This Week in Barrons: January 10th, 2021

When do you: Filter ‘n Sort? Consider: Why do we sort the silverware when we empty the dishwasher? Why don’t we just put it all into a drawer, and then pick out the specific items as we need them? We naturally think that if we take a minute to sort the cutlery as it comes out of the dishwasher – we won’t have to spend 10 seconds every single time we want to find something. Unfortunately, the time required to change gears is higher in our minds – then it is in reality.

1. The web TEACHES us that every additional click and mouse movement – takes away precious time – that we could be using to watch more YouTube videos.

2. Industry TEACHES us that continuing to focus on a single task until it’s accomplished – is the most efficient method of completing an assignment.

3. Scholars REALIZE that innovation and creativity ONLY happen when we: (a) break our rhythm, (b) eliminate the ‘same old – same old’, and (c) remove our heads from the sand, look around, and use the other side of our brains.

If last week taught us anything, it’s that we have a choice of when and where we filter ‘n sort our information – because it dramatically impacts our ability to think, innovate, create, and problem-solve. Hint: I think you will find that the longer you postpone filtering ‘n sorting – the more it allows you to listen, actively take-in and consider more possibilities, combinations and permutations.

The Market: OK - here’s the Memo: $100,000 Bitcoin.

I agree with AP when he says that the best indicator of true inflation is the Chapwood Index. It reports the actual prices of 500 items on which most Americans spend their money without any gimmicks or adjustments. It is needed because in 1983 the U.S. Bureau of Labor Statistics started ‘cooking the books’ on its inflation calculation (CPI) in order to curb the increase in Social Security and federal pension payments. Unfortunately, wage and salary increases along with retirement benefits are also tied to the CPI – so the change affects everything.

Bottom line, the Chapwood Index shows that the average inflation over the last 5 years is about 11% / year. That’s a big difference over the 2% inflation number that our FED is telling us. And although it’s an issue for the top 50% of Americans who have investable assets – it’s a death sentence for the bottom half who put their wealth in a savings or a checking account. The system is working as it was designed. Savers are punished and investors are rewarded.

That is why Bitcoin works. Bitcoin is the single greatest protector of wealth on this planet. You need to stomach Bitcoin’s short-term volatility in order to appreciate its long-term ability to preserve capital and avoid currency devaluation. What looks like a speculative asset, is actually the only financial parachute available. It’s crazy to think 11% inflation is happening in the U.S. We don’t need a hyperinflationary event to drive Bitcoin adoption – we simply need to let the status quo continue, and just sit back and watch.

InfoBits:

- Google: “Hey, what’s goin’ on?” It seems that some Google employees announced their official creation of the Alphabet Workers Union. Employees are unionizing – not about pay, but rather: workplace ethics, sexual harassment, and administrative spying. Now, that’s something to lead with when recruiting talent!

- Remember Haven… the Amazon-Berkshire-JPMorgan venture formed to lower healthcare costs and improve care. They’re calling it quits because: “Healthcare is hard.”

- Remember Quibi… the streaming content company that raised and burned thru $1.75B before shutting down. Well, if you never got the chance to sign up for the service – you may be in luck. Roku just bought their content (for pennies on the dollar) to stream exclusively on their platform.

- Twitter acquired the social broadcasting app Breaker. Twitter did it to “improve the health of the public conversation,” and to work on Twitter’s new audio project – Twitter Spaces. Because we all can’t wait to give Twitter a voice.

o FYI: Twitter has no idea how their own game is played and what their core users want. That is why Roblox (a Twitter knock-off) is pricing a direct listing at $30B, and will pass Twitter in market cap the week it goes public.

- The Discovery streaming service: Streamers need QQE (quality, quantity, and exclusivity) to succeed. Discovery has the trifecta as it owns some of the most-watched cable shows in the US – think: Shark Week.

- Haliade-X: sounds like a Zenon: Z3 spinoff… but it’s actually a monster wind turbine. GE's testing it for a new series of giant (853 ft. high = longer than 2 football fields) offshore wind turbines. It's the largest wind turbine ever built. GE’s planning to make them, place them in oceans – and supply power to cities.

- Google Glass – it’s back: Facebook’s planned ‘smart glasses will arrive in 2021. The glasses are built in conjunction with Ray-Ban to connect to a device and display data – but not in a ‘virtual reality’ sense. Facebook – please, just tell us that you need different ways to invade our privacy.

- Facebook’s WhatsApp… is giving it’s 2B users a choice: (1) Agree to share your personal data with the social network (FB) or (2) Delete your accounts and go away. Facebook – you just can’t live without that privacy invasion, can you?

- 2021 = the Year of the EV (electric vehicle): The top 2 barriers to EV-buying are range-anxiety and price. Couple our Senate passing Chuck Schumer’s new $454B 10-year EV plan with swiftly-falling battery prices – and you have a Happy New (EV) Year!

o China’s EV sales… jumped higher while overall car sales fell. Nio, the "Tesla of China," said its deliveries more than doubled YoY.

o Norway’s EV sales… rose to a record 54% market share in 2020. EVs outsold gas and hybrid models, and VW replaced Tesla as the top EV mfr.

o UK’s EV sales… nearly tripled while total auto sales hit their lowest level since 1992.

o Rivian – Amazon’s EV truck startup… is close to raising funds at a $25B valuation.

o Hyundai Motors… is in discussions with Apple to develop an EV.

- SPAC-me says SoFi… as they agreed to go public through a merger with a SPAC led by Chamath Palihapitiya. The deal values SoFi at $8.65B and will provide up to $2.4B in cash proceeds to the company.

o “SPAC-me baby one more time”… On the heels of using their first, $250m SPAC to acquire the subscription-based dog supply startup BarkBox, Joanna Coles and Jonathan Ledecky plan to raise a second $300m to target businesses in the "beauty, wellness, self-care, e-commerce, subscription, and digital-media space."

- Job creation STOPPED in December… as the U.S. LOST 140,000 jobs rather than gaining the 50,000 estimated by the experts. The unemployment rate fell to 6.7%, but that’s a statistical anomaly because people are continuing to fall off the employment rolls and join the 11.7% discouraged, long-term unemployed.

Crypto-Bytes:

- Cryptos are going crazy… Bitcoin is over $40k and Ethereum is over $1,300. If you’re not: ‘In it to Win it’, you truly missed the memo and need to change brokers to: www.hedgehog.app. It’s the only site I know that: educates, helps you decide, and gets you the guaranteed best price. No plug – just fact.

- Why is crypto going crazy – Part 1? One reason is that a new letter from the U.S. federal banking regulators gives stablecoin networks the same status as other global payment networks like SWIFT. In a last act from Acting Comptroller Brian Brooks, U.S. banks can now operate as stablecoin nodes and are free to send transactions.

- Why is crypto going crazy – Part 2? A new investment report from JPMorgan sets a $146,000 price target for Bitcoin. The bullish target is the latest analytical note that wagers bitcoin will become a popular alternative to gold. “Bitcoin’s [current] market cap of around $700B would have to rise by 4.2 times (to a theoretical Bitcoin price of $146,000) to match the total private sector investment in gold via ETFs, bars and coins.” So, it seems that the only thing holding the bitcoin beast back – is its own volatility.

- The U.S. will come kicking and screaming into a crypto-world:

o The U.S. Treasury and FinCEN are trying… to implement a set of rules that would have exchanges tighten-up on know-your-customer (KYC) requirements for transactions sent to un-hosted wallet addresses, or addresses that exist outside a centralized or custodial setting. Let’s see how far that makes it under the new regime that needs tax revenues.

o The SEC settles w/ everyone – except crypto: Ripple tried to settle charges of conducting $1.3B worth of unregistered securities transactions when selling XRP to exchanges and the public, BUT the SEC would have NONE of it and sued ‘em anyway in December. Gotta luv our outgoing SEC Head and Treasury Secretary.

- Coinbase has acquired… trade execution software startup Routefire.

- Grayscale reported increased “participation” … in its flagship bitcoin and crypto investment products from institutions, pensions, and endowments. They currently have $27.5B in assets under management.

- Addresses holding over 1,000 Bitcoin… stand at a record high 2,334. This indicates that large bitcoin holders have been accumulating BTC during the market run-up. The increase also shows that holders have relatively little interest in profit-taking, even though almost all holdings are in-the-money.

- The next FinTech war will be a cross-border one: Per HL: Work-from-Everywhere requires Live-from-Anywhere cross-border financial solutions in order to: spend money, get paid, collect & pay taxes, and lend. Big Banks are not equipped to win that war because the currency of choice = Bitcoin.

Last Week:

Monday: It appears like we might get a couple days of the "January effect" as the futures are up strongly this morning. The first week of the new year is often an up week. My question is simple: Can the market ignore the upcoming political nightmare or will it finally pay attention? I won’t comment on the valuations, but the market seems to be shouting that the post pandemic world will be fantastic (and soon to be upon us). Israel is breaking out to all-time-highs because it is a center for biotechnology, security software, and months ahead of the US in deploying the vaccine to citizens. GMED was the one that I put on my watchlist. I’m not looking for the FAANG’s to be market leaders anytime soon, and with the market being down over 300 points – it’s making it easier for me to sit on my hands and do nothing. Maybe they buy this dip, but what happens tomorrow and Wednesday? Maybe the sell-off was just some profit taking in the new year so that they don’t have to pay the tax in April of 2020? Crypto continues to trade like crack. Bitcoin was especially volatile today with a 6,000-point range (17%) between today’s high and low. Meanwhile, Ethereum ticked its highest price since January 2018.

Tuesday: Our FED talking about trillions of dollars of bond buying clearly has the market engaged and moving higher. The only issue between me pulling the trigger on anything on my watch list is tomorrow. We are NOT going to know about the GA race tonight. So tomorrow, we'll be dealing with the winner of that race, and whatever sort of theatrics we're going to see concerning the electors. What happens next in either case is indeed uncertain. Clean energy is on the move, and I’ll be grabbing some PLUG and FCEL. I’m also watching: FUBO > $30.15, LTHM > $22.20, and AMCI > $15.60.

Friday: This time around there are a lot more newly minted ‘traders’ than in the 90's. Why – because of COVID and ‘work-from-home’. So many people that are unemployed and bored, got the trading bug, and since the market only goes up – they’re having quite a time for themselves. I'm hearing a lot of new ‘experts’ talk about how easy investing in crypto is. It will continue to be easy – until it’s not. I don't know when that is, but I do know that manias can last a long time – just not forever. I predict that when this does end, the pain inflicted on the NKOTB (New Kids On The Block) will be epic. I almost forgot that today was jobs day, and it appears we LOST 140,000 jobs last month. But, that’s just an excuse for more stimulus – right?

More CRYPTO 101:

As more major players in finance and government begin to openly talk about a global reset, Bitcoin’s number is being called with increased frequency. Obviously, no nation is capable at this point of ‘fiscal responsibility’ and a global pandemic makes a great fall guy for governmental mis-management. This (along with other elements) caused Bitcoin to break thru $41K for the first-time last week – more than doubling in the span of a month. The record price pushed the total value of the cryptocurrency market above $1T (also a first) – with Bitcoin making up over $700B of the total – almost 5X'ing since last year.

Historically, Bitcoin was launched by the mysterious "Satoshi Nakamoto" in 2009 as a result of the global financial crisis. It really took off in late 2017, when it tripled from September to December — but then fell back to earth. That rally was mainly driven by retail investors (and their FOMO). This time around big institutional investors, banks, and hedge funds have caught the FOMO bug. But also, mainstream investors have more access to bitcoin than ever, with fintechs like: Robinhood, Coinbase, SQUARE, and now even PayPal offering crypto trading. PayPal also announced plans to let its users shop ‘n pay with crypto at over 26M merchants worldwide. Well-known investors like Paul Tudor Jones have come out as "Bitcoin believers," inspiring confidence within the entire trading sector.

But Bitcoin’s superpower is its ability to be an ‘anti-inflationary’ currency without any ‘funny-business’. While bitcoin tends to be volatile (both higher and lower), some investors see it as a hedge in case the US dollar loses too much value and prices soar (inflation). After all, our FED’s printing presses have been blasting out dollars at a record pace. More dollars == less demand for dollars == less valuable dollars == inflation. But what really frustrates our FED / Treasury is that Bitcoin's supply is capped – so ‘printing on demand’ is off-the-table. Without the presses, fiscal responsibility will need to return to government, and that will be a shock to the system. Factually, about 18.5m Bitcoin have been mined – out of a total 21m that will ever be ‘mathematically’ created. Bitcoin is further gaining in popularity because people are seeing our Dollar’s global reserve currency status ending sooner rather than later.

Next Week: Danger Will Robinson: T-E-S-L-A

The S&Ps appear (on the surface) to be grinding higher on higher volatility. But moving 160 S&P points in a week, is anything ‘but’ grinding higher.

Bonds and Interest Rates were actually the big movers of the week. There was a wicked breakdown in the bonds (/ZB) that went with massive volume. This is institutional order flow at its finest – driving Bonds (/ZB) lower and interest rates (TNX) a lot higher.

- Rates (TNX) have more than doubled in the last 6 months and are up 20% in the past week.

A sure-fire signal for INFLATION is Interest Rates moving higher.

Chunks of information like bonds, rates and inflation data always serve to tell me: “It’s not about what you THINK, it’s about what you KNOW.”

- We KNOW that our FED is preaching: free money forever, zero short-term interest rates, and they’re printing money like there’s no tomorrow. These actions are all incredibly inflationary.

- We KNOW that the value of the U.S. Dollar is declining rapidly. This emphasizes commodities and crypto for the foreseeable future.

- Therefore, I THINK that the bonds will slow their decent; otherwise, there will be a flight-to-quality like nobody’s business.

- Watch the 166 handle on the /ZBs – if it breaks – buy ‘Calls’ on the VIX and buy Bitcoin (/BTC or GBTC) ASAP.

- Watch the financials (XLF). More bond sales will trigger selling inside of the XLF, and that will push the XLF back into the $26.5 area.

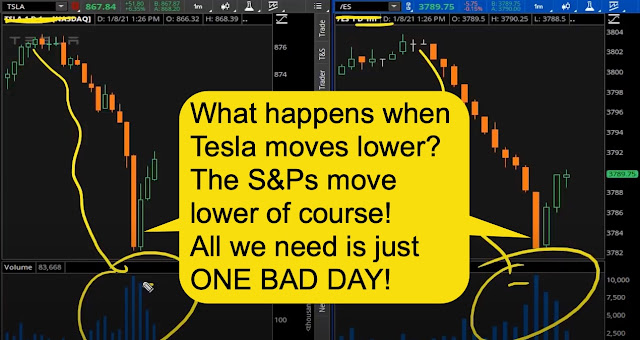

TESLA poses an eminent threat to the S&P 500:

- Tesla ($834B in market cap) has TWICE the implied volatility (91%) as does Apple ($2.2T in market cap and a 40% volatility rating). By multiplying market cap by implied volatility, it says that Tesla has the same power to move the S&Ps as does Apple. The issue is that Tesla moves 8% in a day / delivering a corresponding impact on the entire S&P.

- It will take just ONE BAD DAY in Tesla-land. On Friday (see chart): the S&Ps were flat, the NASDAQ was up HUGE, the DOW was down -0.5%, the Russell was down -0.8%, the Financials were down -0.8%, the ‘Monsters of Tech’ were flat, Energy was flat. Just TESLA was up 7% and that alone carried the S&Ps to safety.

- What happens if Tesla moves down (see chart). The S&Ps will follow it almost tick-for-tick.

- Right now: there is no diversification.

- Right now: BONDS, BITCOIN, and TESLA are running the roost.

Parabolic moves always come to an end. These parabolic moves are across all sectors: Goldman (GS), Tesla (TSLA), and Caterpillar (CAT) to name a few.

- Imagine if you have a 100 point down day inside of Tesla (and Tesla’s earnings announcement is on the horizon). The S&Ps will be down well over 100 points, and the ripple effect through margin calls will be horrific and scary.

- I anticipated Tesla’s volatility decreasing – I was wrong.

SPX Expected Move:

- Last Week = $90

- Next Week = $77 – and we will see every ounce of that.

- The volatility futures remain elevated into March, April and May timeframes.

Watch:

- #1 = The Bonds ( /ZB ) … additional sell side activity below 166 will cause the S&Ps to tip over.

o Bonds remaining range bound or moving slightly lower will allow BTC to move higher.

- #2 = Tesla (TESLA) … understand the knife-edge that it’s on and trade accordingly.

o If Tesla turns lower, then BTC will pause or go lower because retail will need to sell crypto in order to pay for their ripple-effect margin calls.

Tips:

A ton of major players are currently recommending 2 sectors: (a) precious metals and (b) crypto-currencies. Their strategy seems to be working.

HODL’s: (Hold On for Dear Life)

- Bitcoin (BTC = $41,100 / in at $4,310 up 844%),

- Bitcoin Cash (BCH = $610 / in at $170 up 249%),

- CLOV ($16.15 / in @ $12.51 up 29%),

o Sold Jan. $12.50 covered calls for income

o Selling Feb. $15 covered calls for income

- CTIC ($3.39),

o Sold Jan. $3 and $4 covered calls for income

o Selling Feb. $3 covered calls for income

- DM ($20.78 / in @ 14.24 = up 46%),

o Sold Jan. $17.50 covered calls for income

o Selling Feb. $20 covered calls for income

- Ethereum (ETH = $1,340 / in at $310 up 287%),

- ETHE ($13.76 / in @ $13.44 up 3%),

- GBTC ($44.42 / in @ $9.41 = up 371%),

- HYLN ($17.27 / in @ $0.32 = 5290%).

o Sold Jan. $16 covered calls for income

o Selling Feb. $17 covered calls for income

- Pan American Silver (PAAS = $35.41 / in @ $13.07 = up 171%),

o Sold Jan. $36 covered calls for income

Thoughts: I’ve liked lithium provider Albemarle Corporation (ALB) for a while, and last week it hit all-time-highs. It’s the largest provider of lithium for EVs in the U.S.

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>

No comments:

Post a Comment