This

Week in Barrons – 12-25-2016:

“Markets react to people,

and sometimes people are a little strange.”

Alan Greenspan

Thoughts:

Regardless

of how you celebrate the holiday, I think we would all agree that the ‘spirit’

of the season is one of sharing. In the

spirit of the holiday, allow me to share my ‘Tip Jar’ with you.

Leadership Tips:

- Say ‘No’

sparingly but strategically.

- Managing with Care and Gratitude

improves creativity.

- Failing early and often is a

recipe for success.

- Always Position

yourself next to the smartest person in the room.

- Learn to use Sleep to help solve your most difficult problems.

- Work Only

on your top 5 problems, and toss the rest away.

- Ask more questions

before giving answers.

- Always Prioritize:

Budget, Decision-maker, and Timeframe.

- Know which 2 out of 3 to

emphasize: Cheaper, Better and/or Faster.

Stock Tips for 2017:

- Twitter’s

difficulty

in being acquired stems from its foundation: money-losing, niche,

non-growth, tarnished brand – with a part-time CEO?

- Ai will become the new

shiny object / buzz-word.

- Uber will not IPO because

they will not have to.

- Stock

Markets and Interest Rates will NOT go much higher. Valuations are stretched, corporations

continue to invest in buybacks over growth, and our FED is all talk no

action.

- Corporate

Buybacks will have another record year.

- Unemployment will NOT top 5%. The labor market continues to decline along with

the number of truly qualified applicants for the skilled positions.

- Oil will drop under $40 a

barrel again as OPEC’s planned production cuts will not stop: “Drill, baby,

drill”. Fracking introduced a new

age of energy efficiency and oversupply.

- Tax Changes will NOT happen. Even Republicans (although controlling

both houses) will not be able to come together on anything meaningful.

- Federal Deficits will soar. Any stimulus spending is

simply a gift to conservative voters, and won’t be paid for with growth or

budget cuts.

- Millennials will come of age. Household formation is at a 50-year low, and the

average 30-something makes less than their parents – but that is what

happens when you take out over $20,000 in debt and graduate into the worst

recession in 100 years. The metrics

have nowhere to go but up.

Health Tips:

-

Sitting is the new smoking. Sitting for five hours is the same as smoking

a pack of cigarettes.

-

It’s not how long you sleep, but rather that you get up and

go to bed on a Regular Schedule.

-

Every Year you

delay your retirement - you reduce your incidence of Alzheimer's by 3%.

-

Dieting is all about manipulating

the bacteria in your GI tract. Dieting

is as much about what you are DOING – as it is about what you’re EATING.

Happy

Holidays to everyone. Hug your children,

kiss your spouse, pick up the phone and call someone you love. It's the most important thing you can do.

The Market:

“2016 was the year

everybody got it wrong.”

2016

taught us that the mood on both sides of the Atlantic was based upon a sense

that governments were NOT looking after their own. The ensuing governmental anger was exploited

by outlier politicians like Donald Trump, Nigel Farage in the UK, and Beppe

Grillo in Italy. All three of these

‘populists’ (a) used unusually blunt language, (b) explained complex issues in

simple terms, and (c) often sided with the underdog. Their ideologies

were NOT often effectively challenged with facts or tempered with reason. In fact, their positions were often

anti-factual, anti-intellectual, and anti-science.

And

the end of 2016, TV’s talking heads are taking us ‘Back to the Future’.

They’re

talking about investing’s ‘new paradigm’ – where earnings don’t matter. Hedge funds are openly comparing their

investing styles to that of 1999 – only it will end ‘differently this time.’

And

as for it ending ‘differently this time’ – let’s do some math:

- The P/E

Ratio (price-to-earnings)

of the Russell 2000 is approximately 237. At the height of the Internet boom the

NASDAQ’s highest P/E levels were only 175.

And days after it achieved that level, the market began its 75%

plunge.

- The CAPE

Index (created

by economist Robert Shiller) is now over 27. That level has only been achieved 3

times: (a) during the 1929 crash, (b) prior to 2000 tech mania, and (c)

during the 2007 housing bubble.

- Investor

sentiment is cheering for DOW 20,000, but remember: (a) 2012 when cheers

were urging gold to go to $5,000/once – right before it plunged to

$1,100/ounce, and (b) 2014 when cheers were moving oil toward $150/barrel

– right before it plunged below $50/barrel.

- Retail

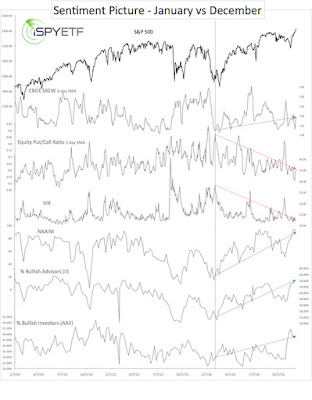

sentiment indicators such as: RSI, the AAII (American Association of

Individual Investors) survey, and the Investors Intelligence survey

continue to reflect the belief that stocks are not going down. These beliefs always happen when the

market is near extremes – just like in 1999.

- And Insider

Selling is heating up in the banking, industrial goods, and energy

sectors. According to Ben Silverman

(Director of Research at InsiderScore), "It's interesting that the

sectors that seem poised to benefit the most from the incoming

administration's policies are leading the insider selling charge."

According to Vickers Weekly Insider, there were almost 5 insider

sale transactions for every 1 purchase last week, and that is bearish in

anybody’s book. The firms leading

in Insider Sales were: United

Rentals, Automatic Data Processing, Athena Health, ON Semiconductor and

Targa Resources.

So

be safe and continue to play the hand that you’ve been dealt – because it’s

still an adventure out there.

Tips:

The

fact that ALL of the above trend lines are moving in lock-step scares the heck

out of me, and brings me to my ‘Tip of the Week’ – the mining sector. The mining sector has been pummeled in the

last month, with the Market Vectors Gold Miners ETF (GDX) dropping 15.4% since

early November. Eventually a bottom will

be established, and these stocks will bounce.

On Friday, someone made a hefty bet that this bounce will happen soon by

purchasing 35,000 GDX January monthly, out-of-the-money calls for $0.63

each. That is a $2.2m investment in pure option premium, and requires

that GDX rally almost 7% within the next month for this trade to

break-even. If GDX can recover (half of what

it lost in November), this position will make $3.5 million for every $1 GDX

rises above $20.63.

To

follow me on Twitter.com and on StockTwits.com

to get my daily thoughts and trades – my handle is: taylorpamm.

Please

be safe out there!

Disclaimer:

Expressed

thoughts proffered within the BARRONS REPORT, a Private and free weekly

economic newsletter, are those of noted entrepreneur, professor and author,

R.F. Culbertson, contributing sources and those he interviews. You

can learn more and get your free subscription by visiting: <http://rfcfinancialnews.blogspot.com>.

Please

write to Mr. Culbertson at: <rfc@culbertsons.com>

to inform him of any reproductions, including when and where copy will be

reproduced. You may use in complete form or, if quoting in brief, reference

<rfcfinancialnews.blogspot.com>.

If

you'd like to view RF's actual stock trades - and see more of his thoughts -

please feel free to sign up as a Twitter follower - "taylorpamm"

is the handle.

If

you'd like to see RF in action - teaching people about investing - please feel

free to view the TED talk that he gave on Fearless Investing: http://www.youtube.com/watch?v=K2Z9I_6ciH0

To

unsubscribe please refer to the bottom of the email.

Views

expressed are provided for information purposes only and should not be

construed in any way as an offer, an endorsement, or inducement to invest and

is not in any way a testimony of, or associated with Mr. Culbertson's other

firms or associations. Mr. Culbertson and related parties are not

registered and licensed brokers. This message may contain

information that is confidential or privileged and is intended only for the

individual or entity named above and does not constitute an offer for or advice

about any alternative investment product. Such advice can only be made when

accompanied by a prospectus or similar offering document. Past

performance is not indicative of future performance. Please make sure to review

important disclosures at the end of each article.

Note:

Joining BARRONS REPORT is not an offering for any investment. It represents

only the opinions of RF Culbertson and Associates.

PAST

RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS

THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING

ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER

VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE

INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT

TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES,

AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN

ONLY TO THE INVESTMENT MANAGER.

Alternative

investment performance can be volatile. An investor could lose all or a

substantial amount of his or her investment. Often, alternative investment fund

and account managers have total trading authority over their funds or accounts;

the use of a single advisor applying generally similar trading programs could

mean lack of diversification and, consequently, higher risk. There is often no

secondary market for an investor's interest in alternative investments, and

none is expected to develop.

All

material presented herein is believed to be reliable but we cannot attest to

its accuracy. Opinions expressed in these reports may change without prior

notice. Culbertson and/or the staff may or may not have investments in any

funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

No comments:

Post a Comment