When is an entrepreneur NOT an entrepreneur… maybe the day after Thanksgiving? Nope! SpaceX employees were still digesting their pecan pie, when Elon Musk sent a company-wide email telling everyone that: ‘The lack of progress in developing Raptor rocket engines has created a “genuine risk of bankruptcy” for SpaceX’. Elon explained that he will be: “on the Raptor line all night and through the weekend”. Elon didn’t sugarcoat it: “We need all-hands-on-deck to recover from this disaster." Elon knows: "only the paranoid survive," and that fear often drives results more than complacency. Elon’s sounding the alarm to motivate employees to reach SpaceX's goal of flying one Starship every two weeks starting New Year’s Day.

Customer Support is NOT free. No real organization views customer support as a cost center. The days of: (a) hiring cheap labor to answer the phones, (b) installing recordings to calm people who are on hold, and (c) putting loopholes in warranties to void the relationship … are OVER! Why? Because customer service is a profit center. Consider the following as a organization:

1. You are finally one-on-one with a fully engaged customer. Unlike every other moment you’ve had with them – now they are paying attention, leaning into the situation / conversation, and on high alert.

2. Since your competition still views customer support as a cost, the chances that you can dramatically overdeliver are pretty good. After all, your product can’t be 10 times better, but your customer service can.

3. Given people love to tell stories about customer service, your actions will allow the word to spread virally, quickly and inexpensively.

4. Loyal customers are the most valuable customers. While customer acquisition is fun – it’s expensive and resource draining. But great customer support will turn existing customers into advocates and ambassadors – at one-tenth the cost.

Money spent on great customer service repays you many times over.

The Market:

It’s a Good News / Bad News market:

- Good News = We needed a down move. Bad News = The volatility expansion wiped out some of my profits.

- Good News = Too much complacency is a dangerous thing. Bad News = Too many people are still disrespecting science.

- Good News = Outliers create opportunity. Bad News = The world is still passively long.

- Good News = The current vaccines do provide some immunity. Bad News = A vaccine focused lifestyle moves us further away from returning to the new normal.

The only part of the economy that’s expanding… is our Debt to GDP level – which is approaching (and will surpass) 150%. 150% Debt to GDP is where 3rd world / developing economies exist. I think that a ‘short term’ bottom was set last week, and we will see a bounce. I also think that unless FED-head Powell retreats from his withdrawing stimulus / rate hike stance – we’re going to see a replay of 2018. In 2018, the markets fell from Dec 1stthru Dec 24th, THEN Powell backed off of his taper-talk, and we rallied to new highs in January and February.

InfoBits:

- Parag Agrawal, Twitter’s new CEO, is reorganizing… and announced that their head of engineering and head of design & research – will both be departing.

- The NLRB has ordered AMZN to have a 2nd union election in Alabama… alleging that the company interfered with the first election. If just one Amazon facility unionizes, it could lead to a domino effect which would be extremely costly for the retail giant.

- Satya Nadella, Microsoft’s CEO… sold half of his MSFT shares last week.

- Depending on Omicron’s severity… it could sidetrack economic recovery, depress markets, and exacerbate supply issues – very similar to Delta’s impact.

- Over in China, Alibaba nearly touched $1T… before PM Xi had enough with Jack Ma and big tech. Alibaba has since lost $500B in value.

- Jerome Powell said… that our FED is prepared to quicken the removal of their easy-money policies, and will raise interest rates in the first half of 2022. They’re suddenly less concerned about our labor recovery, and more about inflation.

- Two shopping trends are emerging… (a) Early Sales == launching Black Friday deals in October, and (b) Buy Now – Pay Later == shoppers bought 5X more pricier products in November than pre-pandemic.

- GM raised its full-year earnings forecast thanks to… soaring car prices and increased chip supply. It doesn’t expect inventory to normalize until 2023.

- Exxon will give pay raises BELOW the inflation rate. After an excellent year, Exxon plans a below-inflation U.S. pay raise for most of its employees. They know that it will anger many employees. So they can’t be surprised when their labor movement gains traction - yes?

- The FTC sued to block Nvidia’s $40B acquisition of ARM… halting what would be the biggest semiconductor industry deal in history.

- Apple has alerted 11 U.S. Embassy employees… that their iPhones have been hacked in recent months with Pegasus spyware from NSO Group

- Per Ben Thompson… “Twitter has had one business model and five CEOs (counting Jack Dorsey twice). Maybe it’s worth changing the former before the next activist investor demands another change to the latter.”

Crypto-Bytes:

- Jack Dorsey, once said: “I’d be working on Bitcoin full time if I wasn’t running Twitter and Square,” is stepping down as CEO of Twitter. I’m betting his talents for crypto, payments, and creative spaces have found a home at Square.

- Tanzania is preparing to launch a digital… Tanzanian shilling. The country will follow Nigeria, which launched its eNaira in October.

- AMC and Sony are giving away 86K Spider-Man-themed NFTs… to customers who preorder tickets for “No Way Home.”

- The Musk brothers Kimbal and Elon… have launched a charitable decentralized autonomous organization (DAO) focused on food justice. One of the goals of the charity is to overhaul the philanthropy industry via blockchain-based tooling. Non-profits are a sector they believe plagued by inefficiency.

- Meta is losing its top crypto exec: David Marcus, who lead Libra and now Novi – announced that he will be leaving the company for his own adventure.

- Crypto exchange Crypto.com will buy… Nadex and Small Exchange to expand its presence in the U.S.

- 1inch Network has raised $175m at a $2.25B valuation… as the DeFi platform gears up for the launch of a new set of institutional products.

- Meta has updated its crypto ad criteria… greatly expanding the number of projects that can market on its highly trafficked social media platforms.

- Square has changed its name to Block… days after CEO Jack Dorsey said he was leaving Twitter. Block is building a hardware wallet and considering creating a bitcoin mining service.

- Blockchain.com, and other crypto exchanges… are charging head-first into NFTs.

- Goldman Sachs is figuring out how to use bitcoin… as collateral for cash loans to institutions.

- Budweiser is joining the Crypto-DeFi game… by buying an ENS username and using it as their display name on Twitter: “beer.eth” NFTs-r-a-comin’.

- NFT is the… Collins Dictionary ‘Word of the Year’ for 2021.

Last Week:

Tuesday: Powell is talking to Congress about accelerating the pace of the taper. He’s also saying that “it’s time to retire the term transitory” concerning inflation. Did he find religion? He knows that fighting rising costs – requires raising rates – which will tank stock buybacks and the market – yes? Unless of course, crashing the market is the plan? I'm watching today, as I'm not desperate enough to try and front run this.

Wednesday: In 2018, when they talked about tapering – the market put in a bunch of pout sessions and our FED quickly walked back their taper talk and added more stimulus. If the market continues to pout, it will be interesting to see if Powell repeats his 2018 behavior. If not, then something substantial has changed. This market can't fall unless THEY want it to. If they get really pushy about tapering and rising rates – this market will fall by 40%. I’m not buying anything in this manic market.

Thursday: For the past decade, the winning play was: “Don’t fight the FED” and “Buy the friggin’ Dip”. If excessive money printing and QE programs got the market to nose bleed levels, wouldn't it make sense that removing them will also stop the market’s ability to move higher. If our FED doesn’t walk back their latest talk about faster tapering, this market could rollover into yearend. Markets simply don't do well when banks taper into weakness.

Friday: The estimates for November’s Jobs Report were for between 500 to 600k jobs to be created. We created only 210k – less than half of the estimates. The Goldman came out and said: "We continue to expect the FOMC to double the pace of tapering at their December meeting, and deliver their first rate hike in June of 2022." Never has our FED been able to hike rates in a falling economy – and have the stock market do well. I suspect that this is the market's way of saying: “Powell, keep up the taper talk and this is what you’ll get.” I'm not interested in doing anything today. I could see some short covering into the close. This has been one heck of a week for volatility.

TW3 (That Was - The Week - That Was):

The Jobs report didn’t make sense. In November, private payrolls increased by 235,000 – much less than the 500,000 estimate. My problem is, the household survey showed that we added 1.1m new jobs. The majority of new hires came from the professional, business services, transportation, and warehousing industries. Other data continues to support the rebound narrative. The ISM Non-Manufacturing Index for November hit a record high of 69.1%. This implies that the services sector is continuing to grow, and it marks the 18thconsecutive month of growth – even amidst all of the supply shortages. So how did we only add 235,000 new jobs?

Will Crypto move higher soon? Honestly, the price action in Bitcoin looks like a failed macro breakout that needs to reclaim $60K. It doesn’t look like we’re out of the woods yet. BTC is still making lower lows and lower highs. The past few weeks have been pretty consistent with BTC undercutting the previous low, bouncing, and being sold off before passing thru that previous high.

What should I think of Web3?

- What is Web3? It’s (a) Decentralized = so instead of accessing the web via Google or Facebook – users will gain access via their own private interface. (b) It’s Unified = so user records are maintained forever on a blockchain. You can carry your data between sites eliminating those 50 different logins. And (c) It’s Direct = blockchain tech allows for more online transactions and interactions without the Mega Tech intermediaries.

- How will I know when I’m in Web3? (a) DeFi: Decentralized financial apps will start to replace banks and allow you to manage your money directly. (b) NFTs: You’ll notice a marketplace where you can exchange everything from digital art to Nikes through non-fungible tokens (NFTs). (c) Voting: You’ll be allowed to make community decisions via platform voting.

- Who’s worried about Web3? Banks and Mega Tech are very worried. But Mega Tech will be very involved – from shaping regulation to integrating Web3 elements onto their various platforms.

Next Week: Are we beginning: The Great Market Unwind?

Mega-Market Caps took a hit last week:

- Now that was a volatile week. For the week, the SPX was pricing in a $155 move, and we only moved $95. However, the Nasdaq (QQQ) and the Small Caps (IWM) did hit the lower edge of their expected moves. So, whatever you may think about this past week – that level of volatility was already priced into the major products. We’re looking at the same sized move for next week; therefore, volatility is far from subsiding any time soon.

- TSLA, NVDA, GOOGL, MSFT, AAPL, AMZN, and FB: Any Great Market Unwind is going to start with this group, and simply look at their 5-year charts for validation. TSLA (for example) closed right on the lower edge of its expected move last week. That means that markets are extremely efficient, and that we have NOT even begun to hit our volatility stride.

- The FED nixed their “transitory” language (when referring to inflation), and accelerated their taper talk. This FED-speak along with the Mega-Market Caps taking a hit – is the scary part of what’s coming. If markets are going to come apart at the seams, it will start with GOOGL, NVDA, TSLA, and MSFT.

- Bonds went on the defensive and rallied – which is in direct contrast to what our FED was saying. So, Tip #1: think about a Put Spread on the TLT (20-year Bonds) expiring January 7th: BUY $154 / and SELL $152 – which is a bet on bonds moving lower in the short term.

- TSLA has the beginnings of a negative Gamma squeeze – which means that people are buying more Puts than Calls. This could become a self-reinforcing prophecy on the way down – just as it was on the way up. If traders wake up on Monday morning and start buying PUTS instead of CALLS, this marketplace is going to move a lot lower in a hurry.

Volatility Update:

- The VIX (volatility index) ended the week over 30, and we’re less than 5% from all-time-highs (ATH). Over the past 5 years, you can count the number of times on one hand when this has been the case. Feel the Fear.

- The /VX (volatility futures) crossed over into backwardation. The 19-day volatility futures are 28.55, and the 47-day are 28.35. That says we are pricing in ‘more risk’ for the next 19 days, than we are for the next 47 days. This changes the way professional firms hedge.

- The VVIX (the volatility of the volatility index) closed at its highest point in 9-months, and one of the top 5 closes in the past 5 years. The SKEW (ratio of Puts to Calls) is also still a rockin’. We are priced for some very dramatic moves.

Strategy Talk:

- The Actual True Ranges (the price ranges of underlying products) are expanding dramatically. Therefore, buying calls for short-term rallies is a fool’s game. In this environment, when you buy a call – you are buying some extraordinarily high volatility. And the second we rally; the volatility component of that call will be crushed and you will lose money. The retail trader will get their ‘call buying’ head taken off.

- In this type of environment, USE SPREADS to offset volatility risk and to take advantage of any directional bias. There are a ton of ‘dip buyers’ that won’t go away overnight. This type of market baits the retail trader and then crushes their spirit – week after week.

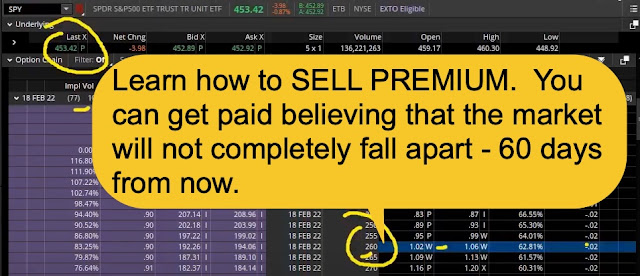

- PREMIUM SELLERS … start your engines! The VIX is over 30 and the SKEW is through the roof. Tip #2: Sell a February SPY $260 PUT – and get a $1 in premium. You’re making a dollar – betting the market will NOT be cut in half over the next 2 months. That’s an incredible amount of option premium that you can sell. Tip #3: Sell the SPY January $365 PUT Spread. Tip #4: Buy the SPY January $440 PUT and SELL 2 or 3 corresponding $385 PUTS to pay for the trade.

SPX Expected Move (EM):

- Last Week’s Expected Move was $154 … we only moved $95. For next week, the EM is $157. We will have no problem reaching that next week.

- Volatility is here and not going away anytime soon. I think we are seeing the beginnings of: The Great Market Unwind.

Tips:

HODL’s: (Hold On for Dear Life)

- AMC – Holding

- *BitFarms (BITF = $6.19 / in at $5.12)

o Sold Nov, Dec, Feb, May, Dec ‘22: $7.50 & $10 Calls for income,

- **Bitcoin (BTC = $49,400 / in at $4,310)

- Energy Fuels (UUUU = $8.02 / in at $11.29),

o Sold Dec $11, and Jan $11 Calls for income,

- Englobal (ENG = $1.63)

o Sold Dec. $2.50 Calls for income,

- **Ethereum (ETH = $4,200 / in at $310)

- GME – Holding

- **Grayscale Ethereum (ETHE = $39.87 / in @ $13.44)

- **Grayscale Bitcoin Trust (GBTC = $41.85 / in @ $9.41)

- Hyliion (HYLN = $6.03 / in @ $0.32)

o Sold Jan. $9 CCs for income,

- **Loopring (LRC = $2.19 / in at $2.27)

- **Solana (SOL = $195 / in @ $141)

- Uranium Royalty (UROY = $3.91 / in at $4.41)

o Sold Jan $5 Calls for income,

** Denotes a cryptocurrency

Thoughts:

In crypto: Per Multicoin Capital: “We continue to be bullish on Solana, Helium, and AR Weave.”

Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson