“My first New Year’s resolution is to:”

1. Start understanding Crypto (by making small investments in BTC and ETH)

2. Start understanding NFT’s (by listening to:

https://open.spotify.com/episode/3U4wMKyvMUhB83qf8FaA3I )

3. Start investing in Crypto… (by using the right toolset == HedgeHog.app)

“Come back to me with your NEXT big idea.” Everyone immediately flashes to something that’s fully original and has no competition. Unfortunately, big ideas are never fully original nor do they have zero competition. Henry Ford didn’t invent the car, there were plenty of social networks before Facebook, and Ray Kroc certainly didn’t invent the hamburger or the French-fry. The success of Big Ideas is not based upon scarcity or originality, but rather customer traction. The compelling reason to use or buy something is based upon: execution, generosity, and the people / leaders. An entrepreneur’s responsibility (along with solving the problem) is to show up with leadership and generosity. The main reason early stage projects fail is because leaders get scared of competition and choice – when both of those actually validate their very existence. In 2021, we have new business models, funding models, and ways of building a community. If you’ve been waiting for that moment to start a project bigger than your own hourly wage == This IS your moment.

“The truth is out there.” Per SG, when someone gives us a NEW reason / excuse every time we hear them – it’s a clue that we’re listening to a story and not a scientific debate. The Truth is hard to find, and difficult to understand. But the Truth doesn’t hide, and remains the one element that stands still until we find it.

The Market:

A couple MUST HAVE’s in trading:

- Trade small (to manage risk),

- Trade often (law of large numbers),

- Manage early (to eliminate outlier moves),

- Stay non-correlated (for true diversification),

- Show product and strategy indifference (to maximize returns), and

- Understand volatility, fear and the expected move.

These mechanics are a MUST, but I still have no clue why: TSLA is $1200, if Bitcoin will trade at $100,000, and whether true inflation will top 15% this year. (NOT a typo).

InfoBits:

- Kroger is leading the e-grocery trend with robots, not stores. ‘Grobots’ (grocery robots) are currently retrieving 800+ products per hour and passing them on to delivery drivers. Online grocery is 12% of all grocery sales (up from 2% pre-pandemic), and over 50% of households are ordering e-groceries.

- Tom Hanks said that Jeff Bezos offered him a seat on a spaceflight… provided he would pay. He told Jimmy Kimmel: "You know, it cost $28 million. Now, Jimmy – I'm doing good, but even I ain't payin’ $28 million.”

- In terms of UFO’s… Why is it that the people who previously saw UFO’s everywhere – stopped seeing them as soon as they got an iPhone?

- What’s wrong with Charlie Munger and the Univ. of Michigan… that they would agree to build a Munger Graduate Residence Hall for more than 600 graduate students – where (at minimum) the singles do NOT have windows.

- Venture Capital’s Q3 investment in India… outpaced that in China – making it the leader in VC investment in Asia.

- Per FW: An NFT Gallery in NYC’s Soho… had thousands of Bored Apes Yacht Club NFT owners standing in line for hours to gain the privilege of hanging out together in person. So, is this metaverse thing overrated? Clearly hanging out together online is still NOT as much fun as hanging out together in person.

- Amazon owns a 20% stake in Rivian ($3.8B)… and has a deal with the EV maker to develop 10,000 last-mile Amazon delivery vans in 2022. Also, Ford owns a 12% stake in Rivian. Not too shabby for a budding EV company.

- Coca-Cola shelled out $5.6B… to buy the energy drink company Bodyarmor.

- Zillow is selling 7,000 homes exiting its home-flipping business… and losing nearly $500m on the transaction.

- Pinterest and other social media giants… are sprinting toward the live shopping market that's been dominated by television networks: QVC & HSN.

- CVS said it wants to add doctors to its staff… taking a big step toward becoming a full healthcare clinic instead of just a pharmacy.

- Some employers, including New York's MTA… may not pay death benefits to families whose unvaccinated loved ones die of COVID.

- The S&P 500 is on pace for its 3rd-straight 15%+ gains year. That would be just the second time it's happened since 1928. See, $120B/mo. does work!

- “Just the facts mam”… Productivity fell 3%, initial jobless claims fell slightly to 269K, unit labor costs are skyrocketing, and we’re seeing the steepest gains in wholesale prices since 2005.

Crypto-Bytes:

- AWS is looking to move into the crypto custody business… with a job posting looking for a specialist in foster digital asset underwriting, transaction processing, and custody in the cloud.

- Most crypto investors know that the metaverse is already here… and they don’t need FB to be its proprietor.

- A Treasury-led panel recommended… that Congress impose a new regulatory framework around stablecoins, and limit their issuance to banks. That legislative request is a tall order given both chambers of Congress are narrowly divided.

- The EU will soon publish… a comprehensive guide on how crypto businesses can expand through the 27-nation bloc.

- Compass Mining (a bitcoin miner)… signed a new 140-megawatt hosting deal with Canada’s Red Jar Digital. The facility will be located in Ontario, Canada and will run on 95% clean energy.

- Quentin Tarantino will offer 7 uncut scenes… from ‘Pulp Fiction’ as NFTs.

- EOS Foundation CEO referred to his smart contract blockchain as… “a failure and a terrible investment.”

- Marathon Digital (a bitcoin miner)… produced 23% more bitcoin in Oct. than Sept. They are expanding their mining fleet, and hold over $500m in BTC.

- Miami Mayor Francis Suarez pledged… to take his next paycheck entirely in bitcoin through Strike – potentially the first U.S. politician to do so.

- BTC investors holding at least 1,000 BTC… are accumulating coins quicker amid inflation concerns. Investors are also moving their BTC off crypto exchanges and into cold storage – suggesting less selling pressure on bitcoin.

- Thailand’s oldest bank, Siam Commercial Bank (SCB)… paid over $500m for a majority stake in the Bitkub crypto exchange.

- Celsius Network (the crypto lender facing legal trouble)… is acquiring Israeli cybersecurity company GK8.

- Goldman's global markets managing director noted… that ETH has been closely tracking inflation expectations for a few years, and projects ETH to have a strong Q4 2021.

- Chainlink (the biggest provider of data to smart contracts)… said the value of all of its smart contracts has risen to $75B.

- Square said that in Q3… Cash App, generated $1.82B of bitcoin revenues and $42m in gross profit – up 115% and 29% respectively YoY.

Last Week:

Monday: A chart that really looks appealing is FLUX. In June it was $12, then it fell, bottomed in October, and is now climbing. It popped through some resistance at $6, and ran to $6.22 before settling back. I could see taking it here at $6.14, or for safety's sake later on if it gets over $6.22.

Tuesday: So, today starts day-one of the two-day Fed meeting. We know that they will initiate a ‘taper’ either now or in December. Heck, maybe the market will rally on the news because it means that: “the economy is so strong we no longer need it.” Or maybe it will weigh on the market because all that FED money is what got us here in the first place. I think that it’s all about the size of the taper. Openly we’re injecting $120B a month, and if they only cut back $10 or $15B – then markets will rejoice. But markets are not going to like +$25B. [Realize that there is over $1T / day being sloshed around ‘behind the scenes’ in ‘dark pools’. So practically, this $120B / month is just for political purposes. It’s like: ‘Bringing a knife to a gun fight.’ In the long run, nobody will care about the less than 1% being taken away.]

Wednesday: Okay so it is done. Our FED has decided to leave interest rates at 0, but start removing $15B a month in asset purchases. Markets really got excited when Powell said that if things changed, then the amount and direction of asset purchases could change too – meaning that they'd throw more money around if their idea of where the economy is falls apart. A $15B taper was "just right" between being too much and not enough. Markets loved it and Powell’s BS about inflation being transitory as well.

Friday: Okay, the jobs number is out, and they say 531K jobs were created. This would be a great number – only if it were true. For them to come up with that number, the Bureau of Labor & Statistics used the Birth/Death model to inject a ridiculous 1.5 MILLION jobs into the official report. These are phantom jobs, with no proof of their existence. And there’s more. That same Labor Department announced on Friday that 100,450,000 people in this country were no longer in the labor force – a monthly increase of 38,000. Where did all of these people go? COVID? Retire? The bottom line is that this Jobs Report was a lipsticked pig of epic proportions. But, this Jobs Report was exactly what the FED was looking for. Do you think they knew it was coming?

As for a "take a shot" trade – that looks pretty good if the market doesn't roll over and die. SNAP was sold big time a while back, and has spent some time building a bottom around $52.90. Watch and see if you can buy it a little lower.

TW3 (That Was - The Week - That Was):

David Beasley, of the UN’s World Food Programme… said that it was time for the ultra-wealthy (specifically Elon Musk and Jeff Bezos) to “step up with $6B and on a one-time basis – help to feed 42m people that are going to die if we don’t reach them.” On Sunday, Musk agreed and asked the WFP for their plan as to how the $6B would prevent 42m people from dying of hunger. Upon receipt of the plan he said: “I will then sell Tesla stock right then, and do it.” No plan was forthcoming.

China’s zero COVID policy… could cost the world its recovery and various economies. Chinese consumers are spending less, and China’s economy grew only 4.9% last quarter – a dramatic slowdown from Q2. China’s approach will also worsen global supply chains. The dominos begin to fall…

Per AD on Hiring / areer path: Whether you’re a software engineer or a sales pro, humans are the new capital and recruiting is the new ‘pumped’ penny stock. There are at least 2 parallel recruiting paths: (a) startups trying to convince you to work for them, and (b) giants trying to convince you of the same. The best bet right out of school is to go with one of the giants (say Salesforce) whose product is rolling downhill. Let them teach you how to do pitches, and how to close. Then do your homework, and let the LinkedIn Jobs algorithm work its magic. The leverage resides in people / workers – where the personal margins are high.

Next Week: Markets of Excess & Inefficiency…

Gamma and Market Cap risk moves higher:

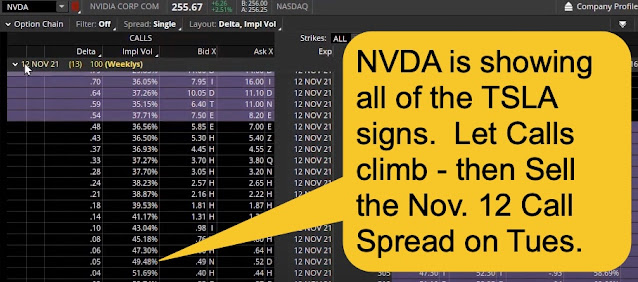

- For the last 5 weeks, this market has continued its linear, 500-point move higher. It’s more about Market Cap * Implied Volatility – than anything else. We have mega-market cap stocks controlling markets because of their extraordinarily high volatility – aka Tesla (TSLA) and Nvidia (NVDA).

- Over the past 2 months, Tesla has risen over 67% and increased its market cap to $1.2T with an 80% implied volatility. Tesla has 4 TIMES the volatility of Apple ($2.5T). Therefore, Tesla has the capability of moving the markets TWICE as much as Apple. The outsized moves in Tesla and Nvidia are being caused by retail call option buying prior to this Friday’s expiration.

Markets of Excess & Inefficiency… so what else is new?

- For the last 4 consecutive weeks, Tesla has closed higher and outside its expected move. That’s 4 weeks in a row where the Options Market did NOT handicap risk correctly. That’s extremely rare, and dangerous.

- That same weekly outside the expected move behavior is repeated within NVDA and within: QQQ, PTON, CAR, MRNA, Z, BBBY, LYFT, NFLX, ATVI, and MRK. There is NOTHING (in history) that even remotely resembles what we are seeing. These excessive moves are accompanied by higher volatility – which will trigger their own downside moves this coming week. Tip #1: Watch for TSLA and NVDA to touch their DOWNSIDE expected moves this coming week.

- Our FED announced a $15B taper – which caused bonds to explode higher (flight to quality) and rates to move lower. The financials didn’t move yet, but will move lower along with rates. Tip #2: If bonds continue to the upside, financials will move to the downside over the coming weeks.

- Markets are nervous: Bonds are higher, the VIX is higher, and the VVIX is over 110. All of this movement is on the heels of a stock market moving a lot higher. Tip #3: Watch for the Dollar to move higher as a flight to safety along with Bitcoin and Ether. A higher Dollar will reduce commodity prices such as oil and gas.

Expected Move SPX (EM):

- Last week’s EM was $63.69, and we moved $90+. Next week’s EM = $62.51. This is the 3rd consecutive week where markets exceeded their Ems, only to have their next week EMs reduced. Call me crazy, but I’m looking for manic moves in the marketplace during this upcoming options expiration week.

Tips:

HODL’s: (Hold On for Dear Life)

- **Algorand (ALGO = $1.84 / in at $1.75)

- AMC – Holding

- *BitFarms (BITF = $7.28 / in at $5.12)

o Sold Nov, Dec, Feb, May and Dec: $5, $7.50 and $10 Calls for income,

- **Cosmos (ATOM = $36.54 / in at $33.18)

- **Bitcoin (BTC = $61,100 / in at $4,310)

- Englobal (ENG = $2.46)

o Sold Nov. & Dec. $2 and $2.50 Calls for income,

- **Ethereum (ETH = $4,100 / in at $310)

- Express (EXPR = $4.45)

o Sold Nov $5 Calls for income,

- GME – Holding

- **Grayscale Ethereum (ETHE = $43.96 / in @ $13.44)

- **Grayscale Bitcoin Trust (GBTC = $48.57 / in @ $9.41)

- Hyliion (HYLN = $8.58 / in @ $0.32)

o Sold Nov. $9 CCs for income,

- Infinity Pharma (INFI = $2.64)

o Sold Nov $3 Calls for income,

- **Solana (SOL = $245 / in @ $141)

- Transocean (RIG = $3.58)

o Sold Nov. $4 Calls for income,

- Uranium Royalty (UROY = $5.29)

o Sold Nov and Jan $5 Calls for income,

- Exela Tech (XELA = $1.78)

o Sold Nov $2 Calls for income,

- Yamana Gold (AUY = $4.16 / in at $4.53)

o Waiting to sell CCs for income.

** Denotes a cryptocurrency

Thoughts:

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson