‘Come On Man… Do the Right Thing’ With SBF’s guilty verdict behind us, it’s time to talk about the challenges associated with behaving ethically (aka ‘Doing the Right Thing’). Ethics is virtually never emphasized as part of a business school curriculum. After all:

- Unethical behavior and inefficient markets were also responsible for the metals and currency price fixing at major banks like: JPM, Citi, and Barclays.

- A lack of ethics and inefficient OTC desks caused Silicon Valley Bank, Schwab, and First Republic to be caught upside down inside of the yield curve trade.

- And a lack of a moral compass allowed real estate commission collusion to go on far too long.

Everyone needs to understand the importance and value of ethical behavior. We can’t continue to idolize those who refuse to understand the foundational aspects of: Doing the Right Thing!

Perseverance: Life is often an exercise in perseverance. Time and time again, it seems like we wait forever, and just before we’re about to leave – the magical transformation occurs. Without knowing that this is how things work, it’s unlikely that most of us would even make it half-way through one of these events. Simply knowing how it’s done – makes it far more likely that we will stick it out and actually do it again.

‘I remember when…’ When the internet was young, the major book publishers had everything they needed to create a dominant search engine. After all, they were the grand organizers of the world’s information. Except for the fact – that they didn’t even consider it. That was because they believed that their job was to sell books to bookstores. Per Seth G: This false vision / belief is more urgent for individuals. What you were trained to do, and What you are doing – is all in the past. When someone asks you: “What do you do?” Try responding with: “What I did yesterday was…” It’s a great way to open the door to envisioning what you could be doing tomorrow.

The Market:

Per Anthony P: CLICK HERE to experience a prototype of an AI-generated sports narration that was created by simply feeding the AI-engine a video file and prompting it to narrate what was happening. [https://twitter.com/geepytee/status/1721705524176257296?s=20 ]. A couple thoughts after playing this a half-dozen times:

- (1) It’s becoming obvious that AI products are going to replace humans in a variety of white-collar jobs. I don’t know that very many sports announcers were worried about their jobs before seeing this.

- (2) This is Version 1.0 of a product that uses sports narration as its proof-of-concept. And yes, this version will not replace the human announcer, but give it 2 to 3 years, and I’m betting the result will be indistinguishable from a human. In many ways, we are all becoming technology investors. Some of us are using our capital, while others our time and effort.

- (3) Now is the time to: acquire new skills, build relevant levels of expertise, and position yourself to benefit (rather than suffer) from the coming changes. You can certainly try and delay it happening, but you’ll never avoid it.

InfoBits:

- Berkshire Hathaway reported a… 41% jump in YoY Q3 operating earnings, and is sitting on $157B in cash.

- Mortgage rates are AVERAGE (historically), but demand is down:

o 50% from pre-pandemic levels,

o At its lowest level in 30 years,

o And is down ~75% from its 2005 all-time-high.

- One of the biggest global shipping giants is cutting 10,000 jobs… due to a global trade slowdown.

- Over 26 trucking companies have declared bankruptcy YTD… putting tens of thousands of truck drivers out of work.

- How about our poor ‘student athletes’:

o USC basketball’s Bronny James earns an NCAA-topping ~$6m/year in NIL (Name, Image, and Likeness) revenues.

o Colorado University’s QB Shedeur Sanders leads college football with $4.3m/year in NIL revs.

o And LSU gymnast Livvy Dunne will make $3.2m doing commercials for American Eagle and Vuori.

- FedEx Express is encouraging cargo pilots… to take other jobs at regional passenger carriers for the holidays – due to the lack of shipping demand.

- The WSJ reported: “The U.S. and its NATO allies are serving notice that they are formally suspending their participation in a 1990 treaty limiting conventional forces in Europe.”

- Amazon will offer its Prime members… low-cost memberships to its boutique One Medical primary care business. It truly sees a future in healthcare.

- The latest in wearable tech is… a Star-Trek’esque pin made by Humane. The Ai Pin (a smartphone replacement) is screen less and controlled by voice commands.

- Eli Lilly received FDA approval for its own weight-loss drug… Zepbound. Lilly said that it will cost 21% less than rivals Wegovy and Ozempic.

- Following a Cruise-powered robotaxi collision… that dragged a pedestrian beneath the car – the CEO of Cruise announced: “Layoffs are coming.”

- Moody’s cuts USA’s outlook to negative… as the ratings agency pointed to the rising risks of our nation’s fiscal strength.

- UAW workers at one GM plan narrowly vote against the labor deal… hoping that other shops will press their leverage and hold out for a better deal.

Crypto-Bytes:

- Stablecoin issuer Circle Internet is considering going public – again... as last year, it tried and failed to go public via SPAC.

- MicroStrategy's (MSTR) stock price has soared 250% this year… thanks in large part to the billions it holds in Bitcoin.

- Bitcoin hit an 18-month high… and Ethereum climbed above $2k for the first time since April. The world’s anticipation of our SEC approving a spot bitcoin ETF is the catalyst for the move.

TW3 (That Was - The Week - That Was):

Monday: Stocks rose Friday after a soft jobs report drove bond yields lower as the S&P jumped 5.85% WoW, the Dow climbed 5.07%, the Nasdaq gained 6.61% and the Russell surged 7.56%. The Volatility Index (VIX) tumbled ~30% on the week, and the US dollar is down at a 7-week low.

Wednesday: Treasury yields declined as markets remained confident that no more interest rate increases are coming this year. Oil prices dropped to their lowest level in 3.5 months as global economic data is pointing toward a potential slowdown in energy demand. Yesterday the S&P tried several times to break-over 4385 but couldn't do it. This market is not running on logic, but rather on the 10-Year interest rate. If the 10-Year falls below 4.5%, the techs are going to scream higher.

Thursday. There’s a lot of resistance right here, as this market is being held up by the Magnificent-7. The results of the 30-year bond auction hit were ugly. None of the foreign bidders showed up, and our own dealers refused to buy into the ‘eat where you poop’ philosophy. Even worse, Powell’s remarks today were quite hawkish. He said we're a LONG way from target inflation, and rates may have to rise more if growth continues at this pace. Up went the 10-Year and the Dollar, and down went the S&Ps.

Friday: Put CCJ on your radar as an example of a cup and handle pattern. When the handle breaks over the lip of the cup, it's often a very good buy signal. We'd want to see it get over $42.85 before seriously considering it. For anyone that likes to play the really little names, watch KOPN over $1.36. We're in a period where they want this market higher, and nothing is going to get in their way. Remember, markets can remain insane longer than you can stay solvent.

AMA (Ask Me Anything…)

What about WeWork? Often people think of SoftBank as an unfortunate passenger on the WeWork train wreck. You know, the one that turned a $49B valuation into last week’s latest bankruptcy. In my opinion, one of the real tragedies of WeWork was that the VCs (mainly SoftBank) made their business model worse instead of better. WeWork’s failures (despite needing better commercial real estate options) included mirroring their needs and growth strategy to that of SoftBank. After all (per Anthony P.), the VCs were writing the big checks, so they got to make the big decisions – including when, why, and how to go public. It’s interesting that a number of co-working’esque businesses have survived and are still growing – admittedly without the massive VC and growth expectations once associated with WeWork. SoftBank’s value destruction at WeWork goes deeper than its own more than $14B cumulative loss, missed lease payments, and evaporated equity for WeWork employees. SoftBank actually destroyed something that could have worked under better stewardship. Going forward, has WeWork's demise permanently ruined SoftBank CEO Masayoshi Son’s reputation as an investor? Prof. Damodaran at the Stern School of Business said: “You can recover from mistakes, but not from the perception that you don’t know what you’re doing.”

Next Week: It’s High-Stakes Gambling…

Some Notes:

- Sentiment shifted and it became a risk-on environment.

- But it came after a shakeout in positioning.

- Assets are trading as if the Fed is finished hiking rates.

- Borrowing costs remain trending higher for listed companies.

- The yield curves act as a reminder of the importance of risk management.

Correlation kicked in and markets flew… This week markets suddenly became correlatedto the upside, and when that happens (Friday) you will cause large, over-sized moves.

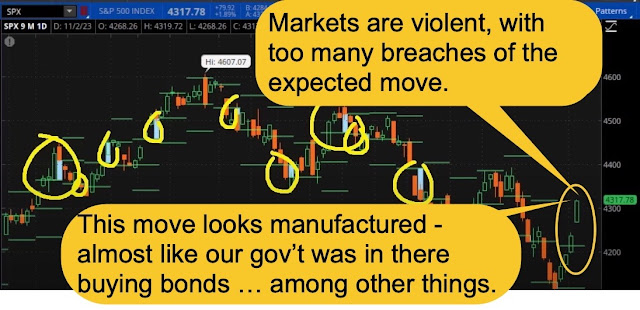

Watch the NASDAQ Expected Move… because when it comes down to it – it’s all about Big Tech. But when you put everything in perspective using Expected Moves (EM), you find that the Nasdaq (QQQ) was destroyed with outside EMs lower in October and applauded with outside EMs higher in November. At this point the Nasdaq is getting ripped apart at the seams – it’s an ‘out-of-control’ marketplace. Tip #1: Never trust a market that is behaving in an unruly fashion. Get ready for some wild-n-wooly reversals coming out of the QQQ’s.

Our FED speaks and markets do NOT listen… J. Powell was incredibly hawkish in his remarks last Thursday, and the markets promptly forgot everything he said by Friday morning.

Bond market auctions DO matter… Thursday, the US Gov’t tried to borrow $24B by selling a bunch of 30-year debt. It was a huge disaster, and in order to get enough people to buy, the rate had to dramatically increase. Even then, the primary dealers (the buyers of last resort) had to buy 25% of the debt.

- China, Japan, Saudi Arabia, and Russia are no longer buying our debt. In fact, most are selling what they already have.

- With fewer buyers and us needing to borrow more than ever ($1.5T in the past 4 months and another $1.5T in the next 6) we will need to offer higher rates to attract lenders.

- Tip #2: Am I to assume that China’s Premier Xi’s visit next week with Pres. Biden in San Francisco is purely a routine discussion? Please, simply follow the bonds.

Major Economic Data week… Starting on Tuesday with the CPI Report, Retail sales and Manufacturing – next week gives us many, market-moving news events.

SPX Expected Move:

- Last Week = $62 … and we basically moved +$62 to the upside.

- Next Week = $64 … Tip #3: Fair Warning: Volatility is NOT collapsing in an upwardly moving market.

TIPS:

A salute to any and all of you who have worn the uniform in any capacity.

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1941/oz. & Silver @ $22.3/oz.

- 13-Week Treasuries @ 5.4%

- **Bitcoin (BTC = $37,600 / in at $4,310)

- **Ethereum (ETH = $2,100 / in at $310)

- **ChainLink (LINK = $16.20 / in at $7.78)

- CCJ – Uranium = ($42.5 / in at $33.8)

- NFGC – Newfound Gold ($3.6 / in at $3.8)

- UEC – Uranium Energy Corp ($5.6 / in at $4.8)

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>