The Birth-Death-Birth of Barstool Sports:

Birth:

- January 2016 – the Chernin Group bought 51% of Barstool Sports for ~$8.5m.

- January 2018 – the Chernin Group invested $15m at +$100m valuation.

Death:

- January 2020 – Penn National bought 36% of Barstool Sports for $163m.

- February 2023 – Penn National bought the remainder of Barstool Sports for $388m. So, as of February 2023, Penn owned 100% of Barstool Sports after paying a total of $551m for it. Not bad for a company that started (20 years ago) as a free physical newspaper handed out by the founder.

Re-Birth:

- ESPN has wanted to get into the gambling business for a while now, because their traditional cable revenue stream is dying.

- August 2023 – Last week, ESPN and Penn National announced a 10-year partnership. Penn will pay ESPN $1.5B over 10 years including $500m in warrants, and Penn gets to launch a new sportsbook called: ESPN Bet.

- Then Penn decided to sell Barstool back to founder Dave Portnoy for $0. Yes, the same man who founded and sold Barstool Sports for $551m – bought it back for $0 – nine months later.

- Dave Portnoy currently owns ALL of a media empire that does hundreds of millions of dollars in cash-flow / year. He sold his ownership once for $551m, and then pulled off one of the greatest business deals of the last decade.

The Market:

- What are your dreams and your roadblocks? Per Seth G:

o Step #1 = Imagine what your customers want and care about it.

o Step #2 = Figure out why they don’t have it.

o Step #3 = Help your customers get to where they want to go, when they’re ready to get there.

o Step #4 = And that marketing stuff just got significantly easier.

- If you would like to see a great 3min. entrepreneurial pitch… look no further: https://www.youtube.com/watch?v=6-gcZMNDc7Q

- 50 neighborhoods, ZERO open houses… By some measures, it’s never been harder to find a home in America – let alone an affordable one. There are over 50% LESS houses for sale as there were five years ago. That’s driving up prices and forcing folks to put their white-picket dreams on hold. People who snapped up houses during the near-zero-interest era don’t want to give up the sweet mortgage rates that they’ve locked in. Almost 90% of mortgaged homeowners have a rate under 6%, while the current 30-yr fixed is closer to ~7%. Nearly 80% of consumers think it’s a bad time to buy a house, and over 50% of owners who plan to sell in the next three years are waiting for mortgage rates to drop. Fed Chair Powell thinks: “Rate cuts are still a couple years out.”

InfoBits:

- S&P500 earnings on pace to decline -5.2% YoY.

- Without warning, all 4 major Australian banks… began limiting cash withdraws to $500 making some areas "cash free".

- Softbank V-Fund #1 = $12B in gains… while V-Fund #2 = $19B in losses.

- China’s export demand fell -14.5% YoY in July… and imports fell -12.4%.

- UPS sees revenues slacking over softer e-commerce deliveries.

- WeWork thinks that there’s “substantial doubt”… about its ability to continue operating due to: sustained losses, canceled memberships, and a negative -47% net margin.

- Verizon folded-up BlueJeans… 3 years after they acquitted the $500m video conference platform.

- China fell into deflation in July… and overall, the country is facing issues with over-supply and weak domestic demand. Additionally, foreign investment is going elsewhere as manufacturing looks to diversify away from China.

- Novo Nordisk's profit margins expanded… as Ozempic sales grow 58% YoY.

- X’s CEO Yaccarino said that video chat and payments are coming soon.

- Adoption isn’t just on consumers… the UAW wants our government to link federal incentives with union standards. EVs require 30% less labor than gasoline cars; therefore, the industry needs to keep their workers employed. If not, a pricey strike of: GM, Ford and Stellantis could ensue.

- Subway’s bizarre promo… the sandwich chain said that nearly 10K people offered to legally change their first name to “Subway” for a lifetime of free footlongs.

Crypto-Bytes:

Venmo-ing Satoshi:

- Stablecoins can be a profitable business… although their usefulness in the U.S. is limited. Stablecoins make 5% interest on customer’s deposits, and pay back 0%.

- PayPal unveiled a new stablecoin (PYUSD)… that is: “designed for payments and is backed by highly liquid and secure assets. You will soon be able to buy, sell, hold and transfer PYUSD”.

- On one hand, this makes a lot of sense for PayPal to do. They are a payments company. A new technology (Ethereum’s blockchain) has been popularized that will allow PayPal users to send money faster, cheaper, and more globally than before. If PayPal does not embrace the new technology, they will risk being disrupted by it because users don’t care which interface or app they are using – they just want to send money to another individual or business.

- My issue with the PayPal solution… is that it is centralized. The centralization of these new digital technologies will give issuers even more control over their users. We may get some gains in convenience and functionality, but we are giving up security and resilience. ‘Same shirt … different day.’

- Swimming against the current… can give you a boost when the tide turns. With crypto regulation up in the air, PayPal’s decision to forge ahead could help it secure a piece of the $126B stablecoin market as other players exit. PayPal’s entrance will force regulatory clarity sooner rather than later.

TW3 (That Was - The Week - That Was):

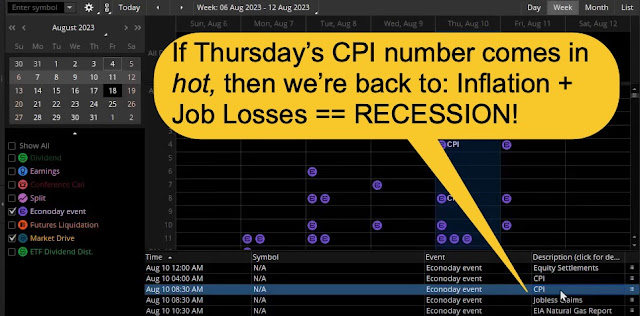

Monday: We had a down week last week – losing 2.5%. Given the seasonality issues, I think it's more likely that we trade lower, possibly down to the S&P's 50 day moving average at 4406. We get the CPI this week, and if it's hotter than expected markets will grumble. I’m watching GE over $114.88, and MRO over $26.50. But today's bounce just doesn't feel right to me. I'm going to remain a bit more cautious than usual, until this proves to me that it's not just a dead cat bounce.

Tuesday: Yesterday’s action showed me that they can jam this market higher, for no apparent reason – whenever they want. August is not traditionally a great market-month, and September is actually the worst market-month of the year. So, history says we should finally get the correction that's been missing for months on end. At 10:40am, we have the DOW down 455 points. If they do come in and start buying, I'd take a shot at the DIA’s if they got over $350.50 and are still going. As economic evidence mounts: “Total credit card indebtedness increased by $45B in Q2, an increase of more than 4% - taking the total amount owed on CC’s to over $1T.” And then there’s Moody's cutting the ratings of 10 US banks – with more to come.

Wednesday: I'm smelling some form of upcoming credit event as tensions are higher than normal. Just today shipping group Maersk warned of a steep decline in global demand for shipping containers – prompted by muted economic growth and customers reducing inventories. The whole world is slowing. Supposedly, markets are going higher due to earnings, but let’s be real: 80% of the earnings beats lately have come from them lowering their estimates so low, a snake could jump over them. The NASDAQ composite closed slightly below its 50-day moving average, and if they don’t rescue it – there’s a 1,700-point gap between the 50-day and the 200-day. It's a great time to sit back and watch things for a bit.

Thursday: The July Consumer Price Index (CPI) MoM headline is estimated to rise +0.2% and on a YoY basis estimated to rise +3.3%. On a core basis, MoM = +0.2%, and to rise +4.8%YoY. The numbers are out and they’re asking us to believe that inflation is up 3.2% YoY, and core inflation is up 4.7% YoY. Hah, using every trick known to man to manipulate the data to look good – wow. Today watch energy and the chip sector. A deciding factor in here is tomorrow's PPI.

Friday: Today is the Producer Price Index (PPI). We will find out whether producers are seeing input costs rise because of commodities, and thus are hiking their prices. The numbers are out and they came in a tenth hotter than expected. The 10-Year yield pushed up over 4.1% after the PPI came in hotter than they hoped. 401k ‘hardship’ loans have sky-rocketed. There’s really no legitimate way this market should be up in the face of inflation, the fastest rate hikes in history, lowered earnings estimates, the increased amount of people living paycheck to paycheck – and yet ‘magically’ every dip gets bought.

AMA (Ask Me Anything…)

Our FED recently rolled out its Novel Activities Supervision Program. Reading it gives you the impression that innovation is a threat to traditional financial systems, and Big Brother is nervous about that. The highlights:

- The Tread-Lightly Areas include:

o 1. Complex tech partnerships with non-banks [Heaven forbid banks lose their monopoly],

o 2. Activities related to crypto-asset custody, trading, and stablecoin issuance [Our FED wants a piece of that pie],

o 3. Projects using Distributed Ledger Technology that could impact the financial system [Challenging the status quo], and

o 4. Banking services for crypto-entities and fintechs [Traditional banks are feeling the heat].

- Implementation Risks include:

o 1. Risk-based supervision based upon how much they perceive you’re shaking up the financial world, and

o 2. Continuous monitoring – as our FED will always be watching.

Next Week: Headed into a Tech Volatility Storm?

Correlation comes back to life… and we’re beginning to see a lot more 2-sided trading.

Watch the critical levels on the XLK, MSFT, TSLA, and AAPL…. It's mostly just the fact that Tech stocks dominate the S&P500 and Nasdaq100 indexes. Without those sectors participating to the upside, these indexes are going to have a hard time advancing. And without tech breaking to new highs (from overbought + bearish divergence) – a tech correction should be looming. If tech (XLK) takes out short-term support at $168, it then opens up a prospective ~10% downside move to previous resistance. Microsoft’s critical level to hold is $320, while TSLA falling below $240 will open up $200. META’s $300 level is pivotal, while the $170 level on Apple would be concerning. Tip #1: Focus your September shorts on AMZN and GOOGL.

Bonds and Notes are pressing into recent lows… The interest rate on the 10-Year is testing 4.2%. That’s the highest rate since 2007, and it brings the entire concept of a soft-landing into question. You can’t go from a 1% rate to a 4.2% interest rate without inflicting absolute pain and damage to financial markets. Tech is going to feel the brunt of the 10-Year’s strength.

Watch continued Dollar Strength… Investors are buying the dollar due to a global capital defensive, strategic rotation. You have bonds that are pressing their lows, rates that are touching new highs, strength in the dollar, obvious weakness in technology, correlation has come to life, and a ‘last gasp’ rotation into energy.

Energy is strong (+6%) in the past month… and Tip #2: Tells that asset managers are running toward the energy sector for cover.

SPX Expected Move (EM):

- Last Week = $79, and we closed approx. unchanged because of the energy sector. It’s never good to have markets rally due to higher fuel prices – because it simply signals inflation and a looming recession.

- Next Week = $66

TIPS:

Remember, the DOW is just 30 stocks = much easier to manipulate than the 4,000 NASDAQ stocks or the 500 S&P’s. All last week, we saw them buying the DOW even if the techs and the S&Ps were red. Watch for a continuation of that behavior.

HODL’s: (Hold On for Dear Life)

- PHYSICAL COMMODITIES = Gold @ $1945/oz. & Silver @ $22.7/oz.

- 17-Week Treasuries @ 5.5%

- **Bitcoin (BTC = $29,500 / in at $4,310)

- **Ethereum (ETH = $1,850 / in at $310)

- Apple (AAPL = $178 / in at $177)

- CCJ – Uranium = ($34.8 / in at $33.8)

- DKGS – DraftKings = ($29.4 / in at $31.81)

- DO – Diamond Offshore ($15.3 / in at $15)

- MESO – Mesoblast Ltd. ($1.25 / in at $3.60)

o SOLD Oct $5 CALLS

- NFGC – Newfound Gold ($4.40 / in at $3.75)

o SOLD Oct. & Jan. $5.00 CALLS

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>