In a world built on ‘Participation Trophies’… we’ve removed their most important skillset – learning How to Fail. Generations have now grown up in a Participation Trophy / Everybody Wins culture; however, the core of their belief system is not scalable or sustainable. Traders and entrepreneurs know how difficult profitability can be, and that’s why their measured financial success is so critical. Their journey is never simple or direct, and the scars of failure and tests of resilience litter the road less traveled. Longevity and profitability are the ultimate measuring sticks, and without our own failures to build upon – it’s impossible to learn. The sad part is that we have been so conditioned to feeling special, that most refuse to recognize that the main reason people succeed – is because they have learned How to Fail.

"I watched as the goal of mainstream journalism shifted from describing reality – to ushering readers into the correct political conclusion.” … Matti Friedman.

The first step is to begin to get AI to do your work… Per Seth G: If you don’t, your boss will. The second step is to use the time that you’ve freed up to do additional work that AI can’t do... yet. The goal is to stay 4-steps ahead of AI, and not to let AI catch-up!

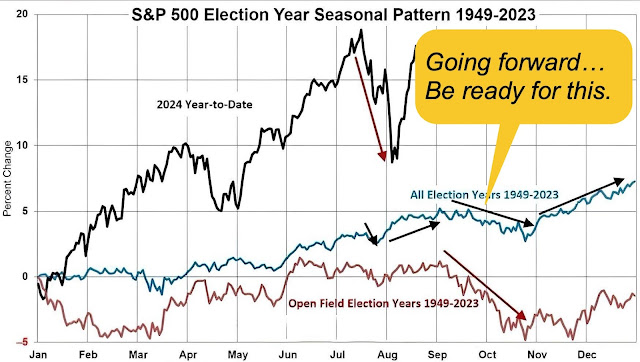

The Market:

Pittsburgh’s 2nd largest skyscraper… has won a whopping $90m cut in its taxable value amid fears that it will be vacant inside of 4 years. Per MJP: With the reduction, the 54-story BNY Mellon Center plummets from $150m to $60m in assessed value – strictly due to downtown vacancy rates. The only larger award was granted to the 32-story EQT Plaza, where EQT natural gas has significantly cut its presence and put much of the space up for sublease. I wonder why Pittsburgh (and cities like it) aren’t more vocal about trying to replace the ~$150m in tax revenue that just went south?

Markets in General:

- Tech is proving that it can be ‘choppy for longer’.

- Tech stocks are cheap when you examine their profit margins.

- The risk appetite for investment managers is collapsing.

- Economics is more important than politics for investors.

As the S&Ps make another attempt at reclaiming their highs, tech stocks remain choppy. Tech has experienced: no major breakdown, no resolution of resistance, and as many points of weakness as strength. Tech is back to leading, and although it could turn at any point – the trend is still up and rate cuts are set to begin this week. Lastly, GOLD & SILVER continue onwards and upwards – especially with oil reaching an extreme low vs gold.

[ Gain free access to Value Investor Daily Trades here… ]

InfoBits:

- Election bets are coming… as Kalshi received approval to list bets on congressional elections. Prediction markets like Kalshi are now being allowed to let users wager on real-world events.

- Molson Coors, Lowe’s, and Harley-Davidson… are openly pulling back from their diversity, equity, and inclusion efforts.

- Kendrick Lamar will perform… at the 2025 Super Bowl Halftime Show.

- Companies issued record volumes of US debt last week… as they brace for volatility around FED rate cuts and the election.

- Apple Intelligence (AI):

- Comes on all iPhone 16’s in October.

- Visual AI... Apple added a camera-activating button that lets you get more info on what it sees.

- Siri can… rewrite, proofread, and summarize text in most apps.

- Siri is better at… understanding commands and users can now type requests.

- Apple partnered with OpenAI… and that allows Siri to tap into ChatGPT in order to answer complex questions.

- Apple Watch 10 has… the biggest display & thinnest design ever.

- AirPods Pro 2 now has… a new bud shape, an active noise cancelling mode, and a hearing aid feature that’s approved by the FDA.

- PricewaterhouseCoopers is getting smaller… as it just laid off 1,800 U.S. staff members.

- Our FED backed off… raising bank reserve requirements by 20%, and chose to raise by 9% instead.

- Nvidia’s Jensen Huang made waves when he said… “I think the days of every line of code being written by software engineers are completely over.

- OpenAI released its Strawberry model… designed to solve “harder problems.

- Boeing's workers took-off… after voting to strike, and rejecting the company's proposed 25% wage hike over four years. The strike was a blow to the new CEO and his own $30 million/yr. salary.

- The net worth of the average American… is at an all-time-high due to the surging stock market and elevated real estate values.

- South Korea, the country with the lowest birth rate… is seeing soaring sales of strollers for dogs as puppy prams outnumber baby carriages.

- Meta has been using Facebook and Instagram… posts, comments, and images since 2007 to train its AI models.

- X is good-to-go in Brazil again… after the Musk paid a $3.3m fine.

- Per Steve F: For the first time in history… we’re seeing the paper market for Brent crude be “net short.” [With gold at all-time-highs, somebody smells a recession coming.]

Crypto-Bytes:

- Institutional interest in Bitcoin ETFs… has over 1,000 institutional players jumping onboard YTD. Institutions now hold over 20% of the shares, and analysts expect that number to double as more pile into Bitcoin.

- Core Scientific (CORZ), a digital asset miner… continues to form a constructive base following its move higher. Look to add to CORZ once prices break from this consolidation.

- MicroStrategy (MSTR) continues its Bitcoin shopping spree… accumulating another $1B+. Their strategy of borrowing fiat at low rates to buy Bitcoin has yielded a 17% return YTD.

- Bankers think that Bitcoin will hit $125,000 if Trump wins… and $75k if Harris wins. According to banking analysts, Bitcoin will break all-time highs no matter who ends up in the White House.

TW3 (That Was - The Week - That Was):

Friday: The futures are green, but that’s no surprise, as markets want to close out this week with a win. Is gold sending us a message? It keeps making new highs; therefore, it surely knows something that the rest of us do not. Boeing is on strike. Maybe the strike will allow them to focus on building planes that don't fall apart, or CEO’s that cost less than $30 million/ yr.? ORCL and WMT are up, and DELL is being added to the S&Ps.

Morgan’s Moments…

7-years ago Thursday… Jamie Dimon (CEO of JPM) said that Bitcoin was a fraud and would eventually blow-up. It did blow-up – just not how Jamie thought. To quote Jaime:

- "Bitcoin is a fraud.”

- “It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed.”

- “Unlike currencies that have legal support, Bitcoin will blow-up.”

- “I’ll fire any JPMorgan trader trading Bitcoin.”

Next Week: Tech is back baby…

Bkgd: We started September at ~5,635 on the SPX, and ended Friday at 5,626 – so we’re basically back where we started the month. It remains Nvidia’s market and we’re just living in it – as it (along with AMZN and MSFT) moved over 2 standard deviations higher last week. Tech said: “We’re back baby” – as they regained their leadership role – allowing the financials and energy to take-a-break.

Volatility was crushed last week… going into our FED’s 25bps cut announcement this coming Wednesday. But even though volatility was crushed, we still moved 225 points higher this past week, and 250 points lower the week before that. Therefore, just because the VIX moved lower – things are still moving rather dramatically out in the marketplace.

The movement in Gold is unmistakably higher… and could go even higher if the dollar breaks below the $100 mark.

Individual Stocks at all-time-highs:

- Tip #1 == ORCL … ‘Old-school-tech’ shows us that profits always win.

- Tip #2 == WMT … When it ain’t broke – don’t fix it.

- Tip #3 == Gold (GLD) … It knows something that the rest of us don’t.

SPX Expected Move (EM):

- Last Week’s EM = $128 … and we moved over $225 points higher.

- Next Week’s EM = $96 … which is ~25% less than last week’s EM. BUT – we moved over 225 points this past week, and over 250 points the week before that.

TIPS:

- 13 to 17-Week Treasuries @ 4.95%

- Physical Commodities = Gold @ $2,606/oz. & Silver @ $31/oz.

- **Bitcoin (BTC = $60,100 / in at $4,310)

- **Ethereum (ETH = 2,430 / in at $310)

- HROW – Harrow Health = $45 / in at $12

- INDA – India ETF ($57.8 / in at $50)

- BRK/B – Berkshire = ($447 / in at $439)

- **IBIT – Blackrock’s Spot Bitcoin ETF ($34 / in at $24)

- **MARA – Marathon Digital = ($16.1 / in at $12)

- Weekly: BUY Puts for protection / SELL Calls for income

- **RIOT – Riot Bitcoin Mining ($7.2 / in at $12.5)

- Weekly: BUY Puts for protection / SELL Calls for income

Options Plays (hedges):

- +TLT – Bonds: Jan ’26: +$110 / -$130 CALL-Sp.

- +SPY – S&Ps: Jan ’25: +$520 / -$500 PUT-Sp.

- +SPY – S&Ps: Jan ’25: +$500 PUT

- +WEC – Wisconsin Power: Oct ’24: +$95 / -$100 CALL-Sp.

- +GLD – Gold ETF: Oct ’24: +$245 / -$250 CALL-Sp.

** Crypto-Currency aware

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting:

https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

http://rfcfinancialnews.blogspot.com