Can you hear it? (click to play clip)

How does this end? Charlie Munger (of Berkshire H. - fame) is worried about how money printing has always ended with inflation and broken economies. Nobody knows the ‘when’ but we’re all worried about the same things: how wretched excess, envy, and money – drive ‘n change innovation and entrepreneurship. As Howard L. said: “The cocktail created by: social media + wealth gap + envy + anger = does not leave a good taste in your mouth.” How do we know it’s coming? Remember the movie: Trouble with the Curve? It’s the sound. You can hear it coming. Truth be told, even when we: “know it’s coming – we still can’t do anything about it.” So, we all agree on how it ends and that we can’t change the outcome. But there’s no consensus on when. Fair warning: war has a way of speeding things up.

Fundamentals are coming back: To paraphrase Fred W.: For a while now there has been a disconnect between how companies were being valued, and the fundamentals of those businesses. Many companies became more focused on raising capital and valuations – than on the basics of a business. That is starting to shift. With the public markets bringing high flyers back to reality, many mutual funds and hedge funds are leaving the private markets because the values in the public markets are so compelling. All of this is healthy. Vitalik Buterin at ETH Denver said: “Now is the time that we get to see which projects are actually long-term sustainable – complete with models, teams, and customers.” The fundamentals need to be in place for a business to succeed. All the money in the world at eye-popping valuations won’t do that for you. I have no idea if the stock market will continue to go down, or whether the slump in the public markets will seep into the private markets. What I do know is that businesses that focus on fundamentals will succeed in any market – up or down. I feel that there is more of that going on in 2022 – than we saw in 2021 and 2020. That’s a good thing.

The Market:

Can we Buy the Dip? Traders always have unanswered questions because trading is literally the only business in the world where nobody knows what’s going to happen tomorrow. I feel the biggest market unknown at the moment is not whether Russia will further invade, or will the Fed raise by 75 basis points, but it's "are we oversold or are we about to crash?" There's no question that most stock market darlings of the last few years are reeling. The golden children are hurting and that's really the bulk of the most popular NASDAQ names. Can we buy them, or more importantly: How would someone know? I always gauge the answer on whether people are buying or selling into a rally. When rallies are being sold – then we’re most likely going lower. When every dip is being bought – then we’re probably going higher. This rally was caused by people selling their PUT hedges, and I believe they’ll be buying them again next week. But I’ve also stopped trying to buy the low or sell the high years ago, but rather operate in the middle and wait for everyone else to confirm the extremes.

Is our FED still hawkish? Per Steve F: Our monetary policy-setting FED has 9 voting members. Six of the nine appear to be more hawkish (favoring higher interest rates faster) than the leadership of J. Powell, Gov. Lael Brainard, and NY FED Chief John Williams. If J. Powell continues down his measured path, and 4 of the 6 would dissent – that would be the most dissenters since 1983, and would raise questions about Powell's level of control. The FED follow-the-leader instinct is stronger during times of crisis, so I would expect the Russian invasion of Ukraine to make it easier for Powell to keep his colleagues on his side.

InfoBits:

- The core personal consumption expenditures price index… rose 5.2% from a year ago, which is the highest level since April 1983. Including food and energy prices, the PCE was up 6.1% - the strongest gain since February 1982.

- Spending (in $’s) is up 4% from December… as January saw the strongest monthly gain in $-retail sales since the first stimulus checks hit in March 2020.

- Travel is rebounding… and Marriott, Hilton and Airbnb expect global travel to surpass pre-COVID levels this year.

- Consumers are feeling it… consumer sentiment is at a decade low. Food prices are up 7% YoY, and gas is up 40%.

- Google will stop advertisers from tracking Android users… after Apple made a similar move last year. Since Android phones make up 70% of global smartphones, the change could cut into sales at social media sites.

- There are now more than 1,200 unicorn startups in the world. These companies topped $4T in value for the first time.

- Volkswagen is considering spinning off Porsche in a possible IPO… as it looks for cash to fund its EV transition. Porsche could be worth +$100B.

- Meta has launched its short-video product Reels for FB users… and introduced many new features for advertisers in a bid to unseat the current short-form-video champ - TikTok.

- VC-backed security companies have raised $2.6B so far this month… about 400% more than the same period last year.

- Russia (last year) was responsible for 60%... of all state-sponsored cybercrime according to Microsoft.

- Lowe’s raised its sales forecast for the year… as Americans take on larger home renovations. They are also partnering with Instacart for same-day delivery.

- Bud got a sales boost last quarter… as drinkers returned to bars and splurged on pricier beers. Molson Coors also saw its first sales growth in a decade.

- An increase in oil prices above $110/barrel would result in… a +10% YoY increase in inflation. When’s the last time you ask your boss for a 10% raise just to keep up with inflation?

Crypto-Bytes:

- Georgia, Kentucky, Texas and Illinois… are looking to introduce tax incentives for crypto mining.

- Ethereum founder Vitalik Buterin criticized… all governmental efforts to freeze bank accounts, and confirmed that “decentralized technology is here to make it more difficult to cut off financial flows without due process”.

- Wealthy Ukrainians are looking to crypto as a safe haven. At least one exchange reports they cannot meet increased demand for stablecoins.

- Italy has published new crypto-AML regulations: The rules outline registration and reporting requirements for virtual asset service providers (VASP) that align with the European Union’s guidelines and directives.

- IBM is positioning itself as your guardian of… cryptocurrencies and digital assets. It will try and lever its existing banking and governmental relationships to serve as a “Layer 0” player – as enterprises adopt public blockchains.

- FTX is launching its own gaming unit: FTX Gaming will debut with a ‘crypto-as-a-service’ platform through which gaming companies can launch tokens and offer support for NFTs.

- Intel revealed the specs of the first generation of its crypto mining chips… at the International Solid-State Circuits Conference.

- The London Stock Exchange has bought TORA… a financial technology provider, for $325m. The company will now offer crypto and non-fungible token (NFT) trading.

- Crypto's popularity with men aged 25 to 50… has the undivided attention of sports marketers. This week Formula 1 Team Oracle Red Bull Racing signed a record-breaking sponsorship deal with crypto-exchange Bybit worth $150m.

- Major League Baseball has teamed up with Terra (LUNA)… signing a 5 year, $40m sponsorship deal for the first-ever partnership between a sports team and a DAO (decentralized autonomous organization).

- Coinbase’s Q4 income more than quadrupled… as the largest U.S. cryptocurrency exchange saw bitcoin set a record before dropping sharply.

- Block (previously Square) reported better-than-expected Q4 results… with total revenues being up +29% YoY. Bitcoin now accounts for about half the company’s revenue, through its peer-to-peer payment service Cash App.

- Pantera Capital estimates $1.4T of crypto capital gains last year… a hefty tax bill to pay on April 18th.

TW3 (That Was - The Week - That Was):

Monday through Wednesday of last week – the world was coming to an end, but on Thursday and Friday we reversed that course dramatically. What changed? Do we still have: ruined supply chains, material & parts shortages, high inflation, and our FED promising to hike rates? Yes. But the war is different this time. This time we’re not fighting one-man-bands in deserts, or sheep herders in Afghanistan. We're playing chess with Russia – a nation chock-full-of nuclear devices and high-tech paraphernalia. So, was the market just faking a little bravado on Thursday and Friday? Well, one FED-head has already said that Ukraine could slow the velocity of rate hikes. They know that markets will take a hit once bond yields spike higher. The situation in the Ukraine simply accelerated a downside action that the market had in place since January. If the situation in the Ukraine causes our FED to reverse their course on rate hikes, and not appreciably reduce their balance sheet – then we could see new all-time highs. But if they proceed as planned with multiple rate hikes and trimming the balance sheet – then this rally fades and we move lower.

AMA (Ask Me Anything…) – an aggregation of e-mail questions

When you’re TELLING, you’re not SELLING: I called a vendor, and was stuck listening to a salesperson with a script but no listening skills. I inquired about a $300 service, but I was willing to pay a bit more if it would save time. Finally, the script-reader got to the price.

- Sales: “The price is twenty-four ninety-five.”

- R.F.: “Do you mean twenty-four dollars and ninety-five cents?”

- Sales: “No, I meant that it was: two-thousand, four-hundred, and ninety-five dollars.”

Huh – this is dumb. Why would you ever write a script that waits until the end to unveil a $2,495 price?

- Why wouldn’t you use a bracketing technique: “Some of our competitors charge $300, and some charge $5,000. We’re right in the middle and I can tell you why.”

- OR you could diffuse the obvious stall-and-objection right up front: “Some people charge as little as $300 for this. Let me tell you why we charge a lot more than that, and why it might be a smarter choice for you.”

In both revised cases, you make the truth a firm foundation for a strong value proposition. After all, money is the story we tell ourselves about value, status and position. And SALES isn’t everything – it’s the ONLY thing.

Why do you like crypto so much? The invention of blockchain technology solved a decades-long computer science problem, and unleashed a monetary revolution in the form of - Bitcoin. Bitcoin has been adopted by hundreds of millions of people, and is worth approximately $1T. Not bad for a completely open-source technology. Bitcoin has no CEO, no marketing department, and has raised no VC dollars. Bitcoin is decentralized – aka no one individual or group controls the product. Any major changes need the agreement of a large portion of the community (from software developers to miners to node operators) in order to be implemented for users. So, it seems that the only element holding this technology back – are all the politicians associated with fiat currency. The funny thing about technology adoption, once you gain 18% of the people’s acceptance today – you’ll have 100% of their acceptance tomorrow.

How do you price a product? The producer of a successful product has a choice to make. If you put a little less in the box, people will run out sooner and have to buy more. If you give people a little more for their money, they’ll purchase less often, but become more loyal. In most markets where there are easy substitutions, the long-term value of loyalty is far greater than the short-term profit of less.

Next Week: Will this rally hold?

Market Update:

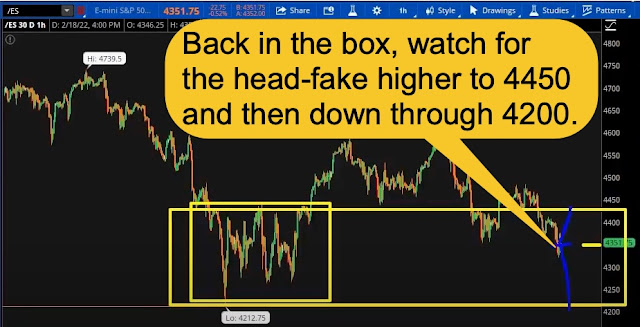

- The markets finished the week slightly higher, but we were already in over-sold territory. We bounced off the 4100 level on the SPX on Thursday, and rallied almost 7% in 2 days. On the S&Ps, we came into the week down 10% YTD, and down 14% on the Nasdaq. Moreover, on Thursday we completed the roundtrip – touching lows we have not seen since over 1 year ago.

- Last week we talked about 4211 on the SPX, and like clockwork – once the S&P’s went under 4211 – we violently moved downward and then exploded higher. Tip #1: Our option markets are moving the S&Ps. The violent movements we saw on Thurs / Friday – were due to actions within the option markets. We now have the S&P options (SPX, SPY, & VIX) controlling over 10% of the market’s notional value. We are accumulating huge amounts of open interest within the volatility channel. And with large amounts of open interest come hedges, and that is what’s driving our volatility.

- Our VIX (volatility index) is around 27… but more importantly we are still in backwardation = riskier now than in the future. To prove that risk is all around us – our bonds and the Dollar both finished the week higher. Tip #2: I fear bonds will begin to sell-off, and push rates higher and the Nasdaq lower.

- It was a MASSIVE HEDGE that CAUSED Thurs / Friday rally:

o 1. Massive Put buying in the S&Ps has been going on for weeks,

o 2. When the SPX crossed below 4211 – they all sold their Puts,

o 3. Market making firms were then forced to buy S&P futures (/ES) to offset their risk,

o 4. And due to the volume of S&P futures buying – we had a completely uncontained snapback rally on ½ Thurs / Friday.

- I think the markets have fully priced-in the Ukrainian conflict…

Pricing Pressures Moving Forward:

- 1. Our FED is voicing a more hawkish tone.

- 2. More inflationary data is coming out.

- 3. Most of the option hedges have largely been removed. Therefore, we may see a rally continuation on Monday, but for the remainder of the week I expect that these Put hedges will be reinstated.

- 4. Therefore, Tip #3: Financials have been left vulnerable because they are only down 1% YTD. Thus far, they have been the out-performing sector.

SPX Expected Move (EM):

- Hedges transpired, and it was the hedges being ‘cashed-in’ that caused the snapback rally. Pricing pressure is coming back due to FED hawks and inflation. In my opinion, inflation will explode due to this being the last gasp to purchase high-ticket items like homes, automobiles, and most durable goods.

- Last week’s EM = $121 (short week)

- Next week’s EM = $126 (for the week) = we moved $96 on Friday alone!

Tips:

HODL’s: (Hold On for Dear Life)

- CASH == Nexo & Celsius == @ 8 to 12% yield

- PHYSICAL == Gold & Silver

- **BitFarm (BITF = $3.29 / in at $4.12)

o Sold May, Dec ‘22: $5 CCs for income,

- **Bitcoin (BTC = $38,700 / in at $4,310)

- CPG (CPG = $6.91 / in at $6.44)

o Sold Jul $7.50 CCs for income,

- Energy Fuels (UUUU = $7.52 / in at $11.29),

o Sold June $11 CCs for income,

- **Ethereum (ETH = $2,725 / in at $310)

- GME – Holding

- **Grayscale Ethereum (ETHE = $21.69 / in @ $13.44)

- **Grayscale Bitcoin Trust (GBTC = $27.17 / in @ $9.41)

- Hyliion (HYLN = $4.20 / in @ $6.01)

o Sold April $4 CCs for income,

- **Loopring (LRC = $0.75 / in at $1.94)

- **Solana (SOL = $88 / in @ $141)

- Uranium Royalty (UROY = $3.64 / in at $4.41)

o Sold April $5 CCs for income,

- Vertex Energy (VTNR = $5.87 / in @ 4.74)

o Sold April $5 CCs for income.

- **Yearn Finance (YFI = $20,250 / in @ 32,850)

** Denotes a crypto-relationship

Thoughts:

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson