This Week in Barrons: July 28, 2024:

https://youtu.be/j32Q4fJ67CE?si=UJaOjMqEE43dK6Ko

“Failure is an integral element of success.” Anyone who wants to get something right – should be made aware of the many ways that it could go wrong. Entrepreneurs often fool themselves away from failure by using words like ‘pivot’ or ‘bridge’. They should admit and just tell the truth. “I failed. I f!@#ed-up, and I’m sorry.” Per Seth Jacobshon: “The idea of going thru life and never admitting failure is dangerous.” I’m still looking for that leader that won’t blame someone else or lie to me. I don’t want ‘their version’ of it, or ‘a spin’ put on it. Jon Stewart said it best: “I know what I saw and heard are real. I just want someone not to bullshit me.”

Top Reasons for Entrepreneurial Failures:

- Founders who refuse to recognize Failure,

- Founders who don’t ‘Tell the Truth’, and

- Bad Product-Market fit

Why is everyone so angry and negative? Whether it's social media, politics, news, and/or entertainment – people are mad about something. Instead of anger, why don’t people use kindness, humor and intelligence to solve their problems? Nothing’s that complicated. Do people think that anger sells – because it doesn’t. Nasty is definitely not a feature. And negativity does not make you smarter – just an insecure fool. Contrary to the myth – nice, truthful, and honest people really do finish first.

Most activities get easier when you get good at them... Per Seth G: #1: Don’t believe you can’t be good at something just because it’s hard. #2: Don’t believe that people who are good-at-something – are talented and born with that ability. Anything worth accomplishing requires learning, discipline, and practice. Hard work always beats talent.

The Market:

It’s caution time in the markets. Learn to be selective and nimble – not stubborn and complacent. Do not believe that what ‘worked before’ will eventually bounce. Stop orders should be honored without question. Keep your drawdowns small during choppy markets. The domination of the Mag-7 in the past 18 months has focused everyone’s attention on those few names. Currently, financials are working better than most other sectors. History tells us that when financials are the leaders, markets continued to reward the shareholders, and penalize cash and short sellers.

If I knew THEN what I know NOW about the capital markets… I would know to ADD to my equity holdings whenever the VIX spikes above 20, 30, and hopefully 40. Instead of selling, ask yourself: ‘What would be the lowest cost & smartest way to remain invested?’ Maybe it’s via a cost-constrained options play? Personally, I’ve always chosen technology (QQQ) over the S&Ps (SPY), but the semi’s (SMH) have been the real winner over the past decade. If you are itching to buy any of these ETFs when trading opens in the morning – try out FREC.COM. They partnered with Van Eck to launch a direct index version of these ETFs – which is more tax efficient without any increase in price. Fair warning: I am a customer.

[ Learn about Value Investor Daily here… ]

InfoBits:

- Netflix streamed past expectations… with its global paid subscribers growing 16.5% in Q2. Their cheaper ad tier saw 34% subscriber growth.

- Southwest was largely unaffected… by Crowdstrike’s software debacle. [I guess decades of hitting ‘ignore’ to those software upgrades finally paid off!]

- Wiz (the red-hot security startup)… has walked away from a $23B buy-out offer from Google – in favor of their own IPO.

- Llama 3.1 is the best open-source AI model… on par with OpenAI’s GPT-4o and Anthropic’s Claude 3.5. Meta is trying to turn Llama into AI’s Linux where 3rd party developers will build apps on top of Llama’s LLM.

- Google’s quarterly sales grew 14% from last year… fueled by search and cloud, but its ad revenue sales underwhelmed. Google will not ditch tracking-cookies in Chrome. [So much for getting my privacy back.]

- Tesla’s quarterly car sales fell 7% YoY… and profit plummeted 45%. TSLA is losing to rivals, who in the first half of the year saw a +33% bump in EV sales.

- Coke boosted its annual sales forecast… citing bubbling demand for its drinks in overseas markets.

- On July 24, the S&P and Nasdaq experienced… their worst single-day declines in almost 2 years. The S&Ps fell over -2%, and Nasdaq over -3.5%.

- New home sales slid to a seven-month low… even with new-home inventory hitting its highest level since 2008.

- Durable goods orders plummeted… 6.60% MoM and -10% YoY in June – its sharpest drop since the pandemic.

- Q2 GDP estimates came in at 2.80%... topping the initial forecast of 1.90% and doubling the 1.40% logged during Q1.

- The CrowdStrike outage cost Co’s over $5.4B… and to apologize for its mistake Crowdstrike is offering some of its corporate partners $10 Uber Eats gift cards. [That should cover a side of fries to cry into – yes?]

Crypto-Bytes:

- Following an initial May approval by regulators… spot Ethereum ETFs started trading on Tuesday with issuers like BlackRock, Fidelity, and VanEck all competing to offer the lowest fees.

- ETH ETFs (in their first day) made over $1B in trading volume… Coinbase is the custodian for 8 of the 9 approved ETH ETFs.

- President Trump spoke at Nashville’s Nat’l Bitcoin Conference, he proclaimed (yawn):

- “If elected, the U.S. will never sell its Bitcoin’.

- “If elected, I will fire the current SEC Chair Gary Gensler.” [Which he would NOT have the power to do – fyi.]

- “If elected, I will create a crypto presidential advisory council.”

- OpenAI could lose as much as $5B in 2024… but announced their new search tool called SearchGPT. It gives users fast and timely answers with clear and relevant sources. Click here to sign up for the prototype - (opens in a new window).

- Polymarket’s trading volume hit an all-time-high this month… the crypto-based prediction market saw bets soar following President Biden’s decision not to seek re-election.

- Michigan's Retirement System invested $6.6m in Bitcoin… via ARK 21Shares' ETF. This makes Michigan the latest pension fund to add Bitcoin – joining Wisconsin and Jersey City.

- The latest survey info shows that 20% of Americans own crypto… and 73% will consider a candidates' crypto beliefs in the 2024 Presidential election.

TW3 (That Was - The Week - That Was):

Friday: This market continues to run on the hopium that Mag-7 earnings will propel us even higher, and unfortunately, they're just not stellar enough as of yet. MSFT and META’s earning are coming this week. This week’s common market behavior is that it will start out the day green, peak around 11am, and fade to red by closing.

Morgan Moments…

- Tech’s in trouble… as the correction has room to run given extreme readings in: technicals, sentiment, positioning, and valuation.

- Growth vs Inflation… even with global growth reaccelerating, disinflation is drying up and inflation resurgence via wage increases is still on the radar.

- Rate Cuts… are mixed across countries and their window could be closing.

- Commodities… short-term technicals are deteriorating due to demand destruction.

Next Week: Release the Volatility?

Bkgd: The volatility beast is definitely waking up. It's time to tighten up your trading discipline, and get ready for some wild two-sided action.

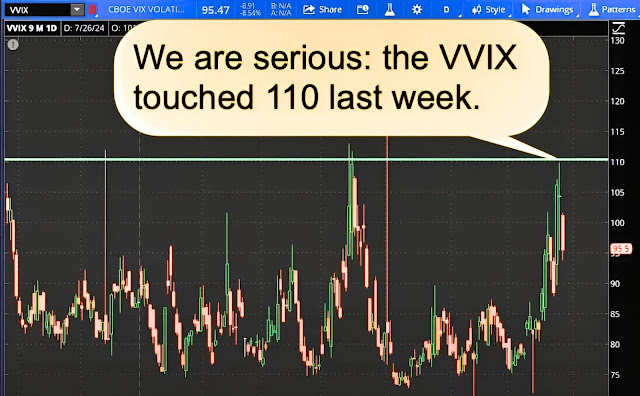

- Volatility… The VIX may not be screaming, but the VVIX is double Tesla’s vol.

- Leaders… The NASDAQ is lagging, and that's scary because they got us to these elevated levels.

- Who’s on First? … If the financials are market leaders, that means the Titanic is sinking and our lifeboat captain is Jamie Dimon.

- News… The market’s (SPX) expected move for next week is $105. That's a 20% increase in risk due to big tech earnings and a FED meeting.

VIX and VVIX are just warming up… If you review the VIX on a 3 or 5-year chart, you’ll see that although elevated @ 16 – the VIX has a way to go if we’re going to make up for lost time. However, the VVIX (the volatility of the volatility index) did touch 110 last week which means that we’re serious in terms of a fear indicator. Tip #1: The VIX itself has a volatility of 95 (twice that of Tesla), and combined with the VVIX @ 110 tells me that the pros are definitely buying their hedges. Also, the volatility futures (/VX) are not quite into backwardation (Aug = 16.2 / Sept = 16.8), but we’re close. Everything is pointing toward increased volatility.

NASDAQ lagging is a concern… because it’s the Mag-7 that propelled this market to where it is today. And even though we bounced higher on Friday, it was only to the lower edge of the expected move. Honestly, only tech can drive this marketplace higher – so earnings out of MSFT, META, and AAPL are critical over the next 2 weeks. Tip #2: If the NASDAQ breaks, this marketplace (cradle) will fall.

Financials are leading - temporarily… but it’s a short-term rotation that’s a long-term distraction. Bonds are rallying slightly; therefore, interest rates are falling. The regional bank index (KRE) has gone hyperbolic in anticipation of a FED rate cut. Regional banks own billions of bonds and rate cuts will boost the value (ever so slightly) of those bonds. However, banks make less money as interest rates go lower.

FED is back in town: Friday’s PCE (inflation) data was more inflationary than anticipated. Currently, this marketplace is assuming that our FED will cut rates by 25bps in September.

Put on your ‘Big Boy’ pants… because if MSFT, META and AAPL don’t hit home-run earnings numbers, we could be in for Mr. Toad’s Wild Ride. Tip #3: Buy QQQ and SPY hedges. Next week’s Expected Move for the SPX is $105, and it’s been a while since we’ve seen a triple-digit expected move. Tip #4: Reduce your Size so you can: Trade when you WANT TO not because you HAVE TO.

TIPS:

HODL’s: (Hold On for Dear Life)

- 13 to 17-Week Treasuries @ 5.44%

- Physical Commodities = Gold @ $2,402/oz. & Silver @ $29.4/oz.

- **Bitcoin (BTC = $68,050 / in at $4,310)

- **Ethereum (ETH = 3,250 / in at $310)

- HROW – Harrow Health == $24.44 / in at $12

- **MARA – Marathon Digital = ($21.57 / in at $12) / Sold Sept $30 Cov-Calls

- INDA – India ETF ($56.82 / in at $50) / BOT Nov, +$53 / -$55 Call Spread

- **IBIT – Blackrock’s Spot Bitcoin ETF ($38.79 / in at $24)

- **RIOT – Riot Bitcoin Mining ($11.2 / in at $12.5) / Sold Sept $16 Cov-Calls

- **MIGI – Mawson Infrastructure ($1.3 / in at $1.1)

- **WULF – TeraWulf ($4.42 / in at $3.75)

** Crypto-Currency aware

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<mailto:rfc@culbertsons.com>

http://rfcfinancialnews.blogspot.com