Stop Wasting My Time…

1. Why do you continue to start meetings with needless introductions – instead of circulating a d-list ahead of time and requiring attendees to do their own homework?

2. Why do you allow your teachers to deliver the same-old lectures – instead of pushing the lectures to video and forcing teachers to engage in spontaneous Q&A?

3. Why do you squander periods of synchronized, real-time interaction – just to display control? Instead, use those moments to enhance the magic, the connection, and the innovation.

There are 11m job openings in the U.S…. but it seems that very few people are interested in those jobs – but rather love the idea of self-promotion on Tik Tok, Instagram, and Snapchat. Even Etsy, Shopify, and Square, are doing their best to steer people away from jobs that our government can track. The jury’s still out as to whether jobs or free money will be the driver of the next economy. I come from the land time forgot – when people said: “I can see myself doing this job for the rest of my life.”

The only thing people dislike MORE than buying a car… is going to the dentist. We actually prefer the IRS over going to a car dealer. The #1 reason people like TESLA is their non-dealership experience. Car dealers make half their money on your ‘trade-in’ (buying it low), and the other half on servicing your car (selling it high). Recently my BMW and I went into a dealership to repair my key fob – and we walked out with a broken windshield. Later, my BMW and I went back to that same dealership for a leaking water hose – and we walked out with broken headlamps. With the onset of EVs, dealerships are going to lose their service revenue. Losing 50% of your revenue overnight is a recipe for change or for a going out of business sale. Place your bets.

The Market:

September has come and volatility has picked up with it. Last week we saw quite a few breakouts reversing and good setups breaking apart. It’s about time. We have become so accustomed to the slow grind higher than even a 1% down day seemed like a big deal. It’s all about perception. Pullbacks are a normal / desired part of the cycle because they make trends sustainable and provide entry points. Don’t panic – our FED is still out there buying. The S&P 500 decided to test its 50-day moving average for only the 8th time this year. Guess what happened in all of the previous occasions? Just when traders became comfortable with the short side, the SPY bounced and made new all-time highs. This behavior won’t last forever, but as of right now there’s little reason to believe that dip buyers won’t show up again. Market sentiment is still bullish and dips are likely to remain buying opportunities. With that in mind, I am holding a large cash position and am focused on crypto and short-term trades.

InfoBits:

- Oil production… lost 1.1m barrels / day due to Hurricane Ida, and it’s unclear when that production will return – making a bullish case for oil.

- Amazon Prime delivers caps and gowns... along with paying full college tuition at select schools for 750,000 employees. Walmart and Target also began offering college tuition perks while Uber and Lyft debuted huge bonuses to attract workers. Big banks even offered free Pelotons – so let’s see what sticks.

- The trial of Theranos’ Elizabeth Holmes… is taking Silicon Valley’s “fake it till you make it” culture to task.

- Club Apple remained easy to enter… by keeping iPhone prices flat and offering accessible installment payment options. It’s harder to leave due to more original content like Ted Lasso and services like Fitness+. The world’s most valuable company could continue to grow with some relatively simple additions.

- Taco Bell is testing… a $7/month subscription to get a taco-a-day.

- Presentation decks are looking like Picassos... as Canva wants to make graphic design accessible to non-design pros. All of those DIY design templates just helped Canva raise $200m at a $40B valuation.

- Microsoft will buy back $60B… of its own stock in its largest-ever repurchase program.

- Ford, and Wal-Mart and self-driving startup Argo AI… are teaming up to launch an autonomous vehicle delivery service.

- Rivian, the Amazon-backed EV maker… registered to IPO and raise between $5B - $8B. Making it one of the largest U.S. IPOs in recent years.

- House Democrats are pushing for a $13,000 EV tax credit.

- Ford is adding 450 new jobs… due to high demand for its electric F-150 pickup.

- China Evergrande, the deeply indebted, Chinese property developer… is not "too big to fail." They have over $310B in debts, and face a $150m coupon payment later this month. Place your bets.

- Jason Ader, CEO of SpringOwl asset management… commented on China: “There’s a debate over whether China is even investable right now. You never like to see increased regulation, increased taxes, and restrained movement.”

Crypto-Bytes:

- Cardano, now has smart contracts. It was launched in 2017 as an Ethereum-like platform for decentralized apps.

- Ethereum’s hash rate reached an all-time-high last week. That told me: (a) the effects of China’s mining crackdown are in the past, and (b) ETH mining is profitable.

- El Salvador will exempt foreign investors… from paying any taxes on bitcoin investment profits. They’re attempting to encourage foreign investment.

- Not all crypto is suffering… Solana (SOL), Algorand (ALGO), and Cosmos (ATOM) are all looking to move higher. And Terra is a tank as (LUNA) is up 5,696% YTD. Place your bets.

- Quantitative trading firm Jump Trading… has launched an 80-person crypto division that will build the plumbing for blockchain ecosystems.

- Fidelity Investments privately prodded the SEC last week… to approve its bitcoin ETF – citing increased investor interest in crypto. There are currently 10 U.S. Bitcoin ETF applications awaiting approval.

- Coinbase has sold $2B worth of debt via junk bonds. The move highlights crypto’s evolution from a fringe asset class to one under the spotlight by mainstream financial types.

- Greenidge Generation Holdings will buy 10,000 Bitmain miners… for its planned new crypto-mining facility in Spartanburg, S.C.

- The head of product at OpenSea… was accused of purchasing pieces from NFT collections before they were featured on the homepage of the platform. Then he would sell them shortly after they were featured and funnel the profits back to his personal account.

- The U.S. Treasury Department is preparing a report… on stablecoins and their potential risks to the financial system.

- Tether does not hold short-term Evergrande debt... but it still could have exposure from other Chinese obligations. Evergrande’s debt is spread across a raft of financial institutions, causing analysts to worry that its collapse could have an impact similar to the fall of Lehman Bros – and the recession that followed.

- The total market value of all 11,899 cryptos is $2.8T… or about 4% of the entire global GDP – with BTC & ETH accounting for half.

Last Week:

Monday: I mentioned Uranium last week, and boy was I late to that party. 2 weeks ago, they all started climbing wildly and it seemed to be overdone. But on Friday they all (UROY, CCJ, UEC, & DNN) lit up again. The reason for the (recent) surge is that a new trading vehicle, the Sprott Physical Uranium Trust Fund, has been accumulating pounds of uranium at a torrid pace, (SRUUF). Yes - there's a lot of nuclear power coming on board, and yes – uranium has been too cheap for too long. If you've got some trading skills, take a peek at FCUUF.

Tuesday: The NY FED now sees inflation at 5.2% in one year, 4% in three years – with "large price rises" in food, rent, and medical costs coming. That doesn't sound very transitory to me? The CPI came in "tamer than expected" at 4% YoY, and the futures exploded higher. How is having the CPI up 4% a good thing? Next week is a big FED meeting and the fear is all about tapering. They're hopeful that the "not as bad” CPI keeps our FED on the sidelines.

Wednesday: Some of this market worry is over our FED, and some is the huge quad witching this Friday. There's almost $2T in calls ‘n puts that are coming due. Shortly after the close yesterday, MSFT announced a $60B buy back and a hike in their dividend. Considering the S&P was just inches away from falling under its 50-day moving average, was this a move to try and "save" the market? Probably. Will there be more buy backs announced? Absolutely. China is melting down. They’re cracking down against video game playing, U.S. businesses, gambling, and let’s not forget their biggest bond bank is going bankrupt. A few days ago, the Atlanta FED quietly revised its GDP forecast DOWNWARD by 41%. Did anyone notice? Let’s see if MSFT can save the market – for at least one day.

Thursday & Friday: Settling $2T worth of expiring options is enough to make anyone’s head spin. Take a break and come back in on Monday.

TW3 (That Was - The Week - That Was):

Condolences Mr. Musk… because Rivian will be the first to produce an electric truck that will actually end up in customers’ driveways. Rivian has raised over $10.5B from investors including Amazon and Ford, and is seeking to go public with an $80B valuation. Their R1T truck has a range of 314 miles and starts at $68K. That’s a longer range, and a higher price tag than most upcoming e-trucks. R1Ts come equipped with: a road-ready air compressor, a built-in drink cooler, an 11,000 lb. towing capacity, and tailgates that can be lifted via app. We may end up discovering that TRUCKS could be the real EV ambassador. Pickup trucks accounted for half of the US auto industry’s top 10 best-selling vehicles last year, and the three best-sellers were all pickups. The best bet for pulling Americans into an EV future – could be towing them there with e-pickups.

Entrepreneurs, remember the ‘finishing move’. Mailchimp employees are furious, after the company's founders promised to never sell, withheld equity, and just this week agreed to sell the business to Intuit for $12B. One x-employee said it best: "I think for anyone who was there for a long time and worked hard to build the company into what it is today – that was a tough $12B pill to swallow. We got screwed." Hey Mailchimp founders: Ben, Dan, and Mark: Is this how you want to be remembered? Is this how you want to remember yourselves? “The people you see on the way up, are the same ones that you’ll see on the way down.”

Why are we so mean? Per SG, I was asked for a serial number the other day and I realized that it was printed in grey type on a black background, included a 0 and an O, and a 1 and an I. Now I’m sure everyone’s proud of all the check digits embedded in that fancy number, but who decided that humanity and technology should not overlap? In med school, they spend months teaching people how to operate on lungs, and no time at all helping them get their patients to stop smoking or obtain a vaccine. Technology that doesn’t solve a problem for the people using it – isn’t finished yet.

Next Week: Risk is Coming: FED, China & Tapering

Market Update:

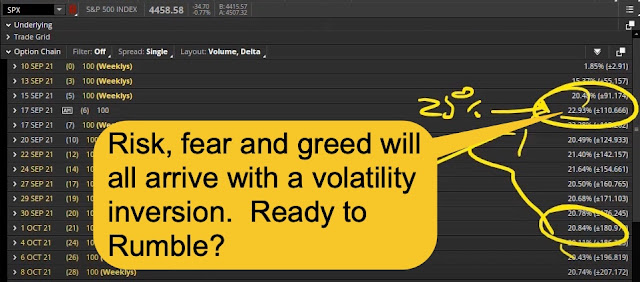

- Last week’s market risk and movement were well within a very tight range. Unfortunately, all of the volatility indicators did not reflect the severity of the moves. The VIX is over 20 – so that’s worth a mention. But the VVIX is back above 110 – which is telling us that the pros are seeing volatility and putting on their hedges.

- Until we see the October /VX futures get to the same level of risk (or higher) as their November counterparts = we are not scraping the surface on the risk chart. Statistically significant moves in the SPX start at 3%, and last week the retail trader panicked by the SPX being down by 1%. The best is yet to come.

Retail vs Pros:

- Last week we saw retail options traders sell their calls in a panic – driving markets lower. We know this because an overwhelming majority of the calls were traded at the bid or below … rather than at the ask and above. That means retail traders were using market orders and just selling to get ‘out at any cost’. This is the first time we’ve seen ‘dip buyers’ turn into ‘rally sellers’ in a long time. Watch for that change of mindset – from BTFD (buy-the-dip) to STFR (sell-the-rally) continues.

- Single handedly retail was responsible for correlating the asset classes to the downside. The dollar was higher due to its ‘flight to quality’ status. If the dollar continues to the upside, watch for volatility to go higher and the major indices to go lower.

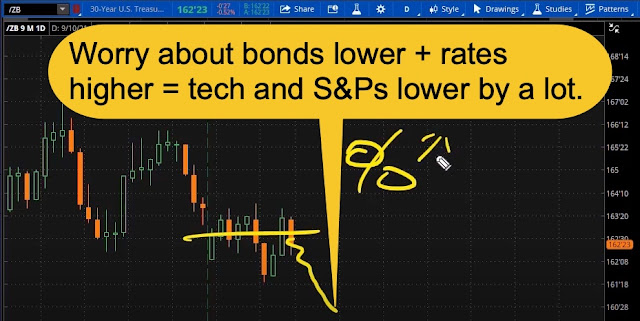

- For a change it was simple: Bonds were Down, Interest Rates were Up, and Tech said Goodnight! What worries me is that the financials (for the 3rd week in a row) also sold off. Right now, they can’t seem to get out of their own way.

- NVDA (+67% YTD), GOOGL (+63% YTD), MSFT (+38% YTD) and FB (+36% YTD) drove this week’s selling / volatility.

- To sell off next week, we need to see 2 things:

o Dramatic pullbacks in: NVDA, GOOGL, MSFT, and FB – and

o the Volatility futures (/VX) need to invert. Which means, the October futures will need to move above November’s. That’s when you will see ‘the whites of their trading eyes.’

Next Week’s SPX Expected Move (EM):

- Last week the SPX EM was $115 and we only moved $30.

- Next week’s SPX EM is projected to be: $95.

- Between our FED, China and Taper-Talk, we should see wicked market movements next week. ‘Keep your hands and feet inside the vehicle at all times’. It could get rough ‘n messy out there in a hurry.

Tips:

HODL’s: (Hold On for Dear Life)

- AMC – Holding

- Bitcoin (BTC = $48,700 / in at $4,310)

- B2Gold (BTG = $3.67 / in at $4.16)

o Waiting to sell CCs for income,

- Englobal (ENG = $2.21)

o Sold Dec. $2.50 Calls for income,

- Ethereum (ETH = $3,500 / in at $310)

- Express (EXPR = $5.41)

o Sold Oct $5’s and $6’s

- GME – Holding

- Grayscale Ethereum (ETHE = $33.08 / in @ $13.44)

- Grayscale Bitcoin Trust (GBTC = $37.70 / in @ $9.41)

- Grayscale Trust (GDLC = $33.30 / in @ $22.75) & buying

- Hyliion (HYLN = $8.68 / in @ $0.32)

o Sold Oct. $10 CCs for income,

- Infinity Pharma (INFI = $3.62)

o Sold Oct $3 and $4 Calls for income,

- Transocean (RIG = $3.36)

o Sold Nov. $4 Calls for income,

- Exela Tech (XELA = $2.08)

o Sold Sept. $2.50 Calls / Oct $2 and $3 Calls for income,

- Yamana Gold (AUY = $4.05)

o Waiting to sell CCs for income.

Thoughts: Follow me on StockTwits.com to get my daily thoughts and trades – my handle is: taylorpamm.

Please be safe out there!

Disclaimer:

Expressed thoughts proffered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can learn more and get your subscription by visiting: <http://rfcfinancialnews.blogspot.com/>.

Please write to Mr. Culbertson at: <rfc@culbertsons.com> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/>.

If you'd like to view R.F.'s actual stock trades - and see more of his thoughts - please feel free to sign up as a StockTwits follower - "taylorpamm" is the handle.

If you'd like to see R.F. in action - teaching people about investing - please feel free to view the TED talk that he gave on Fearless Investing:

https://www.youtube.com/watch?v=K2Z9I_6ciH0

Creativity = https://youtu.be/n2QiPSe_dKk

Investing = https://youtu.be/zIIlk6DlSOM

Marketing = https://youtu.be/p0wWGdOfYXI

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

Remember the Blog: <http://rfcfinancialnews.blogspot.com/>

Until next week – be safe.

R.F. Culbertson

<http://rfcfinancialnews.blogspot.com>