Remember when people told you:

- Smarter people have tried.

- Who gave you permission to solve this problem?

- That’s been tried before.

- That’s never been tried before.

- I don’t get what you’re doing, ‘cause it’s way too original.

- I’m not giving you my blessing.

Quick advice:

- Just Do It… because it’s the only way change happens.

- Be Creative ‘n Be Loud… because one person CAN make a difference.

‘Forget-About’ your resume... In 6 months, you won’t need a better digital resume, or an ingenious way to get the word out. You will need to be smarter about (a) What you want, (b) Why you want it, and (c) How you sell that to somebody else. Why? Because creating instant connections between buyers and sellers is right around the corner with AI. You will want to be there to take advantage of that major change.

R U Pitchin’ or Askin’? If it’s scripted or has a goal – you’re pitching and using your questions to raise engagement. If you’re holding a conversation and willing to modify your point of view – you’re asking and that’s rare. People can tell.

The Market:

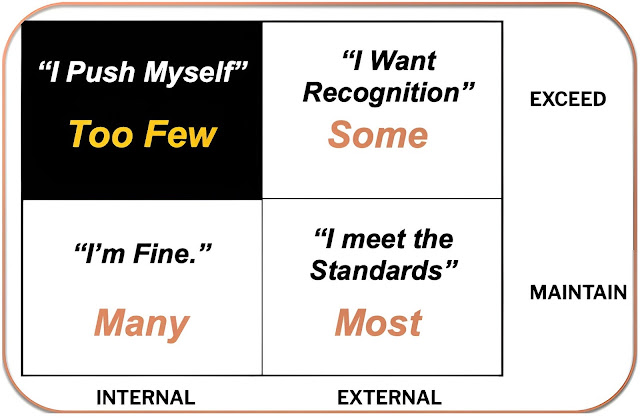

The 4 quadrants of a Leader:

1. Too Few people ‘Push Themselves’, and are actually motivated by the journey. Those Self-Motivators train for a marathon and then run one – because they want the experience.

2. Some people ‘Want the Recognition’, but never win the race due to fear-of-failure or other internals holding them back.

3. Many believe that they’re ‘Just Fine’ because they expend the effort and allocate the time. They’ll move with the group – just not as contenders.

4. Most people find satisfaction in ‘Just Meeting the Standards’. They do the bare minimum in virtually every situation.

Per Seth G: Choose the group that Pushes Themselves. Never let the outside world set your pace for your improvement. However, to be a member of that group does require you to learn how to: Push Yourself.

Try: ‘Buy in May, and Stay’… Elon Musk’s newest startup (xAI) pushed out a press release stating they have raised $6B at a $24B valuation. What does this mean for Tesla and other Elon ventures? Tesla shareholders are now facing a share dilution deadline vote on a $56B payout that Elon is demanding. What are shareholders to do when a founder, who is the brand, chooses to force shareholders to dilute their shares in order to increase his/her own personal stake? Founders can threaten to take their vision and innovation elsewhere and cut everyone out. How is this a win for the shareholders? More importantly, how should investors protect themselves from this risk on future investments? Obviously, everything works… until it doesn’t. But if Elon’s vision is now worth a cool $24B (xAI), we probably need to rethink a lot of things.

InfoBits:

- Outside of Academia… Americans don’t care about the RATE that prices change as much as they do about how expensive things are vs pre-pandemic.

- The cost for hiring a new employee is $4,425… with 20% quitting during their first week and another 17% during their first month.

- The percentage of people who ‘personally know’ their co-workers… is down from ~80% pre-COVID to 64% today.

- T-Mobile is buying U.S. Cellular for $4.4B.

- ~40% of S&P companies mentioned ‘AI’ on their last earnings call.

- ConocoPhillips will purchase Marathon Oil for $17B.

- Custom GPTs for everyone… as PwC will give ChatGPT licenses to its employees and clients – making it OpenAI’s largest customer. PwC will develop custom GPTs to help its workforce review tax returns, generate proposal responses, and generate reports = cheaper, better ‘n faster.

- Nvidia, Microsoft, Apple, and Alphabet… generated more market value in May than the entire S&P 500, with Nvidia representing over 50% of that total.

- TikTok is developing a U.S. version of its algorithm… that would allow it to break-off from ByteDance.

- Miso Robotics has the solution to rising fast-food prices… as its AI-powered robots will increase restaurant profits by 400%. [Does anyone care about the human employee anymore?]

- Q1 GDP growth slowed to 1.3% / yr.

- After $320m in repairs, the Gaza pier broke off and floated away. It lasted 8 days, and the aid that was delivered – was immediately looted by Hamas. [Please don’t tell me that everybody worked really hard on the project…]

Crypto-Bytes:

- As long the Ethereum/Bitcoin ratio is above 0.054… it makes sense to overweight Ethereum relative to Bitcoin in a crypto portfolio.

- There are at least 5 publicly-traded non-crypto companies… using bitcoin as a treasury asset. More companies will pursue this strategy in the coming months as BTC has shown itself to be a superior store of long-term value.

- US crypto investment products saw over $1B… in weekly inflows, with Ethereum attracting $35m. This marks the third consecutive week of strong inflows.

- Riot Platforms (RIOT) has offered to buy Bitfarms (BITF)… at $2.30/share. Riot would then be the world’s largest public Bitcoin mining company.

- Recently, wallets linked to Mt. Gox… became active and transferred ~$10B in bitcoin. Good News: this removes another layer of bitcoin uncertainly.

- Legacy markets are on a crash-course with crypto… The Pres. of the NYSE said @ Consensus: “We saw the ~$58B flow into crypto ETFs, and are salivating over the opportunity to get in the game. But when the ‘adults’ show up, crypto markets will learn what real size and liquidity look like.” [Consensus response: (a) ‘Does he know that his horse has left the barn?’ Oh yeah: (b) ‘Who’s the NYSE, and Why do they matter?’]

- Crypto Chief Legal and Policy Officer Ji Kim said: “Lawmakers are hearing from their constituents that crypto not only matters, but that they want fair and carefully crafted regulations.”

- The Republicans may be the ONLY crypto-ally in D.C. Even though 71 Dems signed a bipartisan House crypto bill, and 11 Senate Dems defied Biden to pass the measure that would roll back some SEC crypto guidance. – Pres. Joe VETO’d the bill. [Jeez… Let the games begin.]

TW3 (That Was - The Week - That Was):

Tuesday: It's a holiday shortened week, but the big news will be Friday’s PCE – one of our FED’s favorite inflation gauges. AAPL is up on word that their price cuts have resulted in a 50% jump in China sales. Put RL on your radar, as Friday it pushed up and over its 50-day.

Thursday: Mr. Market is grumpy today. The 10-Year rate rose over 4.5%, and when the 7-year auction went poorly – it shot up to 4.62%. By 2 pm the DOW was down almost 400, and the S&P was off 33. We can only rip higher if they ‘pretty-up’ the PCE on Friday, and our FED gets busy in the debt market driving the 10-Year under 4.5%.

Friday: The PCE is out and it came in right at estimates. Unfortunately, we still have inflation, and the 10-Year is still above 4.5%. Watch EGY as it pushed over its 50-day, made a high for the day, and then faded. I’d be a buyer over that $6.56 high.

Morgan’s Moments…

The SEC vs. Debt Box might be the most important SEC vs. Crypto case you NEVER heard of.

- August 2023: SEC obtained a Temporary Restraining Order (TRO) and asset freeze against Debt Box. The SEC claimed that $720,000 had been sent overseas to evade seizure, a claim later revealed to be an outright LIE.

- October 11, 2023: The SEC asked to dismiss the case because they got CAUGHT lying and wanted a ‘Do Over’, but the judge denied the request.

- December 14, 2023: Judge Shelby demanded the SEC explain their shenanigans of lying, misrepresenting evidence, and acting in bad faith. He proceeded to put the SEC on notice.

- March 18, 2024: Judge Shelby had all he could take and stated:

o “The SEC has committed a gross abuse of the power entrusted to it by Congress, and it has gone so far as to attempt to undermine the integrity of the judicial process.”

o “The SEC as acted in bad faith when it presented critical evidence in deliberately false and misleading ways. These actions constituted a serious breach of ethical standards.”

o “Within the SEC, a lack of proper oversight appears to exist that would allow these misconducts to occur.” Judge Shelby went on to warn of systemic issues existing within the agency.

o Judge Shelby ended with: “The SEC’s actions violated the trust placed in them by the judiciary.”

- May 23, 2024: Gary Gensler (Head of the SEC) approved the formation of a spot Ethereum ETF.

- May 28, 2024: Judge Shelby ordered the SEC to pay ~$2m to Debt Box for attorney fees and other costs related to the restraining order.

Next Week: “What’s VIX got to do with it…”

Bkg: What’s the VIX got to do with it? The Volatility Index is a manipulated number looking over 30-days out. When stocks gain +100 S&P points in 4 hours (like on Friday) – there’s huge volatility in this marketplace. It’s virtually assured that when May rises ~5%, June will be a good month as well – and the rest of the year will be +13%. Currently, the DOW and the S&P are diverging due to significant capital rotations. We could be in for some continued chop in the days/weeks ahead.

Advance/Decline line… Friday’s S&P 100 Advance/Decline line saw high degrees of correlation on a day when the DOW was screaming higher, the S&Ps were flat, and the NASDAQ was negative. We continue to experience constant and heavy sector rotation – at almost a moment’s notice. The marketplace is: Changing-its-Tone. There are numbers of technical red flags on the horizon. The semiconductor market cap weighting reached a new all-time high this week, with consumer staples becoming increasingly cheap.

Next week, a ton of economic data will come out… but we only have a $62 SPX Expected Move. [FYI: That’s curious because we moved $100 in 4-hours on Friday.]

This past week’s Bond Auctions… were horrific. The Bond Market is telling us that in order for our FED to cut rates, the data is going to have to look extremely ugly and bleak – and that type of data could be right-around the corner. Our FED is also telling us that asset prices (stocks, homes, food, etc.) must come DOWN in order for them to believe in dis-inflation.

SPX Expected Move (EM):

- Last Week … $50, and we ended inside the Expected Move.

- Next Week … $62, and that is way too low for my liking.

TIPS:

- Tip #1: Nike (NKE) BOT the July $90 / $80 Put Spread,

- Tip #2: Bill Holdings (BILL) BOT the Sept $50 / 40 Put Spread,

- Tip #3: CNX Resources (CNX) BOT the Jan. $30 Calls, and

- Tip #4: AMD (AMD) BOT the Oct. $210 / $220 Call Spread.

HODL’s: (Hold On for Dear Life)

- 13 to 17-Week Treasuries @ 5.44%

- Physical Commodities = Gold @ $2,335/oz. & Silver @ $30.5/oz.

- **Bitcoin (BTC = $68,200 / in at $4,310)

- **Ethereum (ETH = 3,850 / in at $310)

- **ChainLink (LINK = $18.4 / in at $7.78)

- HROW – Harrow Health == $17.95 / in at $12

- **IBIT – Blackrock’s Spot Bitcoin ETF ($38.55 / in at $24)

- INDA – India ETF ($53 / in at $50) / BOT Nov, +$53 / -$55 Call Sp.

- LUNR – Intuitive Machines: ($5 / in @ $6.40) / SOLD: June Cov-Calls

- **MARA – Marathon Digital = ($19.5 / in at $12) / Sold Sept $30 Cov-Calls

- **RIOT – Riot Bitcoin Mining ($9.7 / in at $12.5) / Sold Sept $20 Cov-Calls

- TGB – Gold Miner == $3.98 / in at $2.76

** Crypto-Currency aware

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson