They've been trying to break over their 50-day moving average for 4 sessions. If they get over it ($6.41) and hold into the close, it could run. AAPL is pushing to get back to its 50-day. That's one I'd take a shot at if it got up and over, but again – fear would have me with my finger near the sell button. Until some of this uncertainty wears off, we have no choice but to be cautious.

Wednesday: All around the globe COVID is raging and shut downs are beginning again. It might not be a bad idea to go stock up on TP and paper towels again – as supply chains may be disrupted. So, do we keep fading until Mnuchin is forced to deal with Pelosi? I am surprised that the metals are being trashed. Sure, the dollar strength beats on miners and metals, but in this whacked out world – one might expect to see a bit of buying there.

Thursday: Volatility will rule again today. I will not be buying in here. I know it's boring sitting on your hands, but the risk is too high either way. If you go short and they announce some form of stimulus or the FED comes out with some program – we’ll fly higher. If you go long and COVID closures soar – you could get crushed. Sometimes: “the only winning move is … not to play.” I don't think it's surprising to anyone (after peeling off over 2,000 DOW points in just days) that we’re on track for a dead cat bounce here. They’d like to defend it, but only Friday will tell.

Friday: The markets didn’t like AAPL earnings, but loved AMZN – as everyone shops from home. And then our FED decided to “lower the minimum loan in Main Street program to $100k from $250k.” With that announcement the momentum to the downside was slowed. There are just no buyers out there.

Marijuana…

- N.Y. will soon legalize adult-use cannabis…. said N.Y. governor Andrew Cuomo because: “Now we need the money.”

- Caliva and rapper Jay-Z are launching a new cannabis brand Monogram…. over a year after Jay-Z joined the company as chief brand strategist.

Next Week: “When will the Market Horror Show End?”

- The binary event is upon us. The S&Ps just happen to be back to where we were 3 weeks ago – around the SPY = 320 level / SPX = 3211 level.

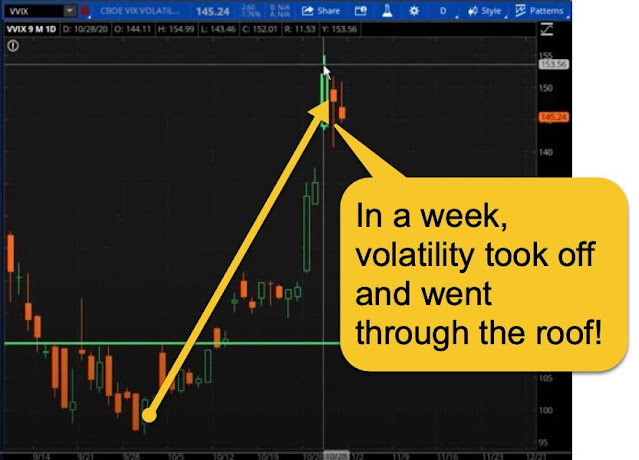

o Volatility is BID: All week long the VIX and the volatility futures moved higher. And on Wednesday, the VVIX broke thru the 150 level.

o The Volatility SKEW has shifted. Previously the market was telling us that this election was not going to be decided until the December / January timeframe. This week the market believes that the election will be decided in mid-November – according to the implied volatility numbers.

o This week you’ll need to put on your ‘Big Boy Pants’ as the volatility is going to be extremely high and movements will be massive and fast. Last week we had a 3-Sigma move that breached the SPX expected move – so things are moving Fast-n-Furious.

o Last week was the largest downside move we’ve seen since the start of COVID. But we’re simply back to where we were a few weeks ago. We are looking at a pure, simple, binary event. It won’t be complex to analyze, but it may take some time to work its way through the markets. It should even offer some premium selling opportunities. For example the QQQ’s are still away from their worry point, and the Russell (IWM) is just a hop-skip-and-jump away from all-time highs.

- The Gravity Points are back in play:

o We have unfinished business at 3211 on the SPX. It is the consummate inflection point for the entire market place. A gravity point that already comes with a fair degree of volatility, now brings with it an explosion either higher or lower due to the binary event. This should be quite a week.

o If we break under 3211 (say down to 3190) – we will get UGLY and in a hurry. Trading firms are ready to sell this market like there’s no tomorrow.

o I also believe that a ‘rip-your-face-off’ rally is coming, but it will also be sold into due to the binary event. We could very well sit right around 3211 UNTIL we hear something more definitive about who won the election.

- 3-Sigma moves continue to haunt premium sellers in 2020.

o Last week, the expected move in the SPX was $78. The actual move was $207 – which is almost 3X the expected move (a 3-Sigma move).

o Currently, this market is ‘wound too tight’ to be a premium seller.

- Risk and Positioning:

o Know your risk! You must calculate your aggregated, beta-weighted delta risk – and act accordingly. Everybody knows about the binary event, and is planning their own actions. You must as well.

o We potentially have an ability to sell WAY out-of-the-money Put spreads in the SPY, QQQ and SPX – expiring near the end of November. Be careful.

- SPX Expected Move:

o Last Week = $78.40 (expected move), and we actually moved = $207.17

o Next Week = $158.40 (expected move).

The only people that make money in these volatility events, are the people that can handle their current risk environment, and then add or subtract accordingly.

Tips:

HODL’s: (Hold On for Dear Life) / (All %’s = YTD)

- Yamaha Gold (AUY = $5.56 / in @ $4.60 = up 22%),

- Canopy Growth Corp (CGC = $18.78 / in @ $22.17 = down 15%),

- CTI BioPharma (CTIC = $3.25 / in @ $3),

o Constantly selling Nov. $3 or $4 covered calls…

- EXK Gold (EXK = $3.18 / in @ $1.53 = up 108%),

o Looking into selling Nov. $4 covered calls

- GBTC Bitcoin (GBTC = $15.38 / in @ $9.41 = up 64%),

- Hecla Mining (HL = $4.58 / in @ $2.36 = up 94%),

- KL Gold (KL = $45.62 / in @ 26.85 = up 70%),

- New Gold (NGD = $2.03 / in @ $0.82 = up 168%),

o Looking into selling Nov. $2 covered calls

- Pan American Silver (PAAS = $31.80 / in @ $13.07 = up 143%),

o Looking into selling Nov. $40 covered calls

- Hyliion (HYLN = $18.92 / in @ $0.32 = 5,812%).

Crypto:

- Bitcoin (BTC = $13,850),

- Ethereum (ETH = $390),

- Bitcoin Cash (BCH = $265)

Thoughts:

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

No comments:

Post a Comment