“Stock prices could fall another 50%...” per TT:

- In 2017, the most expensive stock traded at 11.7x forward revenues. Today, that number is 22.2x.

- In 2017, the average company traded at 5.4x, compared to 7.9x today.

- So, we can easily go down another 50% and stay within precedent.

“A recession is likely, because it’s very hard to stop inflation without one,” says Larry Harris … former Chief Economist of the SEC.

“Businesses solve problems. Capitalism works, but you must Build baby Build…” per HL. There’s no other option. This time our government isn’t coming to save you, or solve your problems. We need every entrepreneur to go to work right now – solving problems and building solutions. If we don’t get that scenario, we are going to be in big trouble. Jeff Bezos, Elon Musk and Marc Andreessen all say: “It is time to build!” They couldn’t have been more right. Hopefully entrepreneurs will take the call to arms seriously. I can’t wait to see what happens when we unleash the builders on a down market.

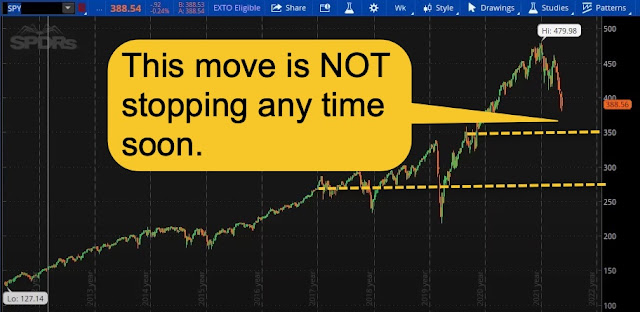

The Market:

Per TS: “The problems with crypto are mainly regulatory, and fixed via regulatory clarity. Regulators botched the meme stock blowup by displaying real-time incompetence, internal arrogance, and the complete inability to make-a-decision. Hey crypto – sound familiar? Even decentralization in its purest form needs some sort of industry validation and transaction integrity – in order to operate with trust. I can’t open an option, futures, stock, or even gambling exchange without regulatory approval. But I can launch a crypto exchange tomorrow.” I believe that the lack of liquidity in both markets is about to catch up with us. The FED PUT that provided a safety net and allowed, rewarded and increased the velocity of money – is no longer available. I believe that stock and crypto prices are headed lower – maybe a lot lower. But that’s not a sell signal as much a challenge and trading philosophy that people need to understand and actively practice. However, I will be pissed if Matt Damon and Tom Brady make more from shilling crypto on TV than I make from my passive buy-n-hold positions. Please = trade small and learn how to sell.

InfoBits:

- Goldman Sachs cut its EOY S&P target… to 4,300, and down to 3,600 if/when there is a recession.

- FED Head Loretta Mester warned… of negative growth for the next several quarters (defined as a Recession), but was careful not to use the ‘R-word’.

- In 67% of developed countries, college costs less than $2k/yr.: US private colleges cost $38k/yr. (avg.). In the past 2 years, US college enrollment has dipped 7% as more students choose to “earn over learn.”

- McDonald’s is pulling out of Russia: They will sell all 850 restaurants to a local buyer, who will no longer use the McDonald’s name, logo, or branding.

- JetBlue will now attempt… a hostile takeover of Spirit Airways.

- May’s Empire State Mfr. Survey… showed a contraction in business activity.

- Former FED chair Bernanke is concerned about stagflation in the U.S. That’s where the economy stalls, unemployment rises, and inflation stays high.

- If you control eyeballs, you have ad-tention: Whether it’s Kroger / Walgreens replacing your fridge doors with digital screens, or Marriott selling you rental cars in your hotel room. There’s a $500B ad market out there that is ripe for a change.

- Last quarter was Berkshire’s largest stock buy ($42B) since 2008: They bought: Apple, Citigroup, HP, Paramount, Activision Blizzard, and Ally Bank.

- Walmart and Target both missed earnings and guided lower… I’m beginning to doubt the health of our consumer.

- Mortgage Applications were down -11%... purchases off -11.9%, and Refis fell -9.5%. Another housing bubble is starting to burst.

- The summer of Americans hitting the travel road… will need to overcome the highest gasoline prices…EVER:

- INTC’s shareholders voted down CEO Gelsinger’s $178m pay package… I’m guessing slowing growth and lower share prices aren’t big winners. The same can be said for JPM shareholders voting down J. Dimon’s $50m bonus.

- Y Combinator has advised its founders to "plan for the economic worst."

- Klarna, a buy-now-pay-later company… is looking to raise new funds that could value the fintech giant at over 30% LESS than their previous valuation. Public shares of their competitor Affirm are down 75% YTD.

- Amazon proclaimed that it will be… more focused on technologies that affect the real world, rather than on the metaverse going forward.

- Delinquencies on subprime car loans / leases… hit a record in February.

- Melvin Capital, the hedge fund at the center of the GameStop saga… is closing its doors. They were down 39% in 2021, and down another 23% YTD.

Crypto-Bytes:

- The number of Bitcoin wallets in the red… and the number of Bitcoin longs – both just hit all-time highs.

- India’s top central bank officials… feel that cryptocurrencies have the potential to become a replacement for the rupee in financial transactions. This could undermine their ability to regulate the flow of money.

- Nigeria’s new securities rule book… is looking to give clarity on crypto’s role in their economy.

- Boost Mobile’s new cellphone plan… will let you play games and earn blockchain-based "BoostCoins" to pay down your bill.

- Despite a nationwide crackdown… Chinese miners contributed about 21% of all crypto’s total hash power… second only to the US’s 37%.

- SEC Chairman Gay Gensler begged for a higher budget to take on crypto… using the UST token collapse as his ammunition.

- Galaxy Digital CEO Mike Novogratz confirmed… that his famous LUNA tattoo, “will be a constant reminder that venture investing requires humility.”

- Chainalysis is launching ‘Storyline’… an on-chain visualization tool that aims to help investigators “follow the money” in crypto crimes.

- Crypto exchange FTX is diversifying… it will let customers trade stocks and ETFs on its popular trading app alongside bitcoin and other crypto.

- Coinbase is pausing new business projects… freezing hiring, and slashing its cloud spending on Amazon Web Services.

- Shopify (SHOP) is expanding its crypto payment options… by adding Crypto.com to its list of tech providers.

- The U.S. Dept. of Commerce is requesting public comments… on how to best ensure our country’s competitiveness in digital assets. It’s a complicated task for governments due to the technology’s ability to challenge their authority.

TW3 (That Was - The Week - That Was):

Monday: We have fallen a long way in a short period of time, so some claw back higher makes sense. Just don't buy into the hype that ‘the bottom’ is in. I believe ‘A bottom’ may be in, but not ‘THE bottom’.

Tuesday: What’s up with today's big futures? Home Depot hit a home run on earnings and even guided higher. However, Walmart missed earnings and lowered guidance. The other story is that China appears close to opening up some more of their locked down regions, and may even be "unlocking" some internet sites. The bottom line however is that we've been looking for a bear market bounce since last Monday, and maybe it is finally here. In MRO and DBA (‘agriculture’ ETF), breakouts are forming so we’ll need to watch those. Now, DBA is not a fast mover, but it is moving in the right direction. After being up almost 300, the DOW faded off and is now only +148. You can see people ‘selling the rally’. I’ll take MRO over $28.65 and DBA over $22.50 if either make it to their buy-ins. Usually bear market bounces are real screamers. This one is more like a whimper.

Wednesday: This morning is a pretty good show of why you don’t get too excited about one or two ‘up’ days. Even yesterday, the volume across the entire stock market was down 9% from the norm. So, not everyone was on board with the bounce. I like the chart of CHPT if things warm up, but right now we’ve given back all of yesterday. This particular bear market is mean. The DOW was off 1077 the last I looked. In times past, our FED would be out in force talking about how they won't be as aggressive as people fear, and basically saving the market. Not this time. Powell has stated that he's gunning for lowering inflation. He can't do a darned thing about supply issues, but he can target demand. He knows that if/when this market puts in a really meaningful drop – inflation will fall. People spend much less when their 401K's get creamed and their individual portfolio's get slaughtered. I'm not surprised that our FED isn’t rushing to the rescue. I am surprised that this market can't even mount a decent counter trend bounce. It looks like they're willing to test the May 12th low, and I’m not up for trying to catch a falling knife.

Thursday: They're trying like mad to make a stand here today, but I do NOT think the selling is over. I’m still in the hunt for my bear market rally. The DOW was down over 300 for most of the day, and is now off just 100. The NASDAQ is up 62, and the S&P is fighting for green. Watch OSTK over $28.50 and CHPT over $11.

Friday: The futures this morning are bright green across the board. Is it possible that this is the bear market bounce I've been looking for? Nope – oh well. I put on a couple PUT spreads on the SPY and FXI – so we’ll see how those work out.

AMA (Ask Me Anything…)

Q: Will entrepreneurs have to change the way they think?

A: YES. The entire ‘Get Big Fast’ / ‘Build Back Better’ thought process will need a reboot closer to the days of earnings and fundamentals. I’ve heard of more term sheets being pulled in the last month – than I have in the last decade. To me that says: (a) there was too much money sloshing around in the hands of newbie investors, and (b) thousands of companies were funded that will need to work off their rich, over-valuations. RR said it best: “In almost no scenario will the inflated private valuations hold. Those gigantic valuations were modeled on the assumptions of strong growth and zero rates – and both of those ideas are dead in the water.” Honestly, there’s always money available for good, sound investments. BUT, if a startup needs to raise without a strong free-cash-flow / profitability matrix behind it – the road will be longer and a lot more painful.

Q: What should I buy in a bear market?

A: Cash (by far) is ‘personally’ my largest position. I’m only buying the indexes and defensive commodities such as: gold, silver and copper. One of the characteristics of a bear market is a very high correlation between stocks – regardless of their current or expected fundamentals. When you are below the 200-day moving average (as we are), I trust the indices over individual stocks. Whenever we rejoin the days of growth stocks breaking higher, that is when I will return to stock picking. In the meantime, I’m focused on using the indexes for market exposure and for liquidity.

Next Week: On the Verge of a Crisis

Market Overview:

- Oversold has become a cliché: The S&Ps have gone straight down for 50 days, and on Friday ended exactly on the lower edge of their expected move. Every short-covering rally is being met with money managers and institutions selling into that rally. We are missing people putting new money to work. Money managers are fighting for their jobs – because when their quarterly reports come out (July) – clients will realize that they don’t have to pay someone to lose their own money. Self-preservation is finally at stake here.

- YTD recap of major sectors: SPY = -18.6%, QQQ = -28.5%, XLF (financials) = -17%, vs XLE (energy) = +42% - which is holding the entire S&P 500 up. Even Apple (AAPL) is down -24.4% YTD, and (along with the rest of mega-tech) could get substantially weaker.

“Give me liquidity, or give me death…”

- Liquidity is non-existent in many products: The bids / asks associated with the S&P futures have been incredibly thin. Nobody wants to make a tight market out of an incredibly volatile one.

- Indices are seeing a concentration of liquidity: Liquidity is concentrated into the major indices rather than individual stocks. Tip #1 = If you’re going to trade – trade small and trade the major indexes. The volume we’re seeing is in response to directional risk being taken in a particular major index product.

“Bonds are being: Bid, Back Better…”

- Bonds and the Dollar are both catching a Bid… and are being used as a hedge. The major players are concentrating their liquidity into the major index products, Bonds and the Dollar.

“We don’t need no stinkin’ BOTTOM…”

- Volatility is just wrong: On Friday the S&Ps broke down to 3807, and the volatility index (VIX) barely responded. We should be seeing a VIX of 45, but we’re barely scratching 30 (29.6). Traders are still taking inordinate amounts of risk.

“ABC’s = Always Be Closing = Sell…Sell…Sell”

- Forget about a BOTTOM: Tip #2 = SELL PREMIUM to survive, or buy inexpensive PUTS in elevated sectors as a hedge.

SPX Expected Move (EM):

- Last Week’s EM = $133… we touched it – to the penny.

- Next Week’s EM = $126… tells me we are not close to a bottom as this market is becoming incredibly efficient to the downside. Markets are on the verge of a much larger crisis that starts with a lack of liquidity and ends with a lack of clarity. Tip #3 = The only way to stay alive is to hedge your positions.

Tips:

If this bear market resembles those in the past, we should see one to two-month long rallies that dissolve into lower market moves. We’re not seeing that…yet. This is a different bear market. Per FW: “I suspect we are either in a recession right now or headed toward one - brought on by tightening our money supply and increasing rates to control inflation. This recession could easily last until the end of 2023. Recessions end when economies and inflation slow down – and when stocks ‘hang-out’ at a bottom for extended periods of time. None of this happens quickly.”

HODL’s: (Hold On for Dear Life)

- CASH == Nexo & Celsius == @ 8 to 12% yield

- PHYSICAL COMMODITIES == Gold @ $1,845 / oz. & Silver @ $21.76 / oz.

- **BitFarm (BITF = $1.82 / in at $4.12)

o Sold Dec ‘22: $5 CCs for income,

- **Bitcoin (BTC = $30,500 / in at $4,310)

- CPG (CPG = $7.58 / in at $6.44)

o Sold Jul $7.50 CCs for income,

- Energy Fuels (UUUU = $6.06 / in at $11.29),

o Sold June $8 CCs for income,

- **Ethereum (ETH = $2,050 / in at $310)

- Chinese LG-CAP ETF (FXI = $30.42 / in @ $30.35)

o Bought the June 17, $29 PUTs,

- GME – Holding

- **Grayscale Ethereum (ETHE = $13.00 / in @ $13.44)

- **Grayscale Bitcoin Trust (GBTC = $18.75 / in @ $9.41)

- Hudbay Minerals (HBM = $5.62 / in @ $5.04)

o Bought the October 22, $7.50 CALLs,

- SPY ($390.60 / in @ $402)

o Bought the June 17, +380 / - 370 PUT Spread,

- Uranium Royalty (UROY = $2.88 / in at $4.41)

o Sold July $5 CCs for income

** Denotes a crypto-relationship

Trade of the Week: in FXI = BOT the June 17, +$31 / -$29 PUT Spread

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson