This Week in Barrons: January 17th, 2021

Thoughts:

Born to Run (things): The first half of Bruce Springsteen’s autobiography makes some things abundantly clear: (1) He had no natural ability to play the guitar. In fact, after his first lessons, he quit – unable to play a note. (2) He had no singing talent. Every early group he was part of that needed a lead singer – did not promote him. Audiences walked out. His first agent stopped returning his calls, and his bandmates gave up and moved on. (3) And he had no natural charisma. So, not only wasn’t he dating in high school – he wasn’t even cruising around town oozing ‘cool’.

Great leaders realize that: (a) TALENT is overrated, (b) HARDWORK is expected, and (c) SKILLS can be acquired. They also realize: (1) SHOWING UP is the key ingredient that every creative leader has in common. (2) Followed closely by: DOING AND SHIPPING. In business, in the arts, in society – despite anyone’s reactions, skillsets, and doubts – you need to DO & SHIP. And (3) your COMMUNITY is essential. The people you surround yourself with not only reinforce your story, but also raise your bar. In fact, your COMMUNITYbecomes an integral part of your success. But before anything else – you must commit to the journey.

The Market:

Stockless Stocks: With the invention of meat-less meat and chicken-less chicken, stock-less stocks make total sense. Just as stockbrokers and floor traders have become extinct, stock-less stocks could be an extremely positive change. In fact, other than long-term holds, why does anyone still trade stocks? Stocks (like real-estate) are a passive component of a financial portfolio. Trading is currently dominated by options, futures, and highly leveraged alternative products like: digital assets, spot FX, pairs trading and spread betting. Stocks are intentionally pricing themselves high for insider control purposes – appealing to institutions that will buy-and-hold through the hard times. With individuals back to trading options, commodities, crypto, and doing pairs trading – I took down the Christmas wreath, and am ready for some changes in 2021:

- Per JC, it seems that small caps, SPAC’s, IPO’s, alt-coins, and late stage funding rounds are getting money flows – while FAANG-n-FRIENDS are going nowhere.

- There could be a sea-change developing toward smaller caps over mega caps, and decentralized over centralized.

- Per HL, index unbundling continues as investors pick stocks, build their own portfolios using fractionalization, and markets continue to replenish with thousands of new public companies over the next 3 years.

This market will keep going up… as long as they continue to create money faster than we create bad companies. The instant the number of smart people / companies are exhausted – the bull market will simultaneously run out of gas. Currently, there is a flashing put/call ratio warning – that could indicate an up-coming correction, but the FED is our friend until the end, and the fat lady isn’t even warming up.

InfoBits:

- Nobody wants their stuff back: Returns cost companies $10 to $20 per return – not including transportation. So, it makes more economic sense to just issue a refund – rather than return, restock and resell that $13 item. Score one for brick-and-mortar. And, online purchases are returned three to four times as frequently as in-store. As return volumes hit record highs, e-commerce just doesn't make sense for some businesses.

- The Senate flipped blue… but the market already knew because solar, EVs, clean energy, cannabis, infrastructure and Chinese stocks have been rallying for weeks. The FAANG stocks are no longer the story.

- Inflation expectations are rising… along with interest rates and energy – as Saudi Arabia cut oil output.

- In the lithium space… a company to watch (per MP) is SQM. They are a company based in Chile and are one of the top producers of lithium chemistries.

- Lordstown Motors has received… over 100,000 reservations for its all-electric pickup truck. The average order was for 600 trucks.

- Walmart is launching a fintech startup… that will offer money management and other financial services to the underbanked individuals in the US.

- The CES – the largest tech conference kicked off last week… with a slate of product intros that included: a rollable computer chess board, a Keurig-style ice cream machine, and my personal favorite – an AI shower that infuses the soap and shampoo directly into the stream.

- Visa’s $5.3B purchase of Plaid gets ‘DECLINED’ by the Gov’t: Plaid's customer base has grown over 60% - post-acquisition announcement. In the pandemic, consumers are flocking to digital payments and online banking – and Plaid is the ‘plumbing’ that connects them. Plaid is worth more NOW than before.

- GM introduces the ‘air taxi’: The automobile giant introduced the Cadillac eVTOL air taxi this week. Yes, it’s a flying car. The 4-rotor aircraft will be powered by a 90-kWh EV motor and move at speeds up to 56 mph. No timeframe was given, but it pushed GM stock to all-time-highs.

- The financing company Affirm began trading this week: The stock priced above its expected range, coming in at $49 – and it still popped to $90 during the day. So much for investment banks getting the pricing right – ugh.

- Online clothing reseller Poshmark… ended its IPO-day up more than 141%. Are investment banks even trying to get close to the right valuation?

- HomeValet is a WiFi-enabled cooler – chilling on your doorstep: This ‘smart cooler’is brought to you by Walmart, and all it does is wait for your grocery delivery – so you don't have to. Groceries account for over half of WMT’s sales, and Walmart+ offers free unlimited grocery delivery. This could definitely level-up standard grocery delivery that’s for sure.

- You’ve got the power… GM's next-gen battery system, Ultium – gets 450 miles per charge at nearly 40% less cost than current batteries. GM is making Ultium its base for future EVs, like the GMC Hummer EV pickup.

- This week 965,000 jobless claims were filed… making it the highest unemployment rate since August.

- The semi-conductor (chip) industry is consolidating: In September, Nvidia bought chip designer ARM for $40B. In October, AMD bought Xilinx for $35B. Qualcomm just announced a $1.4B acquisition of a 5G chip startup. With volumes this high, you need to stay huge to stay competitive.

- Retail sales declined in December 0.7%... marking the sector’s second consecutive monthly decline and an ‘absolute disaster’. The number represents discretionary consumer spending, and is an indicator of economic health.

Crypto-Bytes:

- Bitcoin failed to establish itself above $40k. Analysts are calling this week’s decline a healthy correction for an overheated market.

- The Intercontinental Exchange will take it’s crypto-venture public… by merging it with a SPAC. The deal will further its goal of launching a consumer app for trading and making payments using digital assets.

- Last week there were over 1.3m active bitcoin addresses in a single day… which is the most since the crypto bull run of 2017 – largely driven by a rise in retail interest.

- Institutional investors are ‘key’ to curbing Bitcoin’s volatility. Neither bitcoin’s 20% drop or its volatility, have stopped ‘whales’ from buying the dip.

- I’m noticing that my personal weekend discussions… are dominated by crypto. That never happened before – fair warning.

- Half of all advisors…. started to allocate crypto to client portfolios last year.

- Per MCC: "You’re focusing on the problem. If you focus on the problem, you can’t see the solution." - Patch Adams. Stop focusing on Bitcoin, and start focusing on pair trading Bitcoin. Bitcoin is most often the first cryptocurrency someone hears about. Many cryptocurrencies are highly correlated to Bitcoin. There are countless crypto markets which are quoted in Bitcoin (over 1450 markets in the first 11 exchanges that were reviewed). Resultingly, there are patterns in these Bitcoin-esque pairs that go back years (decades when we convert from crypto to traditional-finance time). Whether you are attempting to time the next crypto-altcoin season, invest directly into the meme economy, or trade network effects against ‘the new and unproven’, here are 3 pairs you should be pattern-watching:

1. Ethereum (ETH) / Bitcoin (BTC): an Ethereum vs Bitcoin chart

2. Dogecoin (DOGE) / Bitcoin (BTC): a Dogecoin vs Bitcoin chart

3. Polkadot (DOT) / Ethereum (ETH): a Polkadot vs Ethereum chart

Wayne Gretzky once said: “I skate to where the puck is going to be, not to where it has been.” Trying to time your next Bitcoin or Ethereum purchase is an investment in futility, but also a ‘crowded trade’. Think differently. Think in terms of pairs, because that’s where the pros and the rest of the globe are skating.

Last Week:

Tuesday: Inflation’s on the rise, oil continues moving higher, and interest rates are now over 1% - “is this a great country or what?” Oil moving higher gives the oil patch money to keep paying their loans - which makes the banks stronger. On the other hand, it hits J.Q. Public squarely in the wallet. All that said, oil names like SLB and RIG are still on the move. I’d try: SLB > $26.43, and XOM > $47.85. I could see taking some GOGO > $11.56 and TLRY > $13.45. There's a little silver exploration company that I think could be a decent play over time. SILEF is only $0.34. I think it could be a $1 stock in the not too distant future. With all the talk of ‘reopening NYC’, pay attention to some travel stocks. EXPE > $144.50 is definitely tempting.

Thursday: The initial jobless claims number came in, and it was a doozy. Everyone expected 800k, but it came in at 960,000 applied for first time unemployment last week. It doesn't get much worse than that. The futures couldn't care less – because all they heard is Biden’s $2T stimulus package. Almost lost in the noise is the fact that the big banks start reporting earnings tomorrow. Years ago, earnings were the fundamental reason you either bought or sold a stock. Today they're nothing more than ‘fake math’ that amuses analysts. I'm hoping that I haven't shot myself in the foot with CLOV – a healthcare company that WMT loves. I’m liking OSTK, but it’s up $6 today and I’m not going to chase it.

Friday: This is a Friday ahead of a 3-day weekend. The futures are soggy this morning because they were expecting the stimulus bill to be $2,000 per person, but it turns out to be just $1,400. The total bill is $1.9T. So, if every American gets $1,400 – that totals $450B. Where's the other $1.5T going? It’s going into ‘pet pork projects’ all around the world.

Wells Fargo’s earnings are out and they missed top-line revenues – but ‘faked’ earnings well enough to beat by 4 cents. Citi had mixed results. JPM beat as their trading desk put in another astonishing year. But interestingly, all of the banks are lower. I don't know that I want to play in this swamp. I love the idea of OSTK which bounced off its 50-day, but it's hard to want to buy something ahead of a 3-day weekend with so much tension in the air.

Marijuana:

- Sales of edibles skyrocketed… across the nation in 2020 as consumers shied away from inhalable forms of cannabis during the COVID-19 pandemic in favor of more discreet consumption methods.

- Following massive MJ legalization successes… in: New Jersey, Arizona, Montana, and South Dakota, momentum and public sentiment have shifted dramatically toward acceptance. Nowhere are the shifting winds more apparent than in New York State, where governor Andrew Cuomo is once again placing cannabis reform front and center in his overall proposal for post-Covid recovery. Cuomo said: “We will legalize adult-use recreational cannabis, joining 15 other states who’ve already done so. This will raise revenue and end the over-criminalization of this product that has left so many communities of color over-policed and over-incarcerated.” New York’s cannabis market is currently expected to generate $300m in state revenue annually. In Virginia, governor Ralph Northam is pushing for legalization following his success in decriminalizing cannabis last year. Connecticut’s governor Ned Lamont likewise called for legalization, and Kentucky lawmakers are slated to consider a proposal to implement a medical marijuana program.

- Canopy Growth CEO David Klein expects… that Federal action from the incoming Biden administration could set the stage for the company to enter the U.S. by this time next year.

- A Democratically controlled Senate… has spurred action by major U.S. multistate operators to raise money in order to accelerate growth

Next Week: Retail vs Institutional … who’s gonna win?

Are we seeing a change in perspective? Maybe. Clearly, markets sold the $1.9T stimulus package news. JPM and Citibank beat their earnings estimates – yet the banks got pummeled on Friday. Does this mean that all of the good news is priced into the market? Maybe. Where does any more good news come from? Answer: the FED. Be careful here, because the FED has already started talking about ‘unwinding the massive amount of monetary stimulus’ – that’s in our economy.

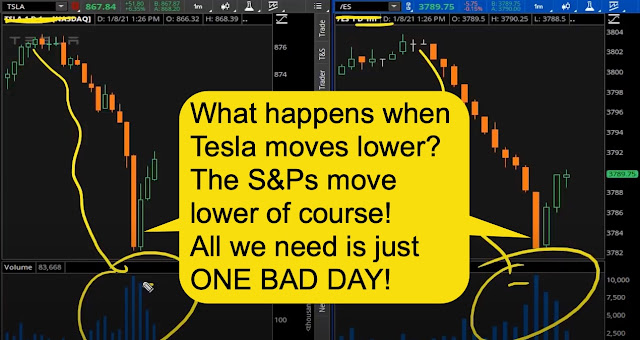

Option volumes are pointing to… a retail fueled, call buying bubble like no one has ever seen. After reviewing the charts, retail call-buying volume has doubled over the past year. Also, over 80% of the stock buying was in response to retail call buying. Unfortunately, what drove markets higher (market makers buying stock in order to cover the calls that they sold to millions of new retail traders) could easily be unwound – only faster. After all, in investor-land ‘you take the stairs up, and the elevator down.’ My portfolio advice for the next week or so, is to put on some hedges so that we’re prepared for whatever the markets throw our way.

Are they worried about inflation or deflation? One of the reasons I’m asking is that the $1.9T stimulus bill that was announced – is definitely inflationary. Which should have driven interest rates and gold higher, but both declined on the news. Potentially, the reaction in rates and gold was because of another deflationary announcement centered around changes in the tax code. The only way to know is to watch the bonds (/ZB) over the next couple of weeks. If traders flock to bonds and they rise off the 168 level, then you’ll know that we have a perceived ‘deflationary’ environment. Last week, the S&Ps sold off, bonds (/ZB) were bought along with volatility (VIX) and the dollar ($DXY). If the world sees sell-side activity, then there will be a flight to quality including the U.S. dollar.

The VIX (volatility index) has started to move higher… and I’ve started to sell premium. I’m selling ‘covered calls’ on all of my stock holdings – some above and some below their existing prices. The equity skews are inverted – allowing you to sell further ‘out-of-the-money’ options than normal. The index skews are massive – giving us ‘fair warning’ of something coming. In fact, the ‘out-of-the-money’ Puts are more expensive than the calls – so the Puts are the way to go in the index products. Finally, the VIX has remained above the 20-handle for the past year, and has started to provide an excellent premium selling opportunity.

The expected move for the SPX next week… (a 4-day trading week) is $82.50. Last week (a 5-day trading week), the SPX’s expected move was only $77. So, be prepared for some action / volatility. Anticipate: lower volumes, increased volatility, and if you see a rally in bonds – additional sell-side activity inside the equities.

Tips:

HODL’s: (Hold On for Dear Life)

- Bitcoin (BTC = $35,700 / in at $4,310),

- Bitcoin Cash (BCH = $480 / in at $170),

- CLOV ($13.24 / in @ $12.51),

o Selling Feb. $12.50 / $15 covered calls for income

- CTIC ($3.24),

o Selling Feb. $3 / $4 covered calls for income

- DM ($23.75 / in @ 14.24),

o Selling Feb. $22.50 / $25 covered calls for income

- Ethereum (ETH = $1,228 / in at $310),

- ETHE ($14.05 / in @ $13.44),

- GBTC ($39.34 / in @ $9.41),

- HYLN ($16.43 / in @ $0.32).

o Selling Feb. $15 and $17 covered calls for income

- NGD ($1.93)

o Selling Feb. $2 covered calls for income

- Pan American Silver (PAAS = $29.33 / in @ $13.07),

o Sold Jan. $34 covered calls for income

Thoughts: Pot stock APHA rallied the equivalent of 3.1 standard deviations on news that it actually turned a profit and beat expectations. APHA’s strength pulled up other pot stocks like TLRY and CGG, whose earnings are coming up in the next couple of months. And as APHA is the largest component in MJ (the cannabis ETF), MJ rallied the equivalent of 2 standard deviations. While you may think MJ’s rally would be due for a break, its OTM calls are trading over equidistant OTM puts – suggesting the market sees more room to the upside. If you’re inclined to agree with the market, you might consider a bullish strategy in MJ. With a 39%, MJ’s options are ripe for short premium strategies. If you think MJ will continue to rally or at least not drop back too much, the short $18 Put in the Feb expiration is a bullish strategy that has an 85% probability of making 50% of its max potential profit before expiring.

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>