Dumb it down… Why? One of the least appreciated aspects of building a business is taking on continuous intellectual challenges. Artists build huge global followings because they’re not afraid to challenge their clients. As an entrepreneur, you shouldn’t have to ‘dumb it down’ for your clients – but rather learn how to lift your customers to a higher level. I believe customer education is in its infancy. Investing (for example) is the only place where you can combine math, emotion, opportunity, skill and probabilities into an efficient and executable model. Financial customers that are interested in markets are smart, and want to get smarter. Learn how to challenge your clients in a meaningful way, and they will be your clients for life.

The COST of Convenience… continues to rise. From the $1 you pay at an ATM to the time you spend in a Starbucks drive-through – we’re finding that a life lived conveniently often isn’t the best life. Shortening the journey often causes the cost of convenience to skyrocket.

How can I really use ChatGPT? Try pasting your text into the ChatGPT chat box and asking for a summary. The AI engine will do it: faster, with more clarity, and less bias.

Why are you asking? If you want to be a poet – write poetry. If you want to help animals – volunteer at an animal shelter. If you want to do marketing – find a good cause and spread the idea. Don’t wait for someone to ask you. Once we eliminate the: ‘and be well-paid’, approved-of, and/or successful – it’s much easier to do what you want to do. In a world of too-much-stress and questionable life choices, don’t make doing what you really want to do – contingent upon anything else.

The Market:

“In the last 2.5 years, the U.S. has printed… ~80% of ALL U.S. Dollars in circulation. At the start of 2020 we had ~$4T in circulation, and now there is ~$19T in circulation – a 375% jump in 2.5 years. Why is anyone (our FED included) surprised that inflation hit a 40-yr high?”… @KobeissiLetter

Time is even more priceless… to post-pandemic consumers that are revenge traveling. With employers calling workers back to desks, travelers are making the most of their remaining free time focusing on big experiences = Event-Cations.

One key can open many doors… While the DC court’s crypto-decision doesn’t guarantee Grayscale’s ETF request, it's an important step forward. Crypto enthusiasts view spot ETFs as an entry into the regulatory mainstream, and this approval could pave the way for more wins.

InfoBits:

- The average start-up’s valuation… is down -58% relative to their last funding round.

- China’s Evergrande’s stock is down ~80%... as trading resumed after 17 months.

- "Although inflation has moved down from its peak, it remains too high." - J. Powell.

- Meta and Goldman doubled down on return-to-office pushes… with Meta saying holdouts could lose their job. As some companies stick with remote, the RTO/WFH divide has split entire industries.

- Pinot Au Revoir… the French government is paying farmers ~$215m to turn this season’s surplus wine into ethanol for cleaning supplies and perfumes.

- Amazon’s CEO is running out of patience… with employees who refuse to return to the office. He said: "It's past the time to disagree and commit. And if you can’t, then it's probably not going to work out for you at Amazon.”

- The latest Case-Shiller index showed… a 0.7% MoM increase in home prices.

- Farmer’s Insurance is laying off… 11% of its workforce.

- July Job openings dropped to… their lowest level since March 2021.

- Apple’s Wonderlust is set for Sept 12 @ 1pm ET… and they are expected to introduce: (a) a new iPhone 15 with thinner borders, titanium edges, action buttons, and better processors and cameras, and (b) some new watches.

- An ongoing Adderall shortage could worsen… as students head back to school. Drug makers have struggled to meet demand, and related ADHD meds are also being stretched thin.

- Credit card processors Visa and Mastercard jumped to new highs… on news that they’re raising fees for merchants again in October.

- Q2 corporate profits are down 6.5% YoY… as earnings fell for the second straight quarter.

Crypto-Bytes:

- The first Bitcoin ETF could be coming soon… as the D.C. Court of Appeals ruled in favor of Grayscale over the SEC when the SEC tried to deny Grayscale’s application to convert their Grayscale Bitcoin Trust to an ETF. This decision will impact other companies that want to create bitcoin ETFs, like Blackrock and Fidelity. Bitcoin, Eth, and other major crypto coins surged on the news, and even Coinbase (which is listed as the custodian partner in multiple spot bitcoin ETF applications) bounced more than 14%.

- Gary Gensler’s SEC is piling up its court losses. The SEC’s war against the crypto industry has hit some significant snags recently. Its largest defeat came when the courts sided with Ripple – knocking down the SEC's inference that nearly all cryptocurrencies were securities. And this week, it lost against Grayscale, which has been trying to convert its bitcoin trust (GBTC) into an ETF. As a plus, the industry’s regulatory environment is becoming clearer.

- Why are spot BTC ETFs such a big deal? ETFs are a popular asset class, with over $10T under management worldwide. ETFs trade on exchanges and can be bought/sold like stocks via a traditional brokerage account. Spot BTC ETFs are widely seen as a potential way to increase mainstream adoption of crypto – and such products are currently being pursued by BlackRock and Fidelity.

TW3 (That Was - The Week - That Was):

Monday: BRICS member India is purchasing 1m barrels of oil from the UAE in its national currency (rupees) – for the first time ever. India is not the only BRICS nation to purchase energy from the UAE without going through the US dollar. In March, China National Offshore Oil Corporation paid in yuan to import 65,000 tons of liquified natural gas from the UAE. In May, China revealed that it signed $582.3B of global currency settlement agreements that will exclusively use the yuan. The UAE is one of the countries that inked the deal with the Asian giant along with Russia, Venezuela, Oman, Bahrain, Qatar, Kuwait and Saudi Arabia. Many nations want ‘off’ the U.S. Dollar – and this is going to be very bad for the U.S.

Tuesday: This morning the 10-Year fell off a cliff and buyers flocked into the tech darlings. The 10-Year was ~4.23% and fell (probably due to our government buying bonds) to ~4.15%. That drop in yield, was one of the fastest ‘n sharpest I've ever seen. That's the big boys like Blackrock and our FED wanting yields lower and equities higher – and they made it so. I still like the miners like PAAS (silver) and AG (gold), but they’re a manipulated bunch – so don’t overstay your welcome. I wouldn't be chasing the darlings right here.

Wednesday: The PCE prices paid fell a bit and GDP ticked down – both are Powell friendly moves. CNN is reporting that U.S. home affordability is the worst it has been since 1984. In terms of things to buy: AAPL over $196, SLB over $59, and V over $248 all make sense.

Thursday: More recent economic data:

- Initial jobless claims = 228k vs estimates of 235k,

- Average Income went up 0.2% MoM,

- Average spending went up 0.8% MoM (back-to-school and vacations),

- The PCE price-deflator INCREASED 0.2% MoM,

o YoY the PCE was up 3.3%, vs last month’s 3.0%,

- The CORE price-deflator INCREASED 0.2% MoM, and

o YoY the CORE was UP 4.2%, vs last month’s 4.1%.

Friday: The JOBS report is out and they say we gained 187,000 jobs. The unemployment rate jumped from 3.5% to 3.8%, and the Labor force participation rate came in at 62.8% - the highest level since pre-COVID. The talking heads are trying to call the PCE inflation report "benign"; however, Powell's preferred Indicator (PCE Inflation Ex-Housing) was up another +0.6% to +4.6% YoY. 4.6% is nowhere near Powell’s target of 2%. So, NO – he’s not done raising rates, and the jump in the 10-Year today reflects that.

AMA (Ask Me Anything…)

How do you Evaluate an Equity (say Mercedes Benz) – per Howard L.:

1. Friends don’t let friends drive Mercedes (MBGAF): Mercedes has a dividend yield of 7% and a PE ratio of 4.7. Instead of buying a Mercedes for $100,000, buy Mercedes stock and create a cashflow stream. Take the dividends and lease the Mercedes of your choice.

2. Look for Value, Quality and Momentum... Mercedes is up 20% in the last 12 months. Benz is a strong brand evidenced by above average profit margins, and an ability to pass on price increases to customers in an inflationary environment.

3. Look for Growth… Sales are growing fastest on the top end & in its EVs. Mercedes is quietly transitioning to the Tesla Direct Sales model. Free cashflow is growing at 13% YoY. Benz’s current PE is 30% below its median, and is extremely disciplined on CapEx and R&D costs.

4. What I don’t like: Mercedes’ revenue growth is only 5% - barely matching inflation. This is a free cashflow story, and not a high growth story. The auto industry is generally highly influenced by interest rates, and Benz presently has high inventory levels.

5. Why now / catalyst? Mercedes is competing with Tesla on the higher-end of the fast growing EV market – with their sales up 67% to ~150k units.

6. Role in portfolio: This is a value stock. Mercedes will generate income like a bond – except this bond’s coupon goes up over time. The stock is discounting a Euro recession, and will potentially surprise to the upside due to their growth story.

Next Week: Bad Times are Good again…

In Summary:

- The August price action looks like a bull market correction.

- However, the correction drivers look to be turning down again, and the market rebound has stalled at short-term overhead resistance.

- Seasonal downdrafts are most intense typically in Sept. and October.

- Retail flows, hedge fund positioning, corporate buybacks, and analyst earnings estimates are all displaying clear bullish optimism.

- Meanwhile, the macro remains murky (from JOLTS jobs jitters to student loan payments unpausing).

It was an incredibly bullish week for the S&Ps. The options market estimated that we would move $66 and we moved $110 higher on the S&Ps. Last week we rallied inside of the financials, energy, and had a huge 2-Sigma move higher in technology. However, the vast majority of the economic data that hit the tape this week – showed us that the economy is slowing, and both inflation and unemployment are rising. What was interesting was that the U.S. Dollar moved significantly higher on the week.

Friday’s big mover was the reversal in the bonds. The bonds (/ZB) had rallied back during the week, but on Friday they collapsed. I think that our bonds were sold, had a slight bid back, and will be followed by more ‘sell-side’ activity driving rates higher. I think our FED will react more to the return of inflation – than they ever will to bad economic data. And if rates go higher – mega-cap technology declines.

Options activity in Technology: On Friday, a ton of Call Options were sold at the bid or below, along with a lot of Put Options were bought at the ask or above. Combine that with the U.S. Dollar going higher and we have a ‘risk off’ / ‘bearish’ environment. My only real question is: “Is the economy weakening and inflation still going strong?”

Volatility (VIX) was crushed down to its most recent lows. So, volatility in short-duration options is dead. If you’re out there selling short-duration options, be careful because you could easily die trying. And, if you’re doing the ‘zero-day expiration trade’ – switch to being on the ‘buy side’.

A strong U.S. Dollar exports inflation. A strong / rising U.S. Dollar is a definitive sign that inflation is coming back to haunt us – and extremely troubling is that it’s on the back of a weakening economic landscape. The strong U.S. Dollar is one of the reasons that interest rates are moving higher.

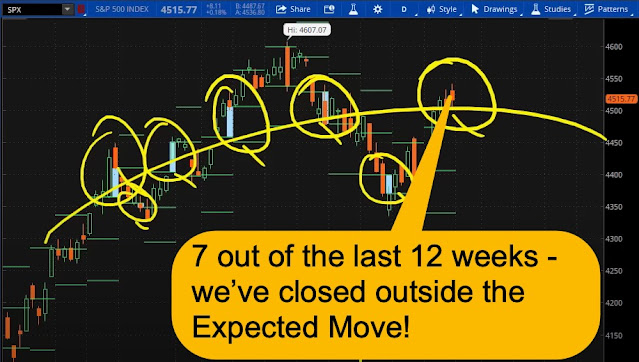

SPX Expected Move (EM):

- Last Week’s EM = $66, and we moved $110. In fact, 7 out of the last 12 weeks we have closed outside of the Expected Move. The options market is having an incredibly difficult time handicapping forward risk.

- Next Week’s EM = $48 – on a 4-day trading week.

TIPS:

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1966/oz. & Silver @ $24.5/oz.

- 17-Week Treasuries @ 5.4%

- **Bitcoin (BTC = $25,800 / in at $4,310)

- **Ethereum (ETH = $1,630 / in at $310)

- Apple (AAPL = $189.4 / in at $177)

- CCJ – Uranium = ($37.4 / in at $33.8)

- DO – Diamond Offshore ($15.2 / in at $15)

- MESO – Mesoblast Ltd. ($1.49 / in at $3.60)

o SOLD Oct $5 CALLS

- NFGC – Newfound Gold ($4.30 / in at $3.75)

o SOLD Oct. & Jan. $5.00 CALLS

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>