Heads Up:

1. Per Jack R: Become a Category of ONE: The key to winning the game is to either be the first or be the only – and it’s far easier to be the only."

2. Was that ever a lucky coincidence… Per Seth G: the first type of coincidence is make-believe / magic / two things occurring that we never expected to occur. When you and your long-lost college roommate, 50-years post college, end up randomly sharing adjacent bowling lanes – now that’s a random coincidence. The second type (which matters far more) is when two unrelated events just happen in proximity. If you were drinking your first smoothie when you heard that your dog died. Going forward – seeing a smoothie may trigger sadness. As the world gets smaller, it’s easier to have these events in proximity prompt feelings that are unrelated to what they actually created. That’s why marketers work so hard to have their products show up in times of our lives when we’re likely to associate them with consumption. These are NOT random coincidences, but rather incidents that were planned in advance by marketers.

3. What do you do 1st when thinking about starting a business? Before getting investors, systems design, or infrastructure – practice getting customers. Then find out what delights / disappoints those customers. Per SG: Customer traction is the only common thread between successful organizations.

The Market:

Heads-Up:

1. The biggest catalyst for stocks being under pressure, is the strength in the US Dollar. It's hard for me to be too optimistic on the major indexes if the US Dollar Index is above $101.50.

2. Apple’s services revenue… (App store, Apple TV, Apple Music etc.) has reached new heights - despite shrinking revenue from weakening iPhone and iPad sales. The iPhone currently accounts for half of Apple’s overall sales, compared with two-thirds 7 years ago.

3. Mergers & Acquisitions are finally picking up… only it’s not the kind of deal-making that investors want – fire sales and over-valued, in-trouble corporations. You know who gets screwed the most on these kinds of deals? It’s not the founders. It’s not the preferred shareholders, who get their money back first. It’s the employees, whose common stock is last in line behind all of the other equity holders.

InfoBits:

- US interest expense is rising exponentially… and about to eclipse $1T for the first time in history.

- Microsoft uncovered evidence… that Chinese-affiliated hackers installed malware inside the U.S. military facility in Guam. There are between 50k to 100k Chinese individuals engaged in global cyberwarfare.

- Barbie is on-track to be the highest grossing movie of all time… the film's total box office is now over $900m.

- The Heartland Tri-State Bank of Elkhart… has been shuttered and all assets transferred to The Dream First Bank. J. Powell wants us to believe the banking sector is safe and stable, a recession will be avoided, inflation is transitory, and a soft landing is imminent.

- Hedge Funds are the shortest they’ve ever been… since at least 2016.

- The PEG ratio (price to earnings to growth rate) on equities… is now comparable to levels seen during the Dot Com bubble.

- In Q2, over half of Amazon’s orders in the 60 biggest cities… were delivered within one day. AMZN is doubling its same-day warehouses.

- The U.S. 10-Year Treasury broke above 4%… a lot of people are betting on a breakout in rates.

- Walmart will begin to incorporate third-party ads… in its self-checkout lanes, store intercoms, and at free-sample stations. Just another way to reach Walmart’s 140m weekly customers.

- The Chinese government is capping… the time minors can spend on their smartphones. The best part is that they laid the task of enforcement at the feet of online platforms – not parents.

- A proposed NY law would block studios from state tax breaks… if they replace human actors with AI. NBC has received $100m in NY tax breaks YTD.

- Per Hank T: the 12-year risk free rate of return is now -7.5%... a 95-year record low.

- Oil prices received another boost… after Saudi Arabia extended its voluntary 1m barrels per day production cut into September.

- U.S. labor productivity surged 3.7% in Q2… while unit labor costs rose 1.6%.

Crypto-Bytes:

- SEC: “We believe every asset other than bitcoin is a security.”

o Coinbase CEO: “How are you coming to that conclusion, because that’s not our interpretation of the law.”

o SEC: “We’re not going to explain it to you, but you need to delist every asset other than bitcoin.”

o Coinbase CEO: “We really don’t have a choice. Delisting every asset other than bitcoin (which is NOT what the law says) would have essentially meant the end of the crypto industry in the US. It made it an easy choice: Let’s go to court and find out what the court says.”

- Michael Saylor CEO of Microstrategy… is issuing $750m in a secondary offering so he can buy more Bitcoin.

- Coinbase asked the judge… to dismiss the SEC's lawsuit against them because they do not trade securities; thereby, rendering the SEC’s arguments invalid.

TW3 (That Was - The Week - That Was):

Monday: The end-of-month / beginning-of-month activities normally bring in fund money. That said, I'm seeing a few sell waves. RIG recently put in an intra-day high of $8.79, if it gets over $8.80 and holds – I’ll take a shot.

Wednesday: Fitch downgraded the credit rating of the U.S. from AAA to AA+. From their remarks, they see the insanity of our situation both monetarily and fiscally. I've been scared of a ‘credit event’ for weeks. Could this be the start of something big and nasty? Combine that with the ripples that are forming due to the Yen carry trade, and the bond market could very well be what blows up. The dollar is up over $102.50 and the 10-Year is over 4.1%.

Thursday: For the second time this week, The Bank of Japan had a bond-buying exercise. While everyone focuses on equities, it’s the debt market that runs everything. When the credit markets get indigestion, everyone gets heartburn - including equities. The Japanese are saying that they’re tired of a cheap yen – because it makes things cost more to them. However, by letting it rise they are risking blowing up tons of global institutions that have borrowed cheap yen and invested everywhere else at higher rates. Credit markets are already upset over the fastest rate hike schedule in history. Add these trillions in derivatives, and a treasury ‘hell bent’ on printing trillions of more dollars – we could be creating our own ‘trouble’.

Friday: The monthly jobs report is out and on-the-surface the U.S. gained 187k jobs last month, the unemployment rate fell to 3.5%, and hourly earnings rose 0.4% MoM. In Q2, US worker productivity rose at a 3.7% annual rate. In June, private sector hourly wages grew 4% YoY, compared to a 3% jump in consumer prices – marking the first time in two years that wage growth outpaced prices. And that wage boost has now effectively been largely offset by the boost in productivity. That’s good for employers and tempers wage-inflation’s impact on overall inflation. BUT that was ‘on-the-surface’, did you see the birth/death adjustment? The BLS’s Birth / Death model added 208,000 jobs for July. That's all of the 187K jobs and leaving us with a net -21,000. The BLS’s jobs are make-believe, and this means we actually LOST JOBS in July. Do the market and FED know this? Absolutely.

AMA (Ask Me Anything…)

Heads-Up:

1. The last time America built a nuclear reactor: My Sharona topped the charts and Jimmy Carter was in the White House. On Monday, a nuclear power plant in Waynesboro, Georgia, started delivering energy to the Southeast US. If all goes well, an additional nuclear reactor (at the same facility) is scheduled to go live next year. When it goes live, over 50% of Georgia’s energy will be from nuclear power. That compares to only 18% of the total US’s energy.

2. In a few weeks we're going to hear from Brazil, Russia, India and China = the BRICs. They will announce their short-term path toward a gold backed common currency. The official statement will outline plans on how they'll bring it to fruition. This basically ‘dooms’ the U.S. dollar as a global reserve currency. We are witnessing the initial step away from fiat to gold backed currencies. Without the burden of expensive welfare commitments, all the attendees in Johannesburg can back or tie their currency values to gold with less difficulty than our welfare-dependent nation. And it is now in their commercial best-interests to do so.

3. What is the Yen carry trade? For years traders around the world have used Japan's low interest rate and falling currency for their borrowing, and then reinvested in currencies and interest rates providing higher yields. Japan has to decide to: (a) let the yen fall even more, which causes inflation for its citizens, or (b) "make it rise" via changing interest rates. Lately, the Japanese Yen strengthened and 10-Year Japanese Government Bond yield (JGB) spiked after the Bank of Japan said it would allow "greater flexibility" in its target range for 10-Year JGB yields. Yields for the 10-year JGB rose to 0.575% for the first time since September 2014. This is a Global margin call, and if the Japanese continue to push things – all manner of heck will break loose.

Next Week: Rally Back – or Bigger Smack?

The back-half of 2023 will look much different than the front-half: The selling pressure this time of year is right in line with all historical norms. The bounce in Consumer Staples relative to Tech stocks has occurred right near logical support levels. The CRB Commodities Index has run into this multi-year downtrend line and bounced. With Commodities outperforming since 2020, having them resume a leadership role makes perfect sense at this time of the year. This is all as historically normal as it gets. However, the back-half of 2023 is going to look much different than the front-half.

Currently, the S&P100 is not correlated… which means that it’s more of a ‘stock-pickers’market than a ‘run-for-the-hills’ situation.

Is market fear making a comeback? Yes, the VIX is higher at 17.19, but it has not broken 20. The VVIX is also higher at 101.17, but it has not broken 110. Thus far, the market is telling us to ‘be careful’, but it is not telling us to ‘exit-stage-left’. I use the 7-day SPX volatility futures (16.4) as my yardstick. I’m constantly comparing them to the VIX, and if their value exceeds the VIX – then I know to ‘pull-back’.

Bonds & Rates are of critical concern. The 10-Year (TNX) exceeded 4.1% last week, and that immediately ignited the ‘fear’ trade in the market. TIP #1: When the TNX exceeds 4.1 and remains there – then keep a close eye on the ‘sell’ button.

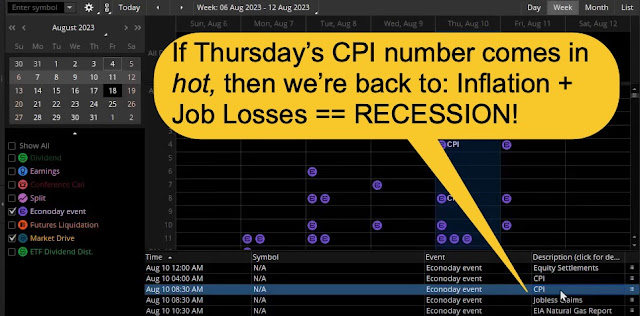

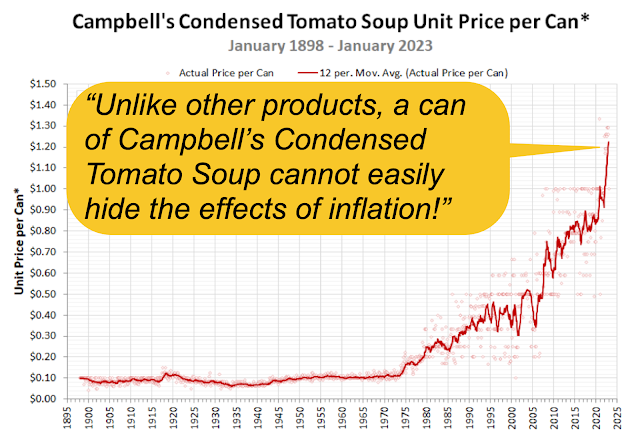

If inflation upticks – then volatility will rage. The longest time our FED goes without a meeting is between July and September. This is the time when the bond market is left to its own devices – to set the tone for the entire financial community. Last week we started to hear rumblings of a RECESSION – because of the soft Jobs number. If the CPI reading comes in ‘hot’ on Thursday, then you will see markets move and the rumblings get louder. Inflation could up-tick because oil has moved from $67/barrel to $82/barrel (+22%) in the span of the last 6 weeks. And if inflation moves higher while our Jobs are disappearing – nobody’s going to like that.

Trades:

- Tip #2 = BA = Boeing’s recent price action has given us a healthy pullback to buy into using an options CALL spread.

- Tip #3 = 3 stocks (per Howard L.) that very few people have heard of, have incredible price momentum, are valued in the billions, and get relatively no social interest. These 3 stocks have out-performed NVDA since 2020 (price and volatility) and each has less than 4,000 Stocktwits followers.

o CELH (Celsius Holdings = $143),

o SMCI (Super Micro Computer = $338), and

o SYM (Symbotic = $54).

TIPS:

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1978/oz. & Silver @ $23.8/oz.

- 13 Week Treasuries @ 5.45%

- **Bitcoin (BTC = $29,050 / in at $4,310)

- **Ethereum (ETH = $1,825 / in at $310)

- Apple (AAPL = $182 / in at $177)

- CCJ – Uranium = ($33.5 / in at $33.8)

- DKGS – DraftKings = ($31.74 / in at $31.81)

- DO – Diamond Offshore ($15.70 / in at $15)

- MESO – Mesoblast Ltd. ($1.64 / in at $3.60)

o SOLD Oct $5 CALLS

- NFGC – Newfound Gold ($4.38 / in at $3.75)

o SOLD Aug, Oct. & Jan. $5.00 CALLS

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>