Words really do matter… more than just their associated outcomes. The newest research evaluated three types of words: those indicating mealtime, going outside, and playing. The team found that dogs (in real life) were able to successfully associate two of the categories with the correct outcomes. The Netflix documentary ‘Inside the Mind of a Dog’ clearly proves that words really do matter – to all of us.

“When you’re busy looking for more reasons to be bitter… you’re not taking the time to be better.” … Seth G.

It’s a doing less and caring less conspiracy… First, someone finds a freelancer who offers cheap and below average work. Then, small companies start to get worn down by the constant pressure to lower prices for lower quality and worse customer support. Just remember, solving a problem with lower quality and less caring – is not the correct solution.

Perfect is useful. Perfect is an absolute measure, a north star, a chance to improve our work. It’s also a shortcut to persistent dissatisfaction. Comparisons to perfect are helpful when we’re creating something – as long as we all agree that perfection is unattainable. What’s being offered is never perfect, but it may be exactly what we need – right now.

The Market:

Telegram is a social media platform with over 900m users… mostly outside of the U.S. Its Founder, Pavel Durov (now being detained in France) is a Russian billionaire who previously believed in no content moderation. Durov’s position on monitoring individual accounts is murky, and the security and encryption used by Telegram is questionable. Why Durov is being detained, and Elon Musk, Mark Zuckerburg and others are not – depends upon how you answer the question: “If you know your platform is being used for criminal activity, and you are profiting from that – are you (as CEO) complicit in the crime?”

Elon Musk’s xAI just launched “Colossus” … the world’s most powerful AI cluster, and is planning to double its size soon. This matters because xAI’s Grok2 recently caught up to OpenAI’s GPT-4 in record time, and was trained on limited resources. Now, with more than 6X those resources at their fingertips, the xAI team and future versions of Grok are going to put a significant amount of pressure on OpenAI, Google, and others to deliver.

[ Gain free access to Bullseye Trades here… ]

InfoBits:

- "Remarkable Alexa” will launch with… conversational shopping tools, aggregated news stories, a child-focused chatbot, and an improved home automation hub that remembers preferences and routines without prompts.

- Manuka honey has long been valued for its… antibacterial and anti-inflammatory properties. It helps to heal wounds, reduce acne, improve oral health and more. A new study out of UCLA has pinpointed another exciting application: treating a common type of breast cancer.

- U.S. household stock allocation is at a record 42.2%.

- The Mouse is over and out… as ESPN went dark on DirectTV when both sides could not reach agreement on a new contract. Disney is profiting from the downfall of pay TV with its own streaming business, AND using ESPN to squeeze cable and satellite TV providers even harder.

- The largest pension fund in the US… sold NVDA, IBM, and Walmart.

- Job openings fell to the lowest point since 2021… and are now almost 1:1 when compared to the number of unemployed workers.

- Summer hiring slowdown… US employers added 142,000 non-farm jobs in August, fewer than the 161,000 jobs anticipated. They also revised June’s hiring lower by -61,000 jobs, and July’s lower by -25,000 jobs.

- The Yield curves are back in alignment… 2 years ago, there was a yield curve inversion (the 10-year Treasury yield began paying less of a return than the 2-year Treasury). This week they returned to being in alignment.

- Big Lots is preparing a bankruptcy filing.

Crypto-Bytes:

- OpenAI now has 1m paid users… for ChatGPT’s business versions

- Telegram quietly removed their privacy claim from their FAQs… aka - the statement that chats are private and untouchable by legal requests is missing.

- Arthur Hayes is walking back his September Bitcoin bull run call… now saying the he expects BTC to wobble around until our FED injects more liquidity into the market (later in September). Hayes is still betting Bitcoin will rip to new highs – just not as soon as he thought.

- Bitcoin holders dumped 642,366 BTC since mid-August…. sending the market into a bit of a tailspin.

- Morgan Stanley is going deeper into Bitcoin… revealing a 2.1% allocation to BlackRock’s spot Bitcoin ETF (IBIT) in its institutional fund.

TW3 (That Was - The Week - That Was):

Tuesday: Today is off to a pretty grumpy start. The ISM manufacturing PMI has something to do with it, it became the 21st (out of the last 22) months that the U.S. factory activity is in contraction. So now the market has gone from hoping for bad economic news in order to get rate cuts – to now fearing the economy is falling into recession.

- The VVIX surged a whopping 38.4%.

- The SPX expected move gained 14%, and lost $119 today.

- Crude oil futures fell 4.2% and the market screaming is "economic slowdown".

- The smart money is buying more hedges – we should all do the same.

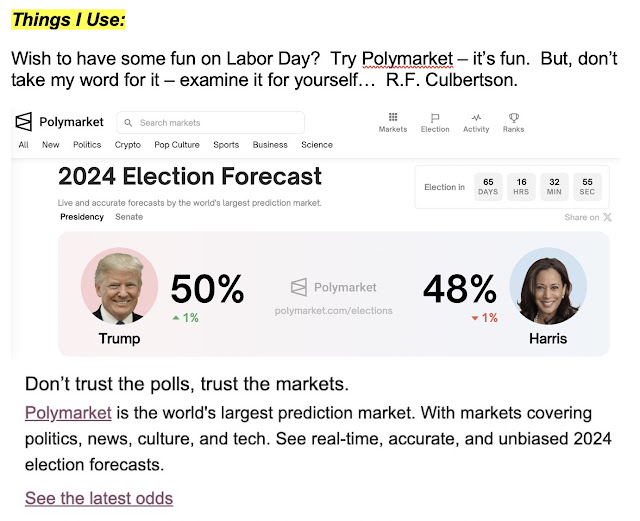

Friday: Markets want a weak jobs report – but not too weak. Weak enough that it doesn't stop our FED from cutting rates, but not weak enough to show that the economy has fallen off a cliff. The number came in at 142K vs estimates of 161K. Both June and July were revised down. The market reacted positively to the numbers, as the implied open for all three indexes moved up. That said, I still don't trust the big picture, and I’m not sure markets can hold themselves up for more than a day.

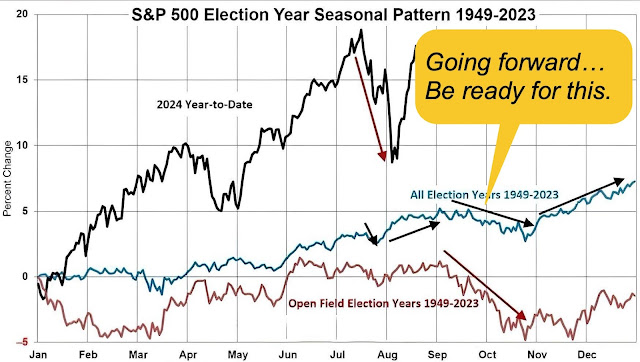

We are red across the board with the S&Ps being down ~100, the techs are off ~500, and the DOW is down ~400. I think that the ‘shock’ we saw a while back concerning the Japanese carry trade, is a big part of what we're seeing now. As much as the ‘Talking Heads’ said otherwise, there were billions of dollars to settle and that doesn’t happen in a week. Calling for a correction has been a death sentence in this market, but it certainly feels like this could be the start of one. We have an advance/decline line showing 10 advancers to 90+ decliners, the seasonality of September, bad economic news, and trillions in debt. I’m not going Full Bear but I continue to like trades to the downside.

Morgan’s Moments…

V.P. Harris proposes increasing the long-term capital gains rate… from 20% to 28%. I don’t believe that people will stop investing if the long-term capital gains tax rate was increased because 28% is still lower than the ordinary income level. But I do believe that our national debt and annual deficit issues are a spending problem, not a revenue problem. So, there is a world where we could decrease the long-term capital gains rate even lower than the current 20%, and you would see more investors and entrepreneurs investing for the long-term. This scenario (however) would require politicians to stop spending needlessly, and that part of the story is nearly impossible to achieve.

ElevenLabs' free mobile app… allows users to convert any text into high-quality audio using AI voiceovers, across multiple languages.

- Download the ElevenLabs app from their website and create a free account.

- Tap the "+" icon and choose "Submit File" to upload your text.

- Tap "Generate" to create your audio file, then find it in your library to listen.

- AND they have an incredible VoiceOver Studio so that you can create listenable audio events.

Next Week: We just got Serious…

We awoke the ‘3-Sigma Beast’… The SPX was predicted to move $77 (either higher or lower last week), but instead we moved $250 to the downside. Therefore, we moved 3 TIMES our expected move. But as much as we had a 3-Sigma move, it was due to limited liquidity and low volume. It was a concentrated attack on the players that were going to move the indexes. such as: big cap tech (esp. Nvidia), the small caps (IWM), the financials (XLF), and crypto (esp. BTC & ETH).

Nobody cares about an ‘Oversold’ Condition… The daily chart may look ominous and oversold in the short-term, but when you open it up to a weekly or monthly chart – those conditions go away. So as much as you may think that we’re preparing for a heck of a bounce next week – we saw no capitulation. Therefore, we may have to wait until after the FED meeting on the 18th. The VIX (volatility index) is in backwardation (where short-term volatility is higher than long-term volatility), but there is no panic in the marketplace.

Where are the Opportunities…

- Oil and Bitcoin scare me. Oil is pointing toward a hard-landing recession, and investors continue to raise cash by selling: BTC and ETH.

- Tip #1: I believe the utilities (XLU) and the financials (XLF) have more room to run to the downside.

- Microsoft, Google, Tesla, and Amazon are way off their highs. That only leaves: Apple, Meta, and Nvidia for investors who are ‘selling their winners’ to survive.

- Tip #2: META remains up over 40% YTD. If the selling continues, I’d play it (with small size): (a) by buying a narrow, in-the-money (ITM) Put Spread, or (b) by buying a wider out-of-the-money (OTM) Put Spread – positioned about 30-days out.

- Tip #3: NVDA remains higher by over 100% YTD. If the selling continues, and it breaks under $100, I’d play it the same as META above.

- Tip #4: GLD has been consolidating for the past several weeks, and needs to break and hold above the $2575. If so, buy an OTM Call Spread – 30-days out.

- Tip #5x`: XLP (Walmart and consumer staples) have escaped the market’s wrath thus far. If the market remains weak, the XLP will go lower – play like META.

SPX ($5415) Expected Move (EM):

- Last Week: EM = $77 and we moved $250 to the downside.

- Next Week: EM = $127, and there is no support until the $5,200 level (200 points lower). 5,200 (interestingly) is the spot where the market found its footing a month ago.

TIPS:

HODL’s: (Hold On for Dear Life)

- 13 to 17-Week Treasuries @ 4.95%

- Physical Commodities = Gold @ $2,526/oz. & Silver @ $28.2/oz.

- **Bitcoin (BTC = $54,200 / in at $4,310)

- **Ethereum (ETH = 2,220 / in at $310)

- HROW – Harrow Health = $38 / in at $12

- BRK/B – Berkshire = ($459 / in at $439)

- INDA – India ETF ($56.5 / in at $50)

- **IBIT – Blackrock’s Spot Bitcoin ETF ($30.4 / in at $24)

- **MARA – Marathon Digital = ($13.4 / in at $12)

- Weekly: BUY Puts for protection / SELL Calls for income

- **RIOT – Riot Bitcoin Mining ($6.54 / in at $12.5)

- Weekly: BUY Puts for protection / SELL Calls for income

Options Plays (hedges):

- +TLT – Bonds: Jan ’26: +$110 / -$130 CALL-Sp.

- +SPY – S&Ps: Jan ’25: +$520 / -$500 PUT-Sp.

- +SPY – S&Ps: Jan ’25: +$500 PUT

- +WEC – Wisconsin Power: Oct ’24: +$95 / -$100 CALL-Sp.

- +GLD – Gold ETF: Oct ’24: +$245 / -$250 CALL-Sp.

** Crypto-Currency aware

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting:

https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

http://rfcfinancialnews.blogspot.com