Remember the movie ‘Up in the Air’… with George Clooney and J.K. Simmons? Their dialogue went something like this:

George: “How much did they pay you to give up on your dreams?”

J.K. “Twenty-seven thousand a year.”

George: “At what point were you going to stop, and go back to what made you happy?”

ALL creatives, entrepreneurs & innovators are driven by the same 3 elements:

- ‘Authenticity’… they LOVE their work – it’s an inextricable part of who they are.

- ‘Will’ - they love the CHALLENGE – and will never will stop learning.

- ‘Generosity of Spirit’ - they NEED to SHARE their gifts with others.

I wonder why ‘suits’ keep trying to inject GREED rather than UNDERSTANDING into this formula?

It’s different this time… Does anyone know how often we’ve all heard that line? I grew up in the 1970’s / 1980’s at Carnegie-Mellon Univ. where my mentors were: (a) Dr. Richard Cyert – whose vision for CMU being globally #1 in computer science, robotics, and AI started a wheel in motion that can’t be stopped, and (b) Dr. Herb Simon (the Father of AI, 1978 Nobel winner) – proved that great ideas and pursuits (like chili and ribs) just take time to marinate, simmer, and nurture.

Where do you go to noodle? Miles Davis recorded one of the bestselling and most important jazz albums of all time (Kind of Blue) in 4 days. Of course, his quartet was ‘noodling’ on it for months in clubs – taking risks and seeing what worked. Per Seth G: Where do you ‘noodle’? We all need a place to ‘noodle’ / try-out our failures. We all need a place where the stakes are real, but not so high that you forget why you’re doing the work in the first place. Find your own special place to ‘noodle’.

The Market:

- What are the stocks most favored by Hedge Funds?

o META, MSFT, NVDA, GOOGL, AMZN, and AAPL.

o META is the top holding among all hedge funds.

o TSLA is no longer a top-5 holding for any of the main funds.

o AAPL is the least favored Mag-7 name.

- When can I buy the Silver Miners? Now that silver has closed above $31, it’s in for the fight of its life. The big boys are short umpteen gazillion ounces of silver, and the first pain level for them was $26 – with the big one being at $30. Either the big boys need to create enormous amounts of new paper shorts, or they must cover – which is something they won't do. But this time the big boys are battling India and China – who are cashing in U.S. debt for metal. The crooked white shoes of Wall Street and London were able to cap gold and silver for years – as long as China and Asia were buying our debt. Now, that nations want something without any third-party risk attached (gold and silver) – the tables are turned. Let the markets fend off the white shoes, before loading-up-on any of the inexpensive miners.

InfoBits:

- Saudi Arabia’s biggest-ever plane order… went to Airbus – not Boeing.

- China is dumping US treasuries at an accelerated clip… and simultaneously accumulating gold. Stablecoins are buying US treasuries, and have quietly become the sixteenth largest holder.

- 9 to 2 is the new 9 to 5… as U.S. part-time work hits record levels. 25 to 34 yr. olds are“prioritizing personal development over a 9-to-5 grind”, and a record 4.1m Americans are retiring this year.

- Scarlett Johansson told OpenAI ‘NO’… to using her voice. OpenAI used it anyway. [Does OpenAI know that they’re angering an AVENGER?]

- Microsoft’s Copilot+ is coming after MacBook… as they introduced their ‘AI-first’ PC for $999 – including a voice interface.

- Target slashed prices on 5,000 items… to lure-back Walmart shoppers.

- According to a new Harris poll… (a) 55% believe the economy is shrinking, (b) 56% believe the economy is in a recession, and (c) 72% believe inflation is getting worse.

- April’s U.S. existing home sales fell 1.90% MoM… even as inventories rose 9%. But the median price is now $407,600 – a 5.70% YoY increase.

- The DOJ has filed suit against LiveNation… for exerting monopolistic control of the ticketing industry.

- Nvidia’s earnings did not disappoint… as they beat estimates by billions, reported Q2 revenues that were 262% YoY higher, and announced a 10:1 stock split. Nvidia now accounts for ~12% of the entire S&P 500’s return YoY.

- The median price for an AI engineer is ~300,000 / yr.

Crypto-Bytes:

- The pro-crypto FIT21 bill passed Congress… and would make the CFTC the leading regulator of digital assets, and not the Gary Gensler-led SEC. It would more clearly define what makes any crypto a security or a commodity.

- The SEC approved key filings for spot Ethereum ETFs… opening the door for mainstream investors to access the world’s second-largest cryptocurrency.

- On May 22, 2010… Laszlo Hanyecz (a Florida resident) made history by trading 10,000 Bitcoin for two Papa John's pizzas. [Just your basic $700 million lunch.]

- If Ethereum (ETH) can close above $3,700 this month… it will confirm a hugely bullish pattern, and mark the highest monthly close in ETH’s history.

- Chainlink (LINK) has recovered the majority of April’s losses… $19.50 continues to be the next target level for LINK.

TW3 (That Was - The Week - That Was):

Monday: Along from NVDA lifting the markets, gold, silver, and Bitcoin miners are seeing significant call option activity. Their role as the anti-dollar is pivotal during a melt-up, and a potential signal that the market / economy isn't healthy as we’re being told.

Wednesday: After the bell we get earnings out of NVDA. If they aren't spectacular, this market and NVDA will head lower. If they are amazing, it should keep the AI momentum in play for a bit. Keep an eye on:

1. CENX as it’s trying to break out.

2. CSTM is looking interesting.

3. PLL is trying to curve higher – after months of sideways action.

4. VALE is trying to hold itself over its 200-day. If it can hold it for a couple of days – it should be time to move.

Thursday: NVDA’s earnings report was indeed a home run as they blew the doors off their estimates, and announced a 10 for 1 stock split. However, markets took an about-face when the PMI (inflation) indicator came in hot, and housing starts came in down (by a lot). A couple of things:

1. The DOW looked kind of toppy anyway.

2. The entire market has been running on fumes.

3. China says that it's an exercise, but they've got the entire Island of Taiwan surrounded.

4. Market indexes shouldn't move strictly due to 20 stocks.

5. FED buying is the only thing saving the 10-Year from being over 5%.

Does anything look attractive? I like INOD over $13.37. Industrial metals will be in vogue again, and copper stocks rallied over 40% - so a fade was in the cards. I’ll be buying this dip.

Morgan’s Moments…

It is not lost on me that various politicians embracing crypto right now are doing so out of personal benefit. Most of them couldn’t care less about the technology or the future, but rather they see the industry as a way to further their own goals / campaigns. That’s fine because the world runs on incentives. Crypto investors have long believed that personal and corporate incentives will drive global adoption. Politicians now believe they have found a new arena that can lead to more fundraising and more votes. At this moment, here are a ton of countries that followed the U.S. into the ban crypto campgrounds: Algeria, Bangladesh, Bolivia, China, Colombia, Egypt, Iraq, Kosovo, Mexico, Morocco, Nepal, North Macedonia, Qatar, Russia, Turkey, and Vietnam. If the U.S. continues to embrace crypto, it is likely that most of these countries will have to change their position. Let’s call it playing global dominos.

Next Week: Good News = Really-Bad Markets

Background:

1. With the S&Ps touching all-time highs this week, consumer discretionary stocks continue to only get worse.

2. Short-term breadth is weak, and we’re developing a bearish divergence.

3. Margin debt is on the rise again.

4. More companies are talking about expense management.

5. Tech stock valuations are making new 23-year highs (expensive).

6. The number of 401(k) millionaires just made a new all-time high.

7. The FOMC minutes were hawkish, and coupled with the VIX below 12 – it screams complacency. It is NOT different this time, and historically will not end well.

The FED Minutes: had an extremely hawkish (‘higher for longer’) tone to them. At this point, Goldman expects no rate cuts for all of 2024. Our FED even mentioned that dis-inflation may require asset prices (stocks) to move 20% lower.

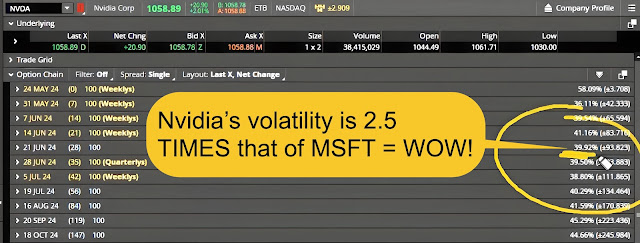

NVDA vs the S&P 500: Last week the Nasdaq (NVDA) cruised higher, the S&Ps were flat, and the DOW (energy and financials) moved significantly lower. This week showed quite a performance divergence, and if not for Nvidia – we would have had a fairly horrendous week. NVDA is a $2.6T company and continues to close the gap on the world’s largest corporations. But the difference between NVDA and all of the other Mag-7’s is its volatility. Even post-earnings, Nvidia’s volatility is 2.5X the volatility of a Microsoft; therefore, NVDA is not behaving at all like its peer-group.

The PMI rocked markets: because it confirmed that our FED should not even consider lowering rates at this point.

On Thursday, the day after NVDA earnings… we saw a 100-point move in the S&Ps – all with a volatility index (VIX) sitting at one of its lowest points in the last 3 years (12). There is a large amount of volatility sitting in this marketplace, that is not being reflected inside of the VIX. Tip #1: In the VIX, I BOT the June 18, $14 to $20 Call Spread for 50 cents - in anticipation of volatility hitting the tape over the next 24 days.

I’m watching:

- Tip #2: Caterpillar (CAT) Buying the June 28 / $340 to $335 Put Spread.

SPX Expected Move (EM):

- Last Week - $56 EM … we ended the week unchanged, but moved $100 in a single trading day.

- Next Week - $47 EM … ridiculously low (in my opinion).

TIPS:

This weekend is Memorial Day, and to many of us – a deeply significant day. We honor the people that have given their lives for our country, and we especially honor the families that had to cope with those losses.

HODL’s: (Hold On for Dear Life)

- 13 to 17-Week Treasuries @ 5.4%

- Physical Commodities = Gold @ $2,335/oz. & Silver @ $30.5/oz.

- **Bitcoin (BTC = $69,080 / in at $4,310)

- **Ethereum (ETH = 3,730 / in at $310)

- **ChainLink (LINK = $17.0 / in at $7.78)

- HROW – Harrow Health == $17.89 / in at $12

- **IBIT – Blackrock’s Spot Bitcoin ETF ($39.4 / in at $24)

- INDA – India ETF ($54.07 / in at $50) / BOT Nov, +$53 / -$55 Call Sp.

- LUNR – Intuitive Machines: ($5.13 / in @ $6.40) / SOLD: June Cov-Calls

- **MARA – Marathon Digital = ($21.2 / in at $12) / Sold Sept $30 Cov-Calls

- **RIOT – Riot Bitcoin Mining ($10.37 / in at $12.5) / Sold Sept $20 Cov-Calls

- TGB – Gold Miner == $3.98 / in at $2.58

** Crypto-Currency aware

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson