Author Ursula Le Guin had a sign over her desk:

- Is it true?

- Is it necessary (or at least useful)?

- Is it compassionate (or at least unharmful)?

The Flexport roller-coaster… is one that most entrepreneurs will be riding this year and next. On Wednesday, Flexport founder Ryan Peterson took back the CEO job (pushing aside Dave Clark) because he felt the strategy for the business had to shift. In particular, Petersen and the board thought Clark's spending had gone overboard. They thought that Flexport should be sticking to its knitting – providing a way for e-commerce companies to coordinate shipments from factories, rather than recreating Amazon’s sprawling logistics network. Peterson also fired at least 5 top execs that Clark had helped to bring on, fired 75 middle managers, rescinded dozens of job offers, and removed +200 job postings from their website.

To be fair, just a year ago when Flexport poached Clark from his top exec position at Amazon – the board and Peterson wanted him to get-big-fast. Why be in one business when you can be in all? Why can’t we: take on the giants?

But suddenly, Wall Street wanted profitability and for that – every grand vision gets put on hold. This pattern is not unique to Flexport. Meta is scaling back the metaverse. Software companies (and even Netflix) are attempting to navigate slower growth. It seems that: New Times require Older Playbooks. The Older Playbook has entrepreneurs proving their team, business model, and technology – BEFORE – raising money. The adjustment back to profitability and sustainability for those who came up during the past decade – won’t be easy. They were not trained in organic growth or to hire & expand AFTER increased demand.

But hey, If it were easy – everybody would be an Entrepreneur.

The Market:

Just watch the 10-Year Yield (TNX):

- #1. Watch TNXs steady uptrend that began in May.

- #2. The TNX broke above its 50-dma, and has maintained that breakout.

- #3. See TNX’s recent initial rejection by resistance (4.4%), and the bounce off short-term support (4.15%).

- #4. If we break above 4.4%, we then go to new highs in bond yields. If we break below support at 4.15%, then we would bring a move to lower yields back on the table. With the recent upward momentum, the odds favor a break higher.

InfoBits:

- Visa and Mastercard… are increasing their fees to merchants starting in Oct.

- The US Health Department recommended moving marijuana… to a lower federal risk category.

- China is launching a $41B semiconductor fund… similar to our $53B worth of subsidies from the CHIPS Act.

- The U.S. deficit is expected to double to $2T (8% of GDP) in 2023… due to higher interest rates.

- Novo Nordisk, semaglutide maker… became the most valuable company in Europe after passing LVMH.

- Disney vs Charter Communications… Everyone wants a bigger slice of the streaming pie. Charter is so determined to get Disney’s streamers included in their cable deal that it’s willing to lose huge channels like ESPN and ABC. At the same time, thousands of writers and actors are striking for better pay from streamers. And the streamers themselves want a bigger slice of their own pie, hiking prices with their sights set on profitability. Grab some popcorn for this one.

- China is banning the use of iPhones… in government-backed agencies and state companies. It’s Apple’s biggest foreign market and global production base.

- Pumped up… are gas prices that hit their highest level in over a decade after the Saudis and Russia agreed to curb oil production through EOY.

- Cruise is on the verge of winning approval… to mass-produce robotaxis with no steering wheel or pedals.

- Insiders are reviving the old rumor that… Bob Iger’s end game is to SELL Disney to Apple.

- How do we avoid running out of diesel fuel… before the EOY? Inventories are horrifically low, and they've already tapped out the strategic reserves.

Crypto-Bytes:

- The IMF is channeling their inner therapist… asking governments to take a deep breath and reconsider blanket crypto bans.

- Spot trading volumes on centralized exchanges… are down 7.8% for the second month. This is the lowest monthly trading volume since March 2019.

- Binance, the king of spot trading with $183B… saw its market share shrink for the sixth straight month – now at 38.5%.

TW3 (That Was - The Week - That Was):

Monday: The economic news continues to deteriorate. They cut the employment numbers from the first of the year in half. Bank of America tells us the debt market is creaking and groaning as bonds continue to fall – for 3 years in a row now.

Wednesday: So, we've got a really soggy market. If these attitudes remain, we could easily lose another 100 S&P points. Right now, I am not interested in buying anything. Practically, if the market is moving sideways, a good chart play can work. If the market is moving higher, lots of things work. But when the market is falling, trying to find long side plays is swimming upstream. The yield on the 10-Year is up and markets don't like it a bit. When it hit 4.3%, the techs really took a gut punch. There’s a lot of commercial property out there that has debt that will have to be rolled over, and instead of 1.5% - they’re going to be paying 6.5%. That's a huge difference on say a $20m building. Honestly, some of it will just go into default.

Thursday: The S&P is on track for its third day of declines. Apple shares are looking lower again – after falling 3.5% on Wednesday – as China moves to widen state employee iPhone curbs. Treasury yields edged higher and the dollar extended gains to a six-month high amid increasing bets for further Federal Reserve policy tightening following stronger-than-expected macroeconomic indicators.

Friday: Stock futures edge lower after the S&P 500 closed lower for a third consecutive session on Thursday and the Nasdaq fell for a fourth day (still up 16% and 31% YTD respectively). A strong jobless claims report, weaker data out of China, and concerns over Chinese government restrictions to Apple iPhones are proving to be a large headwind for tech stocks. The recent economic data has stoked the twin fears of higher-for-longer restrictive Fed policy alongside a global economic slowdown.

AMA (Ask Me Anything…)

Stablecoins per Anthony P: Often the private market can be more effective than our government. We saw that when SpaceX revived the space industry through cost reduction and increased launch frequency. Amazon increased the minimum wage for many Americans to $15/hr, - yet the US federal minimum wage still sits at $7.25/hr. Private markets move faster because they’re closer to the problem. And if a private company ignores any market reality, they are almost guaranteed to fail.

The stablecoin market has grown from $3B to $125B over the past 5 years. There is a perfect product-market fit. The high adoption rates come from areas where there is: high-inflation, high-censorship, or high-fee related transactions. Once again, the private sector beat governments to the innovation punch. There is no material adoption of a state-created stablecoin today. In fact, Tether and USDC are likely doing more to increase dollar adoption globally than any other organization or technology.

We should be thanking the entrepreneurs behind each stablecoin for having the foresight, courage, and dedication to act when our governments would not. And until governments get their act together, entrepreneurs will continue to pick up the slack.

Next Week: Tech is Down… but Not Out.

Background:

- High-yield stocks such as consumer staples and utilities are having one of their worst years in a while. People are finding yield in Treasuries and shorter-term government bonds (+5% of guaranteed yield); therefore, nobody is looking toward stocks for yield.

- Technology Bifurcation: Last week the S&Ps, Technology and Financials all fell around or below their expected moves, while Energy moved higher. The S&Ps and NASDAQ fell because AAPL collapsed on the China / iPhone news. A lot of the other mega-cap tech stocks were up or unchanged on the week – yet the index collapsed under the weight of AAPL and NVDA. Tip #1: Instead of rotating from sector to sector, we are seeing a rotation within the tech-sector – because nothing else matters. Tech was bifurcated last week and we still moved 60 S&P points lower. Imagine how much further we can move when things become correlated.

- This coming week we get the CPI, PPI, and other economic data elements – that will drive markets because our FED is in their quiet period until 9/20. Any piece of data has the capability of being the catalyst in this marketplace.

- Tip #2: The Russell (IWM) is getting ripped, and therefore is the place to sell premium next week.

- Strong Dollar, Higher Rates, and Strong Oil indicate more risk ahead. Tip #3: When I look at the move the dollar made last week, I get scared. It had a huge move higher – which tells me a lot of other nations are scared that their own currencies suck and/or a lot of people are flying to the safety of the U.S. Dollar. Tip #4: And when I look at the 10-Year Rate (TNX), you need to go all the way back to 2007 to see rates this high, and it looks like it wants to break out. Tip #5: Oil is rocking to the upside. Many market crises have kicked off due to incredibly strong oil – and this could be the long-awaited catalyst.

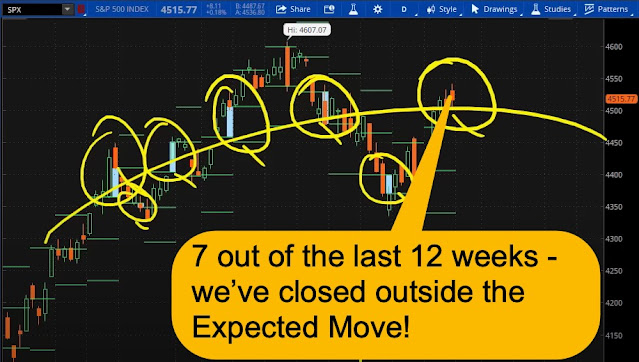

SPX Expected Move (EM):

- Last Week - $48 EM on a 4-day week… but finished $60 down.

- Next Week - $59 EM on a 5-day week…

- Low Volatility & High Risk: I would have to see: (a) Bonds rally back up quickly, (b) the Dollar sell off, and (c) Oil cool off in order to not see incredible risk in this marketplace.

TIPS:

1. UEC = $4.67: I still believe in uranium, and am focused on UEC that has resistance ~$4.65. If it can get up and over $4.65 and hold, I'm a buyer as it has a legitimate shot at its 3-year top of $6.75.

2. Mercedes (MBGAF = $70.50): Mercedes has a dividend yield of +7% and a PE ratio of ~5. I’m a buyer of Mercedes stock / create your own dividend stream – all the while allowing the underlying to increase in value.

3. SOFI = $8.56: Watch SOFI as it’s been trying to get over its 50-day moving average for a few days. I'd take some over $8.95.

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1942/oz. & Silver @ $23.2/oz.

- 17-Week Treasuries @ 5.5%

- **Bitcoin (BTC = $25,900 / in at $4,310)

- **Ethereum (ETH = $1,630 / in at $310)

- Apple (AAPL = $178 / in at $177)

- CCJ – Uranium = ($37.1 / in at $33.8)

- DO – Diamond Offshore ($15.6 / in at $15)

- MESO – Mesoblast Ltd. ($1.51 / in at $3.60)

o SOLD Oct $5 CALLS

- NFGC – Newfound Gold ($4.20 / in at $3.75)

o SOLD Oct. & Jan. $5.00 CALLS

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>