This Week in Barrons: September 1, 2024:

We need more naps… The Goldilocks’ nap is ~20 min. long (to prevent post-snooze grogginess and issues falling asleep later), and ~6 to 7 hours after waking up. Naps put you into a low-power mode – allowing your body & mind to recuperate.

Schools should stop teaching cursive… It amazes me that schools still teach handwriting – when the only thing I write by hand are my shopping lists. Are schools relegated to teaching us where the margins are, while the rest of life challenges us to go beyond them.

90% of the effort – is in the last 10% of the job… I call it the finishing move. But without all of those who do the long and winding prep-work – there is no finishing move.

It’s tough to go back… Once upon a time, pharmacists mixed chemicals by hand, opticians ground lenses from scratch, and lawyers started with an empty page. All of these jobs are still important, but none have stayed the same. In your work, are you fighting change or leading it?

The Market:

Cheaper capital is coming to the market… which also means a portion of the ~$6.4T sitting in money market funds will likely find a new home in equities. History shows us that lower rates lead to higher asset prices. August’s summary:

- The S&P 500 closed August ‘UP’ +2.3%.

- Retail bought the dip.

- Sentiment is euphoric, but seasonal risks are rising.

- Rotation prospects look good – in terms of value and fundamentals.

Broaden your experience, but narrow your field of view… We only have so much emotional storage, but we continue to stockpile market memories unrelated to us and outside of our control. Per Phil P: We have exhausted our emotional storage space. We are great hoarders, but lousy forecasters. Therefore, we need to become less and less interested – in more and more things.

AI needs more ‘herbs’… Per Seth G: Sure, food can sustain us, but ‘herbs’ are the addition that create interest and wonder. For example, the first 100 interactions that you have with AI will leave you amazed, but post-amazement you’ll feel a bit incomplete. User experience pros are trained to add-the-herbs. Pros will create tiny speed bumps, moments of tension, and opportunities for imperfection, traction, and conflict – within an AI experience. Currently, AI is in search of customers and business models. Adding ‘herbs’ into the AI experience will bring in both of those.

[ Learn about BullseyeTrades.com here… ]

InfoBits:

- Are you human? Chinese tech firms unveiled 27 humanoid robots at a Beijing expo, with Tesla’s Optimus being the only foreign competitor present. China is committed to dominating the humanoid robotics race, and commercially available humanoids may be coming sooner than most expect.

- Lower interest rates won’t necessarily help housing affordability… since a cut will most likely trigger more short-term buyers and price increases.

- Boeing’s spaceship is returning from space empty… Both SpaceX and Boeing were awarded funding under a 2014 NASA award. SpaceX has flown nine crewed NASA flights to the ISS since 2020, while Boeing has yet to complete any successful missions despite going $1.5B over budget.

- Australia’s “right to disconnect” laws went into effect… giving Aussies’ the right to ignore their boss outside of working hours.

- Pres. Biden raised duties on Chinese EVs to over 100%... Canada’s now following suit with its own 100% EV tariff (plus a 25% duty on Chinese steel and aluminum).

- Made in China – Stays in China… this week IBM shut down its Chinese R&D team affecting around 1,000 employees.

- Groundhog Day for oil demand… as ExxonMobil forecasts that oil demand will remain constant through 2050.

- Home prices hit record highs… as national prices rose 5.4% YoY.

- OpenAI is raising money… because even with sales of ~$3.4B, it’s will lose $5B by the end of this year. They will need to raise more money than any start-up ever has – at a $100B valuation.

- Warren Buffett’s Berkshire… becomes the first non-tech company worth $1+T.

- A generational shift towards balancing work life… shows that ll sick leave usage increased by 55% from 2019 to 2023. Even white-collar workers took sick leave 42% more in 2023 than in 2019.

- Alibaba just threw its hat into the AI beauty contest… as they released a new vision-language model that outperforms GPT-4o in several benchmarks.

- ChatGPT now has 200M+ weekly active users… up +200% from Nov. 2023.

- Q2 GDP was revised higher… from 2.8% to 3.0%.

Crypto-Bytes:

- Pavel Durov, Telegram's CEO, was detained in France… throwing crypto, privacy, and free speech worlds into chaos. Pavel is currently charged with “complicity, and refusal to cooperate”; with bail being set at €5m. The arrest comes as the EU implements its Digital Services Act – which imposes stricter rules on content moderation. With #FreePavel trending, the crypto and Telegram communities aren’t backing down.

- BlackRock has surpassed Grayscale… as the leading manager of on-chain capital as its lineup of exchange-traded funds now includes the largest Bitcoin product on the market (IBIT).

- Bitcoin spot ETFs enjoyed their eighth… consecutive day of inflows on August 26 – with BlackRock’s IBIT leading the way.

- The Nasdaq is awaiting regulatory approval… to launch BTC Index Options (XBTX). If approved, this will mark a significant step in the maturation of digital assets.

- There are now 172,300 crypto millionaires… with Bitcoin producing 85,400 of them.

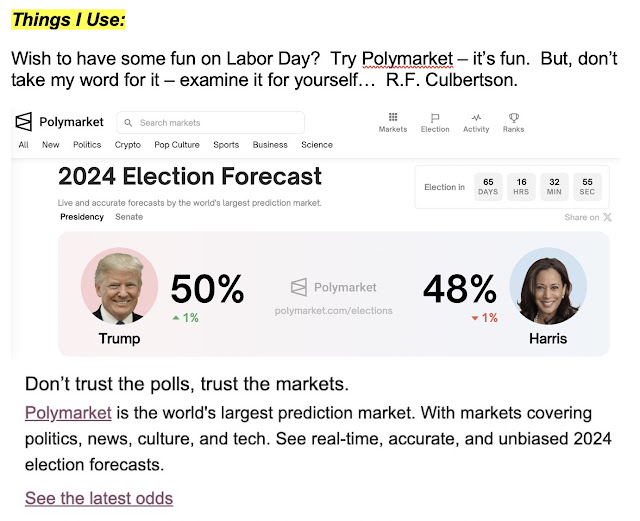

[ Learn about Polymarket.com here… ]

TW3 (That Was - The Week - That Was):

Monday: This week brings us earnings from the most darling of the Mag-7: Nvidia. They report on Wednesday (after the bell) and expectations are for yet another blowout quarter, beating estimates, and raising guidance. If they do all that, the entire AI space will once again light up. If they disappoint, it could rock the entire NASDAQ.

Thursday: Nvidia’s earnings were incredible: Revenue: $30.0B UP +122% YoY, EPS: $0.67 UP +168% YoY, Operating Income: $18.64B UP +174% YoY, Net Income: $16.60B UP +168% YoY, Gross Margin: 75.7%, and they Announced a $50B stock buyback. The only issue is that their revenue growth decelerated from previous quarters.

Friday: This morning we’re awaiting another measure of inflation – the PCE. The PCE headline number is 0.3, they wanted 0.2, but it was better than last month’s reading. Core PCE came in at 0.2% MoM and 2.6% YoY – beating the 2.7% estimate. These numbers will allow Powell to do multiple rate cuts starting in September.

Morgan’s Moments…

The newest Samsung EV battery… uses a 2.2lb. SILVER core. It’s lighter than current batteries. There's much less risk of fire. It will offer a 600-mile range and will recharge in 9 minutes. If they sold 20% of the global EV market, they'd need to use 16,000 tons of the 25,000 tons of silver mined each year. If these batteries work, they will affect the silver supply and price. Tip: The pure silver miners that I like for this solution are HL (the largest silver miner in the U.S. and third largest in the world) and SVM. The key is patience.

Bitcoin performance summary:

- Q2: The most consistent performer, balancing gains with fewer severe losses.

- Q4: High highs, low lows – exciting but risky.

- Q1: A decent start to the year with moderate performance.

- Q3: The most underwhelming, often a quiet quarter for Bitcoin.

Next Week: Time to ‘Bear-Up’?

Bkgd: The plan was easy – until it wasn’t. Nvidia was to deliver dynamite earnings, and markets were to rally from Wednesday night onward. Instead, we received good earnings, and 2-days of a low-volume, illiquid slop-fest. New market leaders are emerging, but the September calendar scares me – along with rate cuts.

- Watch our Monetary Policy pivot… from being a headwind to a tailwind as rate cuts pick up the pace.

- Watch Emerging Markets (INDA)… given their strengthening technicals, sentiment, value, a lower USD, and significant investor under-allocation.

- Watch Global, Small, & Value (HROW)… over U.S., Large, and Growth.

Nvidia and Tech… Factually, we cannot make new highs without technology leading the way.

The Financials & BRK/B try to lead… but the best we can do is tread water with our financials leading.

September is historically and notoriously a volatile month… and with FED rate cuts approaching – this one will be no different.

New Trade Ideas… with the premise being: (a) it’s an election year, (b) the incumbents would like to be re-elected, and (c) people vote with their pocket books.

- 1. Tech will need to reclaim ownership of this market – making it ripe for NVDA and MSFT to assert their dominance.

- 2. Disney is sitting right on 15-year LOWS, and moving in the wrong direction.

Tip #1: Buy a MSFT out-of-the-money (OTM) Call Spread – 30+ days out.

- October +$450 / - $455 Call Spread for $0.60

Tip #2: Buy a NVDA OTM Call Spread – 30+ days out.

- October +$140 / - $145 Call Spread for $0.65

Tip #3: Buy a DIS OTM Put Spread – 30+ days out.

- October +$85 / -$80 Put Spread for $0.55

SPX Expected Move (EM):

- Last Week: EM = $82, and we ended up flat ($0)

- Next Week: EM = $75 – but with a 4-day trading week.

Is it time to ‘Bear-Up’? Not just yet – despite us being in a low liquidity September with Warren Buffett screaming caution. It’s true that this marketplace needs technology to lead it because without it – we can’t make new highs. Financials are trying, but they’re not enough to carry the S&Ps alone. The economic data that drops this week could spark massive moves. Therefore, put your hedges-on, and your hands-n-feet inside the vehicle – as we’re definitely coming into some turbulence.

TIPS:

HODL’s: (Hold On for Dear Life)

- 13 to 17-Week Treasuries @ 5.02%

- Physical Commodities = Gold @ $2,536/oz. & Silver @ $29.2/oz.

- **Bitcoin (BTC = $59,200 / in at $4,310)

- **Ethereum (ETH = 2,520 / in at $310)

- HROW – Harrow Health = $40.4 / in at $12

- BRK/B – Berkshire = ($475.92 / in at $439)

- **MARA – Marathon Digital = ($16.7 / in at $12)

- Weekly: BUY Puts for protection / SELL Calls for income

- INDA – India ETF ($57.7 / in at $50)

- **IBIT – Blackrock’s Spot Bitcoin ETF ($33.3 / in at $24)

- **RIOT – Riot Bitcoin Mining ($7.5 / in at $12.5)

- Weekly: BUY Puts for protection / SELL Calls for income

Options Plays (hedges):

- +TLT ($96.4) – Bonds: Jan ’26: +$110 / -$130 CALL-Sp.

- +SPY ($563) – S&Ps: Jan ’25: +$520 / -$500 PUT-Sp.

- +SPY ($563) – S&Ps: Jan ’25: +$500 PUT

- +WEC ($93) – Wisconsin Power: Oct ’24: +$95 / -$100 CALL-Sp.

- +GLD ($231) – Gold ETF: Oct ’24: +$245 / -$250 CALL-Sp.

- +XLU ($76) – Utilities ETF: Jan ’25: +$80 / -$85 CALL-Sp.

** Crypto-Currency aware

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting:

https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

http://rfcfinancialnews.blogspot.com

No comments:

Post a Comment