Entrepreneurs WANT Early Adopters: Early adopters:

- Bought an iPhone in 2008, and never looked back,

- Played a few games of pickleball, joined a club, and bought the equipment, and

- Buy the newest bestseller, and then read the author’s other works.

The Wealthy show up early ‘n often, but then move on. Early Adopters and The Wealthy both try out the new tech, but only one sticks around through the dip – learning from the hard parts. The Wealthy seek out new experiences, but Early Adopters embrace them and become advocates / ambassadors. Marketers need to be aware of the differences, and plan accordingly. If you push for a free trial, but don’t create the conditions for subscription and persistence – don’t be surprised if only The Wealthy show up. We need to choose (and cater to) the audience we seek.

The easiest thing to sell… is a simple solution to a problem people know they have. It’s a lot more difficult to bring nuance, understanding, and resilience to a complex situation. We are unlikely to run out of problems any time soon. Finding a business that solves a problem is a great first step, but it’s essential that it’s also a good business.

The Market:

This almost never happens: There's a large divergence in consumer sentiment between the wealthiest group and the bottom income earners. The sentiment among the wealthy is soaring while the lower income's is going down. Historically, they've moved (almost always) in tandem. Per Howard L: This chart makes sense during rampant inflationary times – because the wealthy are not crushed by inflation and high interest rates. They may buy fewer homes and yachts, but in a modern world – they travel and buy things that make them happy. The wealthy wait out the inevitable next boom by earning high interest on their cash, and by speculating, entertaining, and gambling. Meanwhile, the suffering intensifies with the bottom income earners, and their anger continues to grow.

InfoBits:

- Morgan Stanley’s bear Mike Wilson has finally thrown in the towel… Nothing changes sentiment like price. Traders wonder whether Mike throwing-in-the-towel could signal a short-term price top in the markets.

- Elon changed Twitter’s brand to “X”… because what better way to get value out of your $44B purchase than to completely change the brand and the product?

- Adidas received $565m in orders for unsold Yeezy’s… the sportswear company will sell 4m pairs of Yeezy’s – topping even the company’s most optimistic forecasts.

- Mattel doesn’t want to be a toy company… but rather an IP company that spins its franchises into multi-revenue machines (toys, movies, and merch).

- Your Free Trial is over… Spotify joins other music streamers in upping prices.

- Chevron and Exxon are lithium bound (the metal used in EV batteries)… as the EV shift continues and oil giants want in.

- Americans’ personal savings have plunged $5.5T since April, 2020.

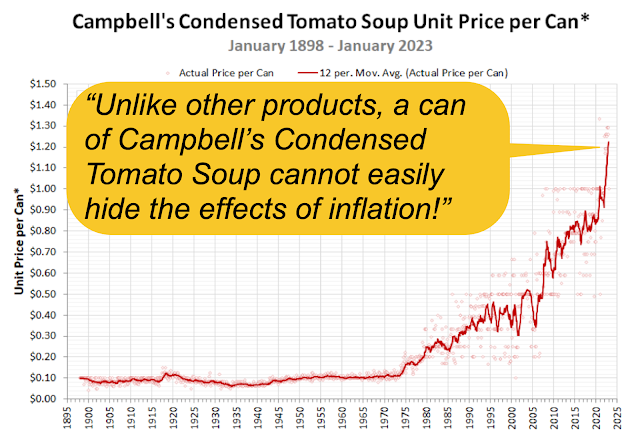

- Tip creep and Tip fatigue… as tips / fees inflate the cost of everyday items, consumers are hesitanting to go out, opting for home-brews and ordering online.

- UPS and the Teamsters reached a tentative deal… on pay raises and workplace safety for 340k workers.

- Alphabet’s search revenue still rose… as Googlers still out-number ChatGPT-ers.

- The market believes the FED will NOT hike rates again this year… unfortunately, a majority of FED officials think otherwise.

- For everything other than WEED, there’s Mastercard… as Mastercard sent cease-n-desist letters to businesses that were accepting its debit cards as payment for cannabis products (credit cards were already a no-go).

- eBay recently expanded its designer-certified program… and just acquired Certilogo – which creates virtual tags to track brand-name goods. Last year, eBay sellers listed +100k handbags and +1m jewelry items every day.

- U.S. GDP grew at 2.4% in Q2… exceeding expectations and delaying recession worries.

- Japan removed their 10-Year Yield cap of 0.5%... and rates moved higher.

- Falling sales volumes remain the trend in consumer goods… with P&G, Colgate-Palmolive, and Mondelez confirming that during their earnings release.

Crypto-Bytes:

- Russia’s digital ruble is now a reality. President Putin has signed the digital ruble bill into law, marking a significant step forward for Russia’s central bank digital currency (CBDC) project.

- Ripple is taking major steps towards regulatory compliance. The company has applied for registration as a crypto asset firm with the UK’s Financial Conduct Authority (FCA) and is seeking a payment license in Ireland.

- While BTC is up more than 80% this year… crypto startups have had a rocky ride – with Q2 venture funding down 76% YoY.

- Federal prosecutors asked a judge to revoke Sam Bankman-Fried’s bail… claiming he repeatedly tampered with witnesses.

TW3 (That Was - The Week - That Was):

Monday: The madness continues as the DOW is up over 200 on its 11th straight up day. I don't know what else to say, this is worse than the 1999 - 2000 melt up. Every leading economic indicator has been down for 15 months. Yellow Freight (a massive trucking outfit) is about to go belly up. Commercial credit is getting crushed, and mortgages are not being paid. Need more proof? Per Hank T: of all of the cars financed:

- 33% are 30+days late,

- 20% are 60+days late, and

- 14% are 90+ days late – lined up for repossession.

- Repos are 20,000 cars / day

Tuesday: We get MSFT and GOOGL after hours today. If their numbers are good, you know the market is going to want to put in more upside into this insane run up. We're entering the dangerous part of this madness. Just about everyone's fully on board with this market, and while this can still keep going, no one thinks it can end. I assure you, it can and it will.

Wednesday: Last evening MSFT announced that their cloud growth was pretty flat and the future doesn’t look much better. Today is FED day. In my opinion, we get the 25bps interest rate hike, J. Powell stands hawkish and says more work needs to be done. The Leading Economic Indicators have been red for 15 months. Credit defaults are dramatically increasing in commercial real estate. Even the third-largest box producer (Packaging Corp. of America) reported a 10% box shipment decline. That doesn’t say booming economy to me.

At 2, the FOMC statement hit: (a) they hiked rates 25 basis points, (b) the vote was unanimous, and (c) the language was changed slightly from "they need to do more" to the "extent of further adjustments”. That brought their overnight rate to 5.25% - 5.50%, the highest levels in 22 years. The things Powell was saying were NOT dovish. He said several times that they need to do more work to get inflation down to 2%. He said the "process has a long way to go.” He said they were going to go month by month, but assured us that if the data suggested they needed another hike in September, they will do that hike. He said core inflation is still elevated and he needs to see it "durably down." Be careful, this has 1999 written all over it. It’s an epic bubble, and you will not want to hang around for the pop.

Thursday: A record-breaking DOW streak moving higher, coupled with absolutely bogus economic news this morning – and here we are in: The Twilight Zone. This disconnect from reality is insane. Heck, the 10-Year is back above 4%, and oil is around $80/barrel = inflation!

AMA (Ask Me Anything…)

With a self-driving car, who gets blamed for a road fatality? After all, humans are essentially babysitters of still-learning AI systems. In the case of Uber’s fatal self-driving car crash in 2018, that question has been answered. The human present during the crash pled guilty to one count of endangerment, and was sentenced to three years of supervised probation – with no prison time.

Did the pandemic change the meaning of “The Weekend?” The consumer economy has significantly shifted since the pandemic, with workers taking more trips and spending more on experiences. Often, that means stretching the weekend beyond the traditional Friday night to Sunday night timeline – and opting to work remotely rather than use vacation days. How long this behavior lasts remains to be seen, but not needing to be in an office has given workers and the economy a significant excuse / boost.

Need European T-Swift Tickets? A Microsoft employee posted a scheme for gaining a small technical advantage in buying tickets to T-Swift’s European tour. Simply figure out which data center the ticket broker is using, and establish a VPN connection into that same area. The reduced latency of the network connection will get you ahead in the ticket-buying queue. Bottom Line = It Works!

Next Week: Big, Bad and Bullish?

- Our FED hikes, and markets rally… but this is NOT a normal rally. Thursday’s massively down trading session showed that in a low volume, limited liquidity trading environment – virtually anything can happen.

- Study the $IMX… The IMX (Investor Movement Index) is a ‘beta-weighting’ of all of the TD Ameritrade accounts – in terms of their actions and holdings. It’s showing that hedge funds and prop-firms are responsible for most of the volume, liquidity, and movement that’s out there right now.

- There’s Low volume & Limited liquidity… in everything other than mega-cap, tech stocks. If tech (QQQ) fails at its current break-out level, that could start a rotation into Industrials (XLI) and Energy (XLE) for the back-half of 2023. Otherwise, stay with AAPL and/or QQQ’s and enjoy the ride. [FYI both Citadel and Virtue (large market making firms) have reported 30% declines in order-flow YoY.]

- NASDAQ rebalance had no material impact. If Technology stops moving higher, then the S&P and QQQ are going to have a hard time. Now, Industrials (XLI) are making new all-time highs, and their ability to hold on to those new highs will likely tell us a lot about how the rest of the market is responding to this pause in Tech and growth.

- Earnings on deck: AAPL and AMZN… but watch Bonds this coming week. All of the volume and corresponding movement is currently inside of the Bond market. The TNX (10-Year Treasury) cracked over 4% on Thursday, and stocks collapsed. That was not a coincidence.

- Will bonds and rates threaten the rally? At the end of the day, it's all going to come down to the US Dollar, then the Bond market, and finally stocks. If the Dollar index is NOT falling, then stocks are going to have a hard time going higher in the back half of the year. This bull market needs a weak dollar to continue strong through the end of 2023. If the dollar (DXY) remains above $101.50, then stocks are most likely selling off or generally struggling.

- Will ENERGY lead us forward? Just as more and more investors are joining this bull market and thinking that Tech is the leader once again – perhaps a nice little rug pull is in order. Per J.C.: “Energy is a place that continues to catch a bid. Energy has proven that it doesn't need Tech or most other sectors going up for it to do well. Energy can stand on its own.”

TIPS:

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1998/oz. & Silver @ $24.8/oz.

- 13 Week Treasuries @ 5.35%

- **Bitcoin (BTC = $29,600 / in at $4,310)

- **Ethereum (ETH = $1,900 / in at $310)

- Apple (AAPL = $196 / in at $177)

- CCJ – Uranium = ($34 / in at $33.8)

- DKGS – DraftKings = ($32.55 / in at $31.81)

- DO – Diamond Offshore ($15.40 / in at $15)

- MESO – Mesoblast Ltd. ($4.00 / in at $3.60)

o SOLD Oct $5 CALLS

- NFGC – Newfound Gold ($4.55 / in at $3.75)

o SOLD Aug, Oct. & Jan. $5.00 CALLS

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>

No comments:

Post a Comment