“Don’t ask me – just tell me.” You know what’s easy to find: little tasks that require us to ‘pick one’, then work hard and follow-up. It seems that we’ve been trained to look for small, do-able tasks with boundaries. Why – because our risks and responsibilities are confined. “Don’t ask me what’s next, just tell me what’s next!” As a result, we default to others when it comes to figuring out the boundaries, AND we MISS the opportunities that are right in front of us. The ONLY alternative is to draw the map instead of reading it. Very few people are willing to draw their own map, and therefore, that ability is valued quite highly. We can learn how to do it, BUT we will need to practice – and the freedom / time to fail.

“When will you speak up?” It’s easy to accept those implied limits when someone asks you for advice and feedback. Fix the typos – sure, but perhaps you have something more to add. A friend shares plans to launch a new website. It’s tempting to fix the small errors on the page, but perhaps it’s more useful to discuss the product line, the pricing, or whether it should be online at all. An agency shows you 3 versions of a new design they’re considering. Is ‘none of the above’ even an option – let alone the correct answer? Remember: When the Titanic went down, the deck chairs were clean and well-ordered. It’s a shame no one talked about the icebergs.

The Market:

In a nutshell, our FED needs a way out of the box that they built for themselves. Our economy remains weak, and any sustained raising of rates and reduction in our FED’s balance sheet will cause economic distress. History tells us that most conflicts can be traced to an impending economic disaster.

- The reason we need low interest rates is because we can’t pay our debts, or even the interest on our debts – without going deeper into debt. And we’re fortunate that the U.S. Dollar is currently the global reserve currency.

- Outside of treaties and agreements, one reason that the Dollar remains supreme is our SWIFT banking software system – that allows instant currency swaps, translations, payments, settlements, rebalancing, etc. And often when we say ‘sanctions’ – we really mean reducing another country’s access to SWIFT.

- The Chinese have built an alternative to SWIFT, and it has been up-and-running for years. Crypto is also an alternative, but lacks scale. Lately, Russia has been doing more commerce with China and in Yuan.

- Economists are beginning to speak-out against the Dollar:

o Alexey Maslov, at the Russian Academy of Sciences believes that: “China-Russia de-dollarization is approaching a breakthrough moment that could elevate their relationship to a de-facto alliance.”

o Prof. Eichengreen of Cal. Berkeley writes: “The current dollar-centric system cannot continue because the U.S. accounts for a declining share of the global economy.”

o Thomas Penn said: “At this juncture, U.S. foreign policy has only one job – to continue the proliferation of the Dollar at all cost.”

- A Russia-China alliance dramatically reduces the Dollar’s sphere of influence, and therefore, poses a direct and real threat to its proliferation.

- Our foreign policy team has one question: “Is the China-Russia threat to the Dollar’s global reserve status – real?”

o If yes, then keep talking and make the best deal you can – because your only goal is to “keep your friends close, and your enemies closer.”

o If it’s not a threat, then you can: “walk softly, and carry a big stick.”

- My money is on this threat being REAL – we will continue talking – markets will continue to drift lower – and I hope we know “our next 6 moves in advance.”

InfoBits:

- Snoop Dogg's ‘Team Fluff’ won the Puppy Bowl… which was a tough break for Martha Stewart's ‘Team Ruff’. Both squads left it all on the field.

- After 2 years, student loan repayments start again in May. 12% of public-college grads owe more than $40k, and 50% of all for-profit school grads have already defaulted.

- College tuitions and fees have doubled since 2010… and a broad loan cancellation would cost $60B/yr. in interest alone, and require a big tax increase.

- Trust funds are becoming a pain… as 50% of all wealth passed down in the next 25 years will come from the richest 1.5% of families.

- Microsoft is fully reopening its facilities… including its Redmond HQ on Feb. 28, and all employees are expected to report in person.

- Over 1/3 of European venture firms… still don't have a single female partner.

- Tesla is recalling nearly 600K cars… because of a feature that lets drivers play fart and goat noises outside their vehicles. Regulators said the sounds could pose a threat to pedestrians, while Elon blamed “the fun police”.

- Texas is suing FB over its practice of using facial rec. to suggest photo tags. FB quit doing it years ago, but could be on the hook for hundreds of billions in privacy violations.

- Former President Trump’s longtime accounting firm – Mazars… cut ties with the Trump organization, saying it could no longer vouch for a decade’s worth of financial statements – that it had helped to prepare.

- $100 oil has been a long time coming. Didn’t oil contracts go negative once?

- NY Governor is telling employers to “bring their employees back”… I’m assuming so they can spend $90/week on gas and $9/cup on coffee – yes?

- Facial recognition company Clearview AI is telling investors… that it’s on track to have 100B facial photos in its database within a year – enough to ensure that “virtually everyone in the world will be identifiable.”

- Google announced that it is adopting new privacy restrictions… that will cut tracking across apps on its Android devices. It follows a similar move made by Apple last year that upended several firms’ (FB’s) advertising practices.

- BA.2 - a subvariant of Omicron… is spreading fast and may cause severe disease. It appears BA.2 is capable of thwarting some vaccines, and some of the monoclonal antibody treatments.

Crypto-Bytes:

- Charlie Munger, Warren Buffett’s longtime partner… “I admire the Chinese for banning crypto. I’ve avoided it like a venereal disease.” Charlie – it’s the #1 performing asset of the past decade!

- FTX US… has opened a wait list for its upcoming stock-trading service.

- Crypto investment firm DARMA Capital… has created the first financial derivative based on a decentralized storage protocol.

- The NFT marketplace OpenSea… after raising $300m at a $13.3B valuation – has launched an investment arm and is offering ‘ecosystem grants’.

- DJ Steve Aoki made more money from last year’s NFT drop… than in a decade of making music.

- Real estate startup Propy… has sold its first NFT-backed property in the U.S.

- Major metaverse investor Animoca Brands… is partnering with global venture accelerator Brinc to launch the Guild Accelerator Program.

- When it comes to ugly divorces… warring spouses are using crypto wallets to hide their wealth.

- Managing Happiness… is the toughest Harvard Business School class to get into.

- Coinbase’s 60-second, Super Bowl spot… featured a bouncing QR code and $15 Bitcoin sign-up bonus. It attracted 20m+ visitors to its website – before it crashed, and jumped the app from #138 to #2 on the download list.

- The SEC fined crypto lender BlockFi $100m… in connection with launching interest-earning accounts without getting the OK from regulators.

- U.S. Rep. Josh Gottheimer (D-N.J.) has introduced a bill… that would establish government-backed insurance for stablecoins.

- Coinbase, the largest U.S. cryptocurrency exchange by trading volume… will hire 2,000 people this year as it seeks to take advantage of opportunities in the Web 3 and other arenas.

- JPMorgan said that it is the first lender to arrive in the metaverse… having opened a lounge in Decentraland.

- ConocoPhillips is routing excess natural gas… from North Dakota to Texas in order to supply necessary power to a bitcoin mining operation.

- 3 Russian banks are piloting… a Central Bank Digital Currency, and the Bank of Russia moved into the pilot stage for its digital ruble project.

TW3 (That Was - The Week - That Was):

Howard L asks the question: Is there an end in sight? “Interest rates didn’t kill this market – over-supply did. It’s now up to the media to hop on a bear market narrative, and talk people into dollar-cost averaging. Stop. As a stock investor it’s easy, you just stop buying. Honestly, this is a great time to have cash and be investing – or to be an entrepreneur. As of Friday’s close, the Nasdaq is down over 14% YTD. There is little panic. The selloff in tech is still orderly. I have NO IDEA what a bottom looks like in a non-panic, relentless selloff. The last time the Nasdaq had two months this bad was 2008, and in 2008 it took another 4 months of hell before we got a good bottom.”

AMA (Ask Me Anything…) – an aggregation of e-mail questions

- Who you gonna call? Crypto. Argentinian inflation is over 50%. As its currency loses value, crypto exchanges are coming in and issuing over 3m bitcoin rewards cards. Crypto to the rescue.

- Who gave the most in 2021? Elon Musk donated nearly $6B in Tesla shares to an unnamed charity. Elon’s donation was the 2nd largest, as Bill and Melinda Gates donated $15B to themselves – I mean to their own foundation.

- Can I really make a living on social media? The Creator Cash Boom is just beginning. Now that creators are being seen as crucial to social companies’ success: Snap, Twitter, TikTok and Insta are racing to help them sell merch and attract sponsors. As the $100B+ creator economy grows, we are going to see social apps get more creative with creator toolkits and ads.

- Will prices ever come back down? Commodities are cyclical and their outperformance started over a year ago. Rising inflation, COVID reopening, and geo-politics are driving prices higher. Financial markets always overshoot – so it’s not a question of IF but WHEN will prices come back down. The silver lining is that the bigger the correction, the bigger the opportunity afterward. The winners here are companies like Walmart. Walmart’s CEO Doug McMillon said it best: “During periods of inflation, lower-middle, middle, and even wealthier income families become more price-sensitive – and that’s to our advantage.”

Next Week: Selling begets more Selling?

This week was a geopolitical Tape Bomb…

- This past week, Eastern Europe and our own FED were constant threats to the tape. Our politicians and bankers put us through some wild up-moves and vicious down-moves seemingly coming out of nowhere.

- It has really emphasized the need for a risk management strategy, because it’s tough being LONG, and CASH is a position.

- This past week, inflation took a back seat, as BONDS (once again) became a ‘duck-n-cover’ event. Take Notice: With our low interest rates, the only people buying bonds are those with some very serious capital.

- In the coming week, I’m less inclined to think of Eastern Europe (as I suspect those discussions will continue for months) – and increasingly more worried about our own internal economic data-drops.

- Tip #1: Why do you want to be long? Most of last week’s selling occurred on Thursday, and we are nowhere near capitulation – so I suspect it will continue for the coming 6 to 8 weeks at minimum.

- For last week, both Energy and Financials both finished on the lower edge of their respective expected moves. I always take notice when previous strength turns into a current market weakness.

- Tip #2: Gold broke over $1,900 per ounce. If our Government and naked short sellers (JPM) allow Gold to go over $2,000, we will know that something dramatic is about to happen.

We are at the edge of a market abyss…

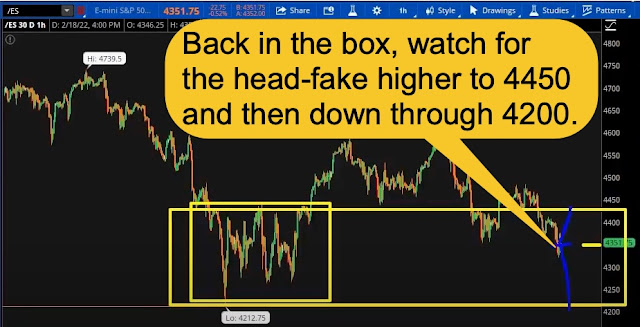

- Tip #3: We are back in the volatility box. On the S&Ps that box extends from 4211 to about 4450. There is no question that we could move higher and test 4450, but if we go below 4211 on the /ES’s or 14,000 on the /NQ’s = ‘Look-Out-Below’.

- Tip #4: I believe, inflation will explode in the next 6 to 8 weeks, driving interest rates higher, and panicking our FED. To me this feels like the calm before the interest rate storm. So, if you need any big-ticket items – NOW – is the time to buy them at low interest rates.

- The Volatility Index (VIX) is hovering around 30 and ready for action. But more importantly we are in backwardation. That means that the experts view the next 21 days as being ‘riskier’ than the next 61 or 89 days. But mark my words, the VIX will explode higher the minute the SPX goes below 4,211.

- Tip #5: We will retest the /ES lows of 4211 and the /NQ lows of 14k – and below. If/when the NASDAQ gets below 14,000 – you will see all kinds of ‘heck’ break loose in this marketplace.

- The Monsters of Tech (AAPL, AMZN) are down about 15% YTD. Individually: AAPL = -8%, AMZN = -10%, MSFT = -14%, FB = -40%, GOOGL = -10%. Tip #6: For the upcoming weeks, watch AAPL and AMZN as they will be the next big tech names to be SOLD as the weeks go on.

- Tip #7: Financials will lead the next leg lower in the S&P 500. Specifically, look to Wells Fargo (WFC +10% YTD) to lead the financials lower. The Financials are basically flat on the year. The financials (outside of geo-political energy) are the only sector that has not been ‘hit’ in a marketplace that is on-the-edge.

SPX Expected Move:

- Last Week’s EM = $135

- Next Week’s EM = $121 (4-day trading week), but if we touch the lower-edge of the expected move next week – we are most-likely making new lows for the year.

Tips:

HODL’s: (Hold On for Dear Life)

- CASH == Nexo & Celsius == @ 8 to 12% yield

- PHYSICAL == Gold & Silver

- **BitFarm (BITF = $3.45 / in at $4.12)

o Sold May, Dec ‘22: $5, $7.50 CCs for income,

- **Bitcoin (BTC = $39,950 / in at $4,310)

- CPG (CPG = $6.45 / in at $6.44)

o Sold Jul $7.50 CCs for income,

- Energy Fuels (UUUU = $6.23 / in at $11.29),

o Sold June $11 CCs for income,

- **Ethereum (ETH = $2,700 / in at $310)

- GME – Holding

- **Grayscale Ethereum (ETHE = $22.51 / in @ $13.44)

- **Grayscale Bitcoin Trust (GBTC = $27.30 / in @ $9.41)

- Hyliion (HYLN = $3.96 / in @ $6.01)

o Sold April $6 and $7 CCs for income,

- **Loopring (LRC = $0.87 / in at $1.94)

- **Solana (SOL = $90 / in @ $141)

- Uranium Royalty (UROY = $3.08 / in at $4.41)

o Sold April $5 CCs for income,

- Vertex Energy (VTNR = $5.02 / in @ 4.74)

o Sold April $5 CCs for income.

- **Yearn Finance (YFI = $21,500 / in @ 32,850)

** Denotes a crypto-relationship

Thoughts:

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson